Kursformationer

Kursgrafen viser, hvordan optimismen hos investorerne har svinget over tid. Ved at se, hvilke opture og nedture de har været gennem, kan vi sige noget om, hvad de tænker og føler. På den måde kan vi også sige noget om, hvad de vil gøre fremover.

Visse mønstre, kaldet kursformationer, kan forklares med præcise beskrivelser af investorernes psykologiske tilstande. Når disse dannes i kursgrafer gives klare købs- eller salgssignaler. Identifikation og handel på kursformationer er meget centralt i teknisk analyse.

Investtech har lavet computerprogrammer, som identificerer formationer og tegner dem ind i graferne. Købssignaler angives med grønne pile og salgssignaler med røde pile. Højden på pilene angiver forventet kursbevægelse.

Hovedprincipper

- Køb aktier som har givet købssignal fra kursformation.

- Sælg aktier som har givet salgssignal fra kursformation.

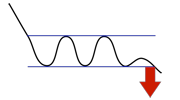

Topformationer

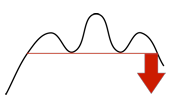

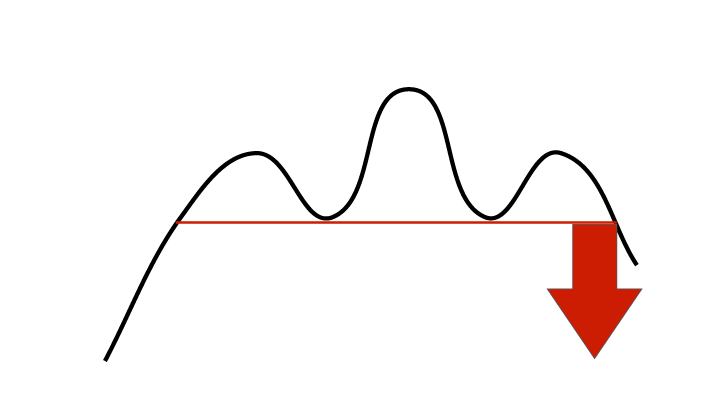

Hoved-og-skuldre-formation

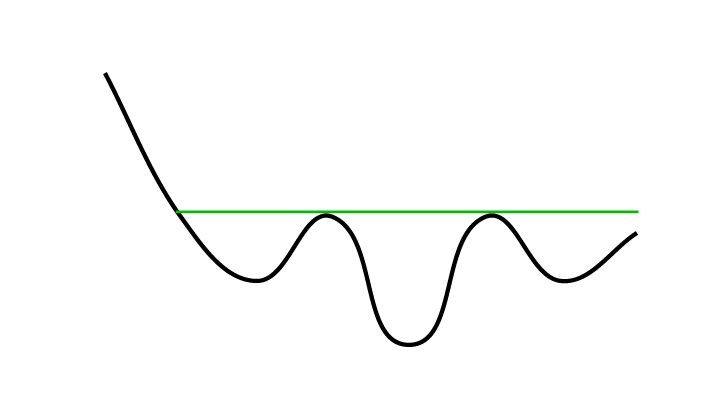

Dobbel-top-formation

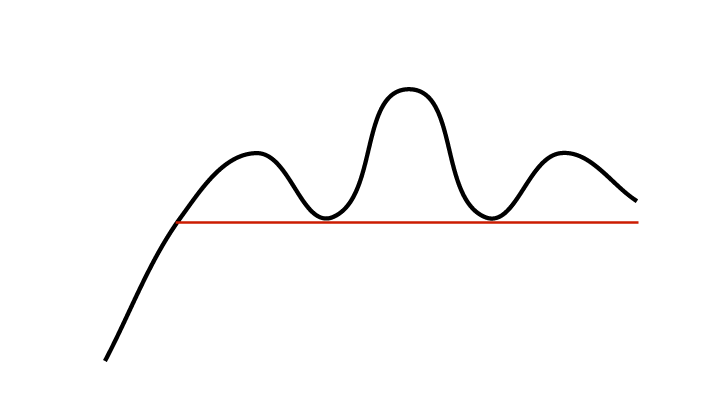

Rektangelformation

- Varsler at en stigende trend er ovre, og at en faldende trend starter.

- Sælg!

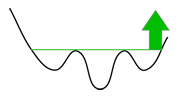

Bundformationer

Omvendt-hoved-og-skuldre-formation

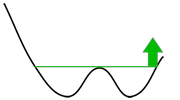

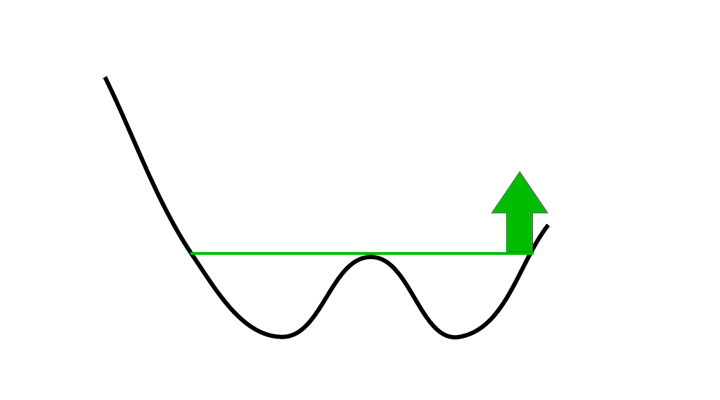

Dobbel-bund-formation

Rektangelformation

- Varsler at en faldende trend er ovre, og at en stigende trend starter.

- Køb!

Fortsættende formationer

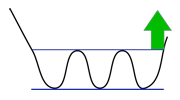

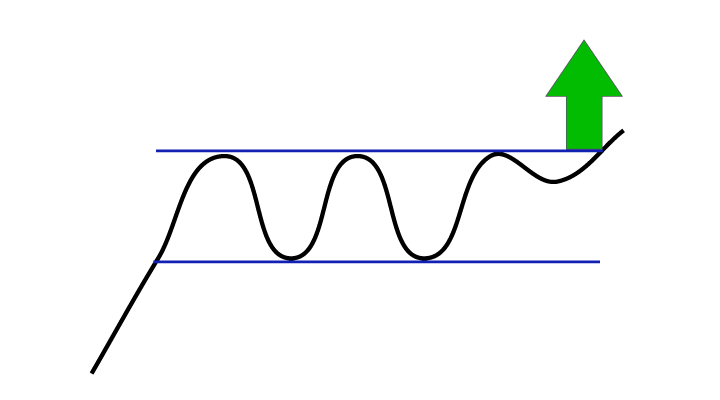

Rektangelformation køb

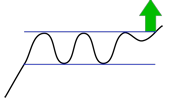

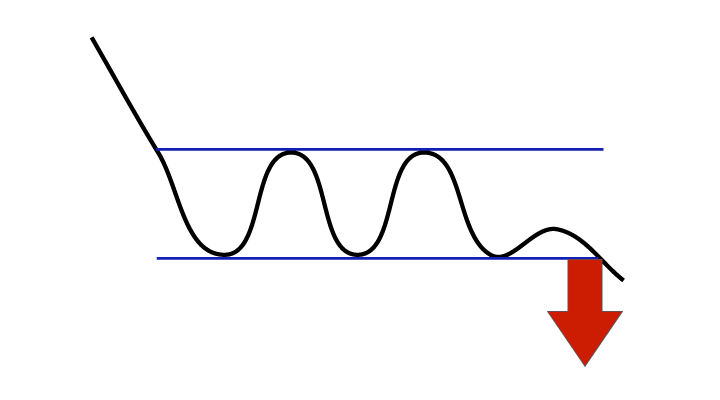

Rektangelformation sælg

- Varsler at en konsolideringssituation er ovre.

- Kan give købssignal om, at en stigende trend fortsætter op.

- Kan give salgssignal om, at en faldende trend fortsætter ned.

Vigtige detaljer

- Kraften bag en kursbevægelse beskrives med volumenet. En øgning i volumenet forstærker et signal fra en formation. En reduktion i volumenet er ofte tegn på et falskt signal.

- Ofte kan kursen gå meget direkte efter et brud. Derfor bør man handle hurtigt ved et brud. Imidlertid kan kursen mange gange bevæge sig tilbage igen lidt senere, så var man for sen på den i første omgang, kan man ofte få en ny mulighed.

- Selv om kursen når kursmålet (højden på pilen), kan aktien ofte gå meget længere. Kursformationer varsler indledning eller fortsættelse af trender. Trender er den kraftigste indikator, vi har. Så længe trenden er intakt, bør positionen sædvanligvis holdes.

Buy signal from rectangle formation

A buy signal from a rectangle formation signals increasing optimism among investors and signals that the stock continues or enters a rising trend.

A stock that has triggered a buy signal from a rectangle formation is indicated to rise further. This is especially the case when the stock price is already in a rising trend channel. Investors have experienced a positive surprise which has triggered the signal, and optimism is on the increase.

Details

Volume is a good indicator of the strength of the buy signal. High volume on rising prices indicates that aggressive buyers keep paying more in order to buy. This is positive for further development. High volume and positive volume balance will strengthen a buy signal.

Rectangle formations are usually continuing formations. This means that the price usually continues in the long term direction, or the long term trend, it was in before the formation. Rectangle formations that trigger buy signals in rising trends are therefore seen to give stronger signals than rectangle formations that trigger buy signals in falling trends.

Small rectangle formations can trigger false buy signals. This is especially the case when the formation is small, when the stock remains in a falling trend channel, and when volume development is negative. At buy signal from a rectangle formation the stock as a whole should be assessed, not solely the buy signal. Many investors have bought long term losers too soon following weak buy signals from rectangle formations. The following applies:

- Long rectangle formations are stronger than short ones.

- Buy signals with positive volume development are stronger than buy signals with negative volume development.

- Buy signals when the chart shows a rising trend are stronger than when the chart shows a falling trend.

- Buy signals with a break upward though a falling trend, including break above the previous pivot top, are stronger than if trend and pivot top are not broken.

Investtech research: Buy signal from rectangle formation

statSummaryRelPos statSummaryRelPosNumberSignificant

| Annualised return (based on 66-day figures) | |

| Signaux positifs moyen terme | 19.8% |

| Reference index | 10.8% |

| Excess return | 9.0pp |

statSummaryTemplate

Lire plus

- Research Report: Investtech Research: Return following signals from rectangle formations in stock prices - medium term, Nordic markets, 1996-2018 (Niveau d'accès exigé: PRO)

- Research Article: Sterk meravkastning etter kjøpssignaler fra rektangelformasjoner

- Research Report: Investtech-forskning: Signalstatistikk kursformasjoner under koronapandemien, Norden 2019-2020. (Niveau d'accès exigé: PRO)

- Research Article: Investtech-forskning: Formasjoner gav ikke signifikante signaler under koronapandemien

- Research Report: Investtech-forskning: Kursformasjoner - signalstatistikk Norden 2008-2020 (Niveau d'accès exigé: PRO)

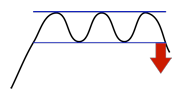

Sell signal from rectangle formation

A sell signal from a rectangle formation signals increasing pessimism among investors and signals that the stock continues or enters a falling trend.

A stock that has triggered a sell signal from a rectangle formation is indicated to fall further. This is especially the case when the stock price is already in a falling trend channel. Investors have experienced a negative surprise which has triggered the signal, and the level of fear is increasing.

Details

Volume is a good indicator of the strength of the sell signal. High volume on falling prices indicates that aggressive sellers keep reducing the price in order to sell. This is negative for further development. High volume and negative volume balance will strengthen a sell signal.

Rectangle formations are usually continuing formations. This means that the price usually continues in the long term direction, or the long term trend, it was in before the formation. Rectangle formations that trigger sell signals in falling trends are therefore seen to give stronger signals than rectangle formations that trigger sell signals in rising trends.

Small rectangle formations can trigger false sell signals. This is especially the case when the formation is small, when the stock remains in a rising trend channel, and when volume development is positive. At sell signal from a rectangle formation the stock as a whole should be assessed, not solely the sell signal. Many investors have sold long term winners too soon following weak sell signals from rectangle formations. The following applies:

- Long rectangle formations are stronger than short ones.

- Sell signals with negative volume development are stronger than sell signals with positive volume development.

- Sell signals when the chart shows a falling trend are stronger than when the chart shows a rising trend.

- Sell signals with a break downward from a rising trend, including break below the previous pivot bottom, are stronger than if trend and pivot bottom are not broken.

Investtech research: Sell signal from rectangle formation

statSummaryRelNeg statSummaryRelNegNumberSignificant

| Annualised return (based on 66-day figures) | |

| Signaux négatifs moyen terme | 4.3% |

| Reference index | 10.9% |

| Excess return | -6.6pp |

statSummaryTemplate

Lire plus

- Research Report: Investtech Research: Return following signals from rectangle formations in stock prices - medium term, Nordic markets, 1996-2018 (Niveau d'accès exigé: PRO)

- Research Article: Gode salgssignaler fra rektangelformasjoner

- Research Report: Investtech-forskning: Signalstatistikk kursformasjoner under koronapandemien, Norden 2019-2020. (Niveau d'accès exigé: PRO)

- Research Article: Investtech-forskning: Formasjoner gav ikke signifikante signaler under koronapandemien

- Research Report: Investtech-forskning: Kursformasjoner - signalstatistikk Norden 2008-2020 (Niveau d'accès exigé: PRO)

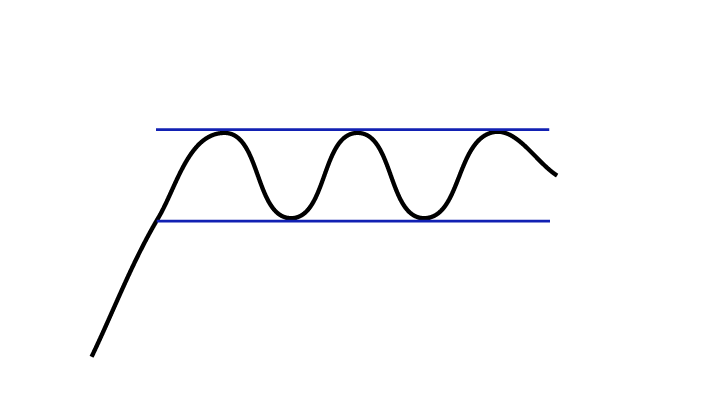

Rektangelformation under udvikling

En rektangelformation markerer en konsolidering i markedet. Jo længere formationen udvikler sig, jo højere pres bygges der op blandt investorerne. Når formationen brydes, følges det gerne af en kraftig kursbevægelse i samme retning.

Købssignal fra sådanne formationer har givet statistisk gode signaler ifølge Investtechs forskningsrapporter for flere børser.

Følg med når rektangelformationer udvikles. Især hvis kursen samtidig ligger i en stigende trend, og volumenudviklingen er positiv, gives kraftige købssignaler. Brud ned giver kraftige salgssignaler, især når kursen samtidig ligger i en faldende trend, og volumenudviklingen er negativ.

Inverse head and shoulders formation

A buy signal from an inverse head and shoulders formation signals increasing optimism among investors and the beginning of a rising trend. Formations like this are considered some of the most reliable formations in technical analysis.

An inverse head and shoulders formation is a bottom formation which marks the end of a falling trend. The formation consists of a left shoulder, a head and a right shoulder, connected by a neckline. The buy signal is triggered when the price breaks upwards through the neckline heading up from the right shoulder.

On the left shoulder investors are negative. The trend is falling and it does not look good for the company. As the pessimism wanes, the head is formed. Here the stock might break out from a falling trend channel and buyers become more aggressive or sellers more passive. On the right shoulder, the pessimists are unable to push the price downwards to a new bottom. Instead buyers push the price upwards through the neckline and the buy signal is triggered. The stock breaks upwards through resistance at the neckline and a rising trend begins.

A stock that has triggered a buy signal from an inverse head and shoulders formation is indicated to continue rising, for at least as long as the formation is high.

Please note that false buy signals from small inverse head and shoulders formations may arise in long term falling trends. Sometimes these can be spotted by a reduction in volume on the break. This indicates little strength in the price movement, and the stock can easily break down again and continue the falling trend. In such situations it can be advantageous to keep the stock and wait to see what happens also after the buy signal. This is especially the case if the stock is still in a falling trend or faces resistance from previous tops.

Sometimes good indicators of a coming break exist before the neckline is broken. Volume reduction on or towards the bottom of the right shoulder indicates that the sellers are passive. Increasing volume on the way up from the head or up from the right shoulder indicates that buyers are aggressive. Aggressive buyers and passive sellers are a good mix and a clear indication of increasing optimism in the stock and a coming break upward. In such situations it can be advantageous to buy before the buy signal is triggered.

Investtech research: Inverse head and shoulders formation

statSummaryRelPos statSummaryRelPosNumberSignificant

| Annualised return (based on 66-day figures) | |

| Signaux positifs moyen terme | 14.0% |

| Reference index | 9.7% |

| Excess return | 4.3pp |

statSummaryTemplate

Lire plus

- Research Report: Investtech Research: Return following signals from inverse/head and shoulders formations in stock prices - medium term, Nordic markets 1996-2018

- Research Article: Meravkastning etter kjøpssignaler fra omvendt-hode-og-skuldre-formasjoner

- Research Report: Investtech-forskning: Kursformasjoner - signalstatistikk Norden 2008-2020 (Niveau d'accès exigé: PRO)

- Research Article: Investtech-forskning: Kursformasjoner 2008 - 2020

Omvendt-hoved-og-skuldre-formation under udvikling

En mulig omvendt-hoved-og-skuldre-formation er under udvikling. Den vil kunne udløse et kraftigt købssignal.

Signaler fra sådanne formationer anses som nogle af de kraftigste købssignaler inden for teknisk analyse. Vær opmærksom på, at et signal snart vil kunne udløses. I nogle situationer kan det være gunstigt, at købe før købssignalet udløses, da dette giver en klart større upside.

Vigtige indikatorer på et kommende brud op er:

- Positiv volumenbalance

- Brud på faldende trend

- Øgende volumen på vej op fra hovedet

- Aftagende volumen på vej ned mod højre skulder

- Øgende volumen på vej op fra højre skulder

Hvis volumenudviklingen derimod er negativ, og aktien fortsat ligger i en faldende trend, indikeres frygt hos investorerne og en videre negativ udvikling for aktien.

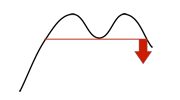

Head and shoulders formation

A sell signal from a head and shoulders formation signals increasing pessimism among investors and the start of a falling trend. Formations like this are considered some of the most reliable formations in technical analysis.

A head and shoulders formation is a top formation which marks the end of a rising period. The formation consists of a left shoulder, a head and a right shoulder, connected by a neckline. The sell signal is triggered when the price breaks downwards through the neckline heading down from the right shoulder.

At the left shoulder, investors are optimistic. The trend is rising and things are looking good for the company. Optimism is reduced when the head is formed. Here the stock might break out from the trend channel and buyers become more passive or sellers more aggressive. At the right shoulder, the optimists are unable to push the price upwards to a new top. Instead sellers push the price downwards through the neckline and a sell signal is triggered.

The stock breaks support at the neckline and a falling trend begins. A stock that has triggered a sell signal from a head and shoulders formation is indicated to continue falling, for at least as long as the formation is high.

Please note that false sell signals from small head and shoulders formations may arise in long term rising trends. Sometimes these can be spotted by a reduction in volume on the break. This indicates little strength in the price movement, and the stock can easily break upwards again and continue the rising trend. In such situations it can be advantageous to keep the stock and wait to see what happens also after the sell signal. This is especially the case if the stock is still in a rising trend or has support from previous bottoms.

Sometimes good indicators of a coming break exist before the neckline is broken. Volume reduction on or towards the top of the right shoulder indicates that the buyers are passive. Increasing volume on the way down from the head or down from the right shoulder indicates that sellers are aggressive. Passive buyers and aggressive sellers are a bad mix and a clear indication of increasing pessimism in the stock and a coming break downward. In such situations it can be advantageous to sell before the sell signal is triggered.

Investtech research: Head and shoulders formation

statSummaryRelNeg statSummaryRelNegNumber

| Annualised return (based on 66-day figures) | |

| Signaux négatifs moyen terme | 8.3% |

| Reference index | 9.3% |

| Excess return | -1.0pp |

statSummaryTemplate

Lire plus

- Research Report: Investtech Research: Return following signals from inverse/head and shoulders formations in stock prices - medium term, Nordic markets 1996-2018

- Research Article: Salgssignaler fra hode-og-skuldre-formasjoner har varierende prediksjonskraft

- Research Report: Investtech-forskning: Kursformasjoner - signalstatistikk Norden 2008-2020 (Niveau d'accès exigé: PRO)

- Research Article: Investtech-forskning: Kursformasjoner 2008 - 2020

Hoved-og-skuldre-formation under udvikling

En mulig hoved-og-skuldre-formation er under udvikling. Den vil kunne udløse et kraftigt salgssignal.

Signaler fra sådanne formationer anses som nogle af de kraftigste salgssignaler inden for teknisk analyse. Vær opmærksom på, at et signal snart vil kunne udløses. I nogle situationer kan det være gunstigt, at sælge før salgssignalet udløses for at undgå risikoen for et større tab.

Vigtige faretegn er:

- Negativ volumenbalance

- Brud på stigende trend

- Øgende volumen på vej ned fra hovedet

- Aftagende volumen på vej op mod højre skulder

- Øgende volumen på vej ned fra højre skulder

Hvis volumenudviklingen derimod er positiv, og aktien fortsat ligger i en stigende trend, indikeres optimisme hos investorerne og en videre positiv udvikling for aktien.

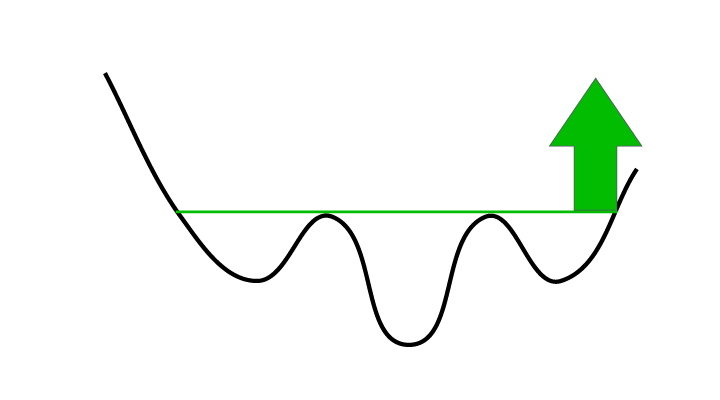

Buy signal from double bottom formation

A buy signal from a double bottom formation signals increasing optimism among investors and the beginning of a rising trend.

A double bottom formation is a bottom formation which marks the end of a falling period. The formation consists of two bottoms of about the same depth. The buy signal is triggered when the price breaks upwards above the bottoms.

At the first bottom the investors are pessimistic. There is a falling trend and things are not looking good for the company. As the second bottom is formed, the pessimism is reduced. Many are positively surprised when the stock does not fall below the previous bottom, and thus might not continue the falling trend. When the price breaks above the top between the bottoms, it breaks the resistance located there. Pessimism has been replaced with dawning optimism and a rising trend has begun.

A stock that has triggered a buy signal from a double bottom formation is indicated to rise further, for at least as much as the formation is high.

Details

Double bottom formations trigger false buy signals fairly often. This is especially the case when the formation is small, when the stock remains in a falling trend channel, and when volume development is negative. At buy signal from a double bottom formation the stock as a whole should be assessed, not solely the buy signal. Many investors have bought losing stocks too soon following weak signals from double bottom formations. The following applies:

- Large double bottom formations are stronger than small ones.

- Buy signals with positive volume development are stronger than buy signals with negative volume development.

- Buy signals with a clear break through a falling trend, including break above the previous pivot top, are stronger than without breaks through trend and pivot top.

Investtech research: Buy signal from double bottom formation

statSummaryRelNeg statSummaryRelNegNumber

| Annualised return (based on 66-day figures) | |

| Signaux positifs moyen terme | 7.5% |

| Reference index | 9.5% |

| Excess return | -2.0pp |

statSummaryTemplate

Lire plus

- Research Report: Investtech Research: Return following signals from double top/bottom formations in stock prices - medium term, Nordic markets 1996-2018 (Niveau d'accès exigé: PRO)

- Research Article: Investtech-forskning: Kjøpssignaler fra kortsiktige dobbel bunn-formasjoner går mot etablert teknisk analyse-teori

- Research Report: Investtech-forskning: Kursformasjoner - signalstatistikk Norden 2008-2020 (Niveau d'accès exigé: PRO)

- Research Article: Investtech-forskning: Kursformasjoner 2008 - 2020

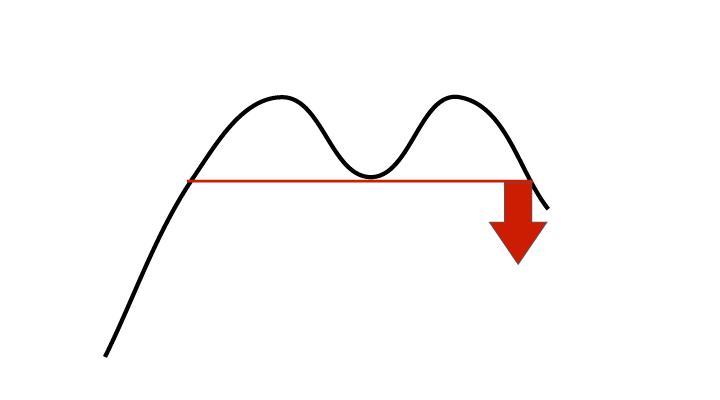

Sell signal from double top formation

A sell signal from a double top formation signals increasing pessimism among investors and the beginning of a falling trend.

A double top formation is a top formation which marks the end of a rising trend. The formation consists of two tops of about the same height. The sell signal is triggered when the price breaks down below the tops.

At the first top, investors are optimists. The trend is rising and things are looking good for the company. As the second top is formed, the optimism wanes. Many are disappointed when the stock does not reach above the previous top and thereby possibly does not continue the rising trend. When the price breaks down below the bottom between the two tops, the support there is broken. Optimism has been replaced with pessimism and a falling trend has begun.

A stock that has triggered a sell signal from a double top formation is indicated to continue falling, for at least as long as the formation is high.

Details

False sell signals are triggered fairly often from double top formations. This is especially the case when it is a small formation, when the stock is still in a rising trend channel and when volume development is positive. At a sell signal from a double top formation the stock as a whole should be assessed, not solely the sell signal. Many investors have sold long term winners too soon following weak signals from double top formations. The following applies:

- Big double top formations are stronger than small ones.

- Sell signals with negative volume development are stronger than sell signals with positive volume development.

- Sell signals with a clear break down from a rising trend, including break below the previous pivot bottom, are stronger than if the trend and pivot bottom have not been broken.

Investtech research: Sell signal from double top formation

statSummaryRelPos statSummaryRelPosNumber

| Annualised return (based on 66-day figures) | |

| Signaux négatifs moyen terme | 13.4% |

| Reference index | 11.6% |

| Excess return | 1.8pp |

statSummaryTemplate

Lire plus

- Research Report: Investtech Research: Return following signals from double top/bottom formations in stock prices - medium term, Nordic markets 1996-2018 (Niveau d'accès exigé: PRO)

- Research Article: Investtech-forskning: Salgssignaler fra dobbel topp-formasjoner har liten signalkraft

- Research Report: Investtech-forskning: Kursformasjoner - signalstatistikk Norden 2008-2020 (Niveau d'accès exigé: PRO)

- Research Article: Investtech-forskning: Kursformasjoner 2008 - 2020

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices