Signals from lotto stocks: Research results 2008-2023

Published 30 October 2024

By researcher Fredrik Dahl Bråten and Head of R&D Geir Linløkken.

Many investors may be tempted to buy stocks with large and rapid price fluctuations. But such stocks can also have high downside potential and risk. The most volatile stocks, often called lottery-type stocks or lotto stocks, have historically performed much worse than other stocks, according to Investtech's research. It has been statistically beneficial to avoid such stocks, or possibly to short them. This applies especially to technically negative lotto stocks, but also when they have been technically positive.

Return 2008 - 2023

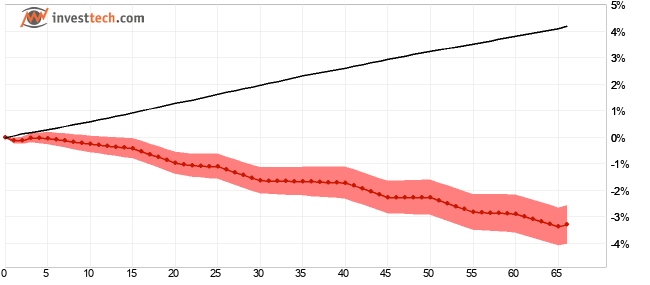

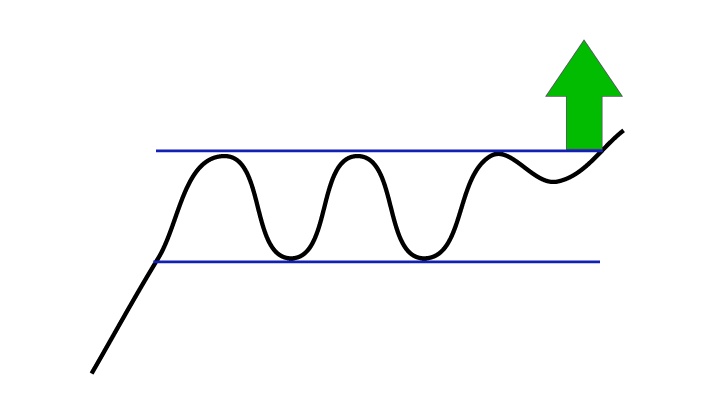

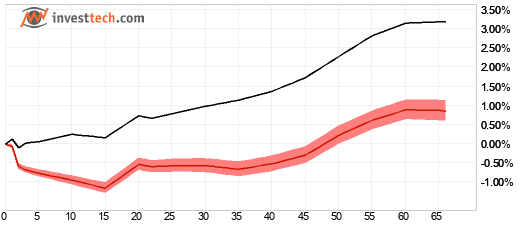

The chart below shows average price development following sell signals from a negative trend in Investtech's medium-term price charts for stocks with over 40 per cent monthly price fluctuations. These are lotto stocks in a falling trend, breaking downwards from a falling trend, or breaking downwards from a horizontal trend. The signals are triggered on day 0, and we have observed the development up to 66 days later. Only days when the stock market is open are included, so 66 days correspond to approximately three months. The thick red curve shows how stocks with sell signals developed. The shaded area indicates the standard deviation of the calculations. The narrow black curve shows how the benchmark index developed during the same period that we measured the performance of stocks with sell signals. A total of 4,443 signals were identified during the time period. This provides a solid statistical basis.

Figure 1: The Nordic markets combined. Return for stocks with negative trend development (sell signal), with over 40 per cent price fluctuations per month, identified in Investtech's medium-term price charts. The thick red curve represents the signal stocks, black is benchmark. The Nordic markets, 2008–2023.

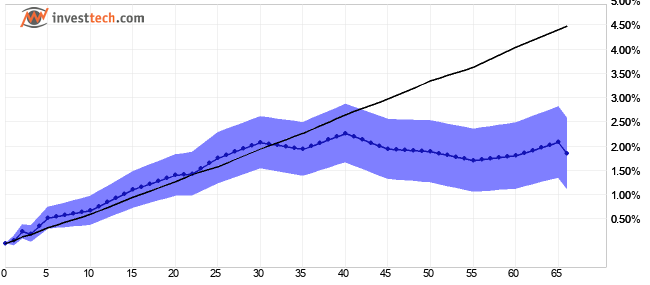

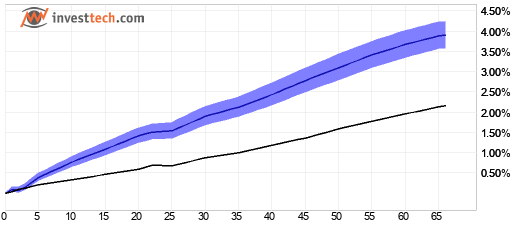

Similarly, the chart below shows return for buy signals from stocks with positive trend development and over 40 per cent monthly price fluctuations. These are lotto stocks in a rising trend, breaking upwards from a rising trend, or breaking upwards from a horizontal trend. A total of 4,927 signals were identified during the period, providing a solid statistical basis.

Figure 2: The Nordic markets combined. Return for stocks with positive trend development (buy signal), with over 40 per cent price fluctuations per month, identified in Investtech's medium-term price charts. The thick blue curve represents the signal stocks, the thin blue curve represents benchmark. The Nordic markets, 2008–2023.

We observe that stocks in a falling trend (sell signal) have decreased in the subsequent period. The decline has been fairly steady over the entire three-month period and has clearly been weaker than benchmark, which has risen in the same period. After 66 days, the sell signals have on average fallen by 3.30 per cent, while the benchmark index in the same period has risen by an average of 4.20 per cent. This results in an average underperformance of 7.50 percentage points after 66 days. The lotto stocks with buy signals performed somewhat better, rising by an average of 1.85 per cent after 66 days. However, benchmark rose by 4.48 per cent in the period, resulting in an underperformance of 2.65 percentage points.

Converted to annualized figures, stocks with sell and buy signals have, on average, provided 25.7 and 9.7 percentage points of underperformance vs benchmark, respectively. This is based on 4,443 buy signals and 4,927 sell signals in the Nordic region during the period 2008-2023.

The table below shows annualized return based on 66-day figures for the Nordic markets, as well as a weighted average for the Nordic markets combined.

| Annualized return (based on 66-day figures) | Norway | Sweden | Denmark | Finland | Weighted average |

| Sell signal | -13.3 % | -10.7 % | -25.4 % | 19.6 % | -12.0 % |

| Benchmark in same period | 14.6 % | 12.7 % | 16.0 % | 21.0 % | 13.7 % |

| Excess return sell signal | -28.0 %p | -23.4 %p | -41.5 %p | -1.4 %p | -25.7 %p |

| Buy signal | 25.1 % | -1.8 % | -14.4 % | 40.2 % | 7.3 % |

| Benchmark in same period | 18.0 % | 16.2 % | 17.8 % | 19.0 % | 16.9 % |

| Excess return buy signal | 7.2 %p | -18.0 %p | -32.2 %p | 21.2 %p | -9.7 %p |

%p = percentage points, meaning the difference in percentage returns. Annualized figures are calculated by repeating the 66-day figures over a year, assuming an average year has 252 trading days.

The same pattern is reflected in other buy and sell signals for stocks with extreme volatility.

For analysts to consider

Among the sell signals, we see that stocks breaking downwards through support have statistically produced an underperformance of 22.9 percentage points, stocks with a technical score below -50 have resulted in an underperformance of 24.8 percentage points, and stocks with RSI21 below 40 have shown an underperformance of 22.9 percentage points.

For buy signals, stocks breaking upwards through resistance resulted in an annualized underperformance of 13.3 percentage points, RSI21 above 60 led to an underperformance of 12.7 percentage points, and a technical score above 50 resulted in an underperformance of 14.4 percentage points.

Summary

In the period 2008-2023, stocks with extreme volatility have performed poorly, both following buy signals and especially after sell signals. During the 16-year period, we observed an underperformance of 25.7 percentage points after sell signals and 9.7 percentage points after buy signals on an annual basis. The risk in companies with over 40 percent monthly price fluctuations is extreme. Given that returns have statistically been weak, regardless of technical signals, it is considered a solid foundation in technically and quantitatively based investment strategies to completely avoid such stocks.

How to use this

It is very easy to avoid stocks with extreme volatility. These are marked with a warning triangle and the text "Extreme Volatility" on Investtech's pages. Also, see information about the stock's volatility further down on the stock's analysis pages. If the stock fluctuates significantly on a monthly basis, 40 per cent or more, it is classified as a lotto stock. Our 2021 article on the 20 and 10 per cent most volatile stocks also showed that highly volatile stocks statistically delivered weaker returns over time compared to less volatile stocks. Lotto stocks are a subgroup of the 10 per cent most volatile stocks.

For an overview of stocks with extreme volatility, see Investtech's stock selection tool.

Appendix: Data and methodology

Data

All publicly listed stocks in Norway, Sweden, Denmark, and Finland with a daily turnover higher than 1.0 million NOK or the equivalent in SEK, DKK, or EUR. For the Nordic markets combined, we used the four largest Nordic countries, i.e. Sweden, Denmark, Norway, and Finland, as the data basis.

All signals identified during the period from 01.01.2021 to 31.12.2023 are included, including from stocks that were later delisted from the stock exchange due to, for example, acquisitions or bankruptcy. Return is calculated from the day after the signal date and 66 days forward, until approximately 31.03.2024 for the last identified signals.

Adjustment for dividends and other corporate actions

All stock prices are adjusted for dividends, splits, and other capital changes, so the price development reflects the real price movements for investors as accurately as possible.

How signals are identified

Investtech’s algorithms generate analyses for all listed stocks every day after the stock exchange closes. The algorithms automatically identify trends, support and resistance levels, chart formations, volume patterns, and a number of other technical signals and indicators. The signals are identified completely automatically based on these.

Sampling frequency

Indicators, for example a rising trend and high RSI, can appear for several consecutive days. For a new signal to be identified, at least 14 trading days must have passed since the previous signal in the same direction.

A sampling frequency shorter than the measurement period for return results in overlapping samples. In addition to different stocks correlating with each other, this means that caution is advised when considering robustness based on standard deviation. Nevertheless, we have plotted standard deviation in the charts and made a subjective assessment of the significance of the results in our conclusions.

References

- Investtech-forskning: Såkalte lottoaksjer har statistisk gitt dårlig avkastning - vær varsom med lottoaksjene (in Norwegian)

- Signals from lotto stocks: Research results 2008-2020

- Signals from lotto stocks: Research results 2021-2023

Den mest almindelige fejl småsparere begår; at sælge vinderaktier for tidligt

Publiceret d. 19. maj 2020

Når Investtech afholder analysekurser - eller er i dialog med småsparere på anden vis - hører vi ofte investorer sige, at småsparere ynder at sælge aktier, når disse er steget fem eller ti procent. Mange tænker, at aktien allerede er steget meget, og vil gerne sikre en gevinst. Og så hellere gå ind i aktier, der er faldet, da de tænker, at upsiden er større.

Fra forrige artikel, som du kan læse her, så vi, at det, at købe taberaktier, ifølge Investtech-forskning statistisk set har vist sig at være en dårlig strategi.

Nu vil vi se, at det ligeledes kan være en fejl at sælge vinderaktier tidligt. Og vi vil samtidig påstå, at det er den allermest almindelige fejl, småsparere begår. Investtech-forskning kan fremlægge overbevisende tal for, at aktier, der allerede er steget, og viser visse typer købssignaler, fortsat vil stige. Og ikke blot fortsætter de med at stige; de stiger mere end andre aktier.

Historisk set har det godt kunne betale sig at holde fast i vinderaktierne i langt tid. Den positive udvikling for selskaberne og optimistiske stemning hos investorerne varer ofte meget længere, end mange tror, og kurserne fortsætter med at stige over langt tid.

Vi skal herunder se på fem typer aktier, som man, ifølge Investtech-forskning, bør købe.

Stigende trend

En stigende trend indikerer, at bedriften befinder sig i en positiv udvikling, og at købsinteressen blandt investorer er stigende. Da vil aktiekursen fortsætte med at stige. Statistik* på 45.958 tilfælde, hvor aktier på de nordiske aktiemarkeder lå i stigende trendkanaler på mellemlangt sigt, viser, at disse i gennemsnit steg med 7,5 procentpoint mere end referenceindeksene på årlig basis.

En stigende trend indikerer, at bedriften befinder sig i en positiv udvikling, og at købsinteressen blandt investorer er stigende. Da vil aktiekursen fortsætte med at stige. Statistik* på 45.958 tilfælde, hvor aktier på de nordiske aktiemarkeder lå i stigende trendkanaler på mellemlangt sigt, viser, at disse i gennemsnit steg med 7,5 procentpoint mere end referenceindeksene på årlig basis.

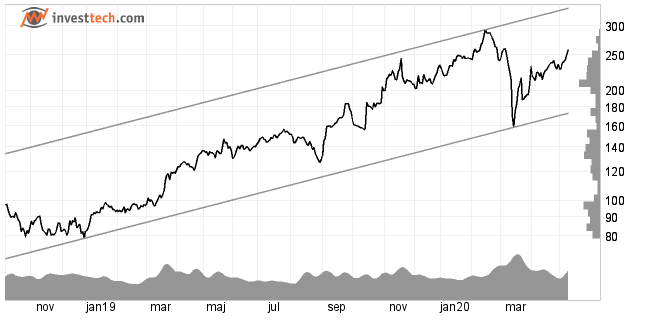

Ørsted ligger i en stigende trendkanal på mellemlangt sigt. Et videre opsving indikeres.

Ørsted ligger i en stigende trendkanal på mellemlangt sigt. Et videre opsving indikeres.

Overkøbt på RSI, stærkt positivt momentum

Aktier, der er steget meget på kort tid, anses for at være ‘overkøbte’. Forholdet måles ved at se på aktiens Relative Strength Index, RSI, og regnes af klassisk teknisk analyselitteratur for at være et salgssignal. Investtechs forskning viser imidlertid, at høj RSI indikerer, at aktien har stærkt positivt momentum, og at købsinteressen fortsat vil stige. Dermed vil det være en fejl at sælge disse aktier. Investtech-forskning* baseret på 36043 tilfælde, hvor RSI oversteg 70, viste en gennemsnitlig årlig stigningstakt i den efterfølgende periode på 9,0 procentpoint mere end andre aktier.

Aktier, der er steget meget på kort tid, anses for at være ‘overkøbte’. Forholdet måles ved at se på aktiens Relative Strength Index, RSI, og regnes af klassisk teknisk analyselitteratur for at være et salgssignal. Investtechs forskning viser imidlertid, at høj RSI indikerer, at aktien har stærkt positivt momentum, og at købsinteressen fortsat vil stige. Dermed vil det være en fejl at sælge disse aktier. Investtech-forskning* baseret på 36043 tilfælde, hvor RSI oversteg 70, viste en gennemsnitlig årlig stigningstakt i den efterfølgende periode på 9,0 procentpoint mere end andre aktier.

Bavarian Nordic har en RSI over 70 og viser derved et stærkt positivt momentum og bør derfor ifølge Investtech-forskning købes.

Bavarian Nordic har en RSI over 70 og viser derved et stærkt positivt momentum og bør derfor ifølge Investtech-forskning købes.

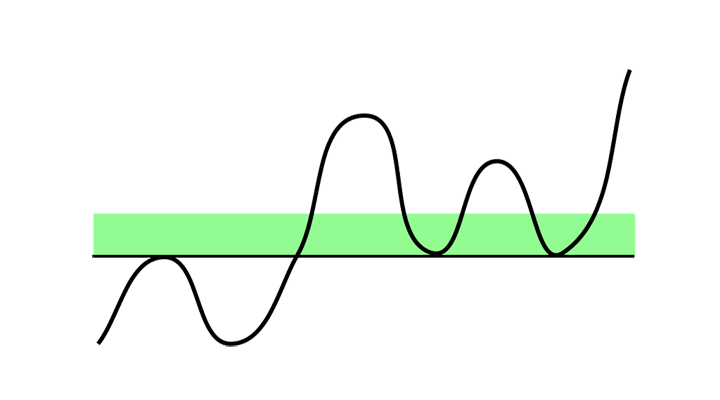

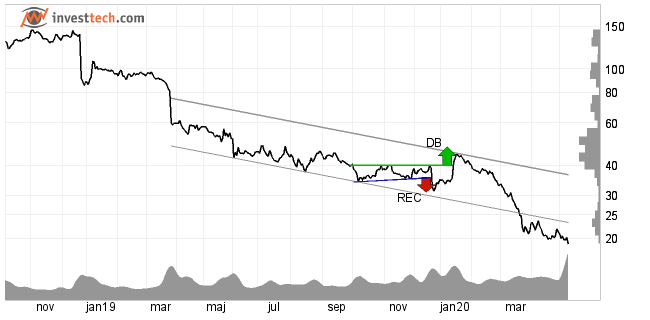

Købssignal fra rektangelformation

Købssignal fra rektangelformationer opstår, når investorer presser kursen op gennem tidligere toppunkter for at komme ind i aktien. Investtech-forskning* baseret på 4314 signaler viser, at kursen i den efterfølgende periode steg 9,8 procentpoint mere end andre aktier årligt.

Købssignal fra rektangelformationer opstår, når investorer presser kursen op gennem tidligere toppunkter for at komme ind i aktien. Investtech-forskning* baseret på 4314 signaler viser, at kursen i den efterfølgende periode steg 9,8 procentpoint mere end andre aktier årligt.

Brdr.Hartmann har afgivet købssignal fra en rektangelformation og indikerer derved en videre stærk udvikling.

Brdr.Hartmann har afgivet købssignal fra en rektangelformation og indikerer derved en videre stærk udvikling.

Brud på sidste modstand

Brud over det sidste modstandsniveau i et kursdiagram forekommer, når mange investorer køber, selvom aktien aldrig – eller ikke i meget langt tid – er blevet handlet til højere kurser. Samtidig er der få, der vil sælge, og kursen bryder derfor op. Aktier, der udløste et sådant brud, og samtidig lå langt over det sidste modstandsniveau i grafen, steg ifølge Investtech-forskning* 12,0 procentpoint mere end andre aktier på årlig basis.

Brud over det sidste modstandsniveau i et kursdiagram forekommer, når mange investorer køber, selvom aktien aldrig – eller ikke i meget langt tid – er blevet handlet til højere kurser. Samtidig er der få, der vil sælge, og kursen bryder derfor op. Aktier, der udløste et sådant brud, og samtidig lå langt over det sidste modstandsniveau i grafen, steg ifølge Investtech-forskning* 12,0 procentpoint mere end andre aktier på årlig basis.

ChemoMetec har brudt modstanden ved 9,00 kr. Det udløste et købssignal, kursen ligger langt over dette niveau, og Investtech anbefaler at købe aktien.

ChemoMetec har brudt modstanden ved 9,00 kr. Det udløste et købssignal, kursen ligger langt over dette niveau, og Investtech anbefaler at købe aktien.

Insiderkøb

Når en person i selskabets bestyrelse eller ledelse køber aktier, er det et signal om, at vedkommende tror, aktiekursen vil stige. Det kan være, at insideren mener, markedet har straffet aktien for meget efter negativ omtale eller at positiv omtale ikke er værdsat nok. Det kan også være mere generelt, at fremtidsudsigterne for selskabet ser gode ud, og at insidere opfatter risikoen ved et køb for at være lav. Aktier med køb fra insidere er statistisk set* steget 7,1 procentpoint mere end referenceindeksene på årligt basis.

Når en person i selskabets bestyrelse eller ledelse køber aktier, er det et signal om, at vedkommende tror, aktiekursen vil stige. Det kan være, at insideren mener, markedet har straffet aktien for meget efter negativ omtale eller at positiv omtale ikke er værdsat nok. Det kan også være mere generelt, at fremtidsudsigterne for selskabet ser gode ud, og at insidere opfatter risikoen ved et køb for at være lav. Aktier med køb fra insidere er statistisk set* steget 7,1 procentpoint mere end referenceindeksene på årligt basis.

Pandora faldt drastisk, da frygten for Corona var på sit højeste i februar og marts. CEO og CFO købte på samme tid, og i sidste uge købte et bestyrelsesmedlem også aktier. Pandora er positiv på insiderhandler.

Pandora faldt drastisk, da frygten for Corona var på sit højeste i februar og marts. CEO og CFO købte på samme tid, og i sidste uge købte et bestyrelsesmedlem også aktier. Pandora er positiv på insiderhandler.

*Alle forskningsresultaterne gælder for de nordiske aktier tilsammen; Norge fra 1996, Sverige fra 2003, Danmark fra 2005 og Finland fra 2007. For alle landene gælder, at vi så på data frem til 31.12.2018. De årlige afkastningstal er beregnet med udgangspunkt i kursudviklingen de første tre måneder efter signalerne.

Forskningsresultater

Investtech-forskning: Stigende trend

Aktier med sådanne købssignaler har i gennemsnit klaret sig bedre end markedet de kommende måneder. Årligt merafkast har været 7.5 procentpoint (%p). Dette er signifikant bedre end referenceindekset.

| Årligt afkast (baseret på 66-dages-tal) | |

| Købssignaler mellemlang | 20.0% |

| Referenceindeks | 12.6% |

| Merafkastning | 7.5%p |

Disse forskningsresultater er baseret på 45958 signaler fra nordiske aktier i perioden 1996-2018.

Læs mere

- Forskningsartikel: Aktier, som ligger i stigende trend, har givet merafkast i Norden

- Forskningsrapport: Aktier, som ligger i stigende trend, har givet merafkast i Norden

- Forskningsartikel: Trendsignaler endnu bedre end teorien foreslår

- Forskningsartikel: Aktier i stigende trend har givet et godt merafkast

- Forskningsartikel: Trendsignaler endnu bedre end teorien foreslår

- Forskningsraport: Stigende trender i aktiekurser - Afkastning som følge af, hvor højt i kanalen kursen ligger

Investtech-forskning: Højt positivt momentum og overkøbt

Aktier med sådanne købssignaler har i gennemsnit klaret sig bedre end markedet de kommende måneder. Årligt merafkast har været 9.0 procentpoint (%p). Dette er signifikant bedre end referenceindekset.

| Årligt afkast (baseret på 66-dages-tal) | |

| Købssignaler mellemlang | 22.5% |

| Referenceindeks | 13.4% |

| Merafkastning | 9.0%p |

Disse forskningsresultater er baseret på 36043 signaler fra nordiske aktier i perioden 1996-2018.

Læs mere

- Forskningsartikel: RSI er en god momentumindikator

- Forskningsrapport: RSI - Relative Strength Index – signalstatistik på de nordiske markeder fra 1996 til 2018

Investtech-forskning: Købssignal fra rektangelformation

Aktier med sådanne købssignaler har i gennemsnit klaret sig bedre end markedet de kommende måneder. Årligt merafkast har været 9.8 procentpoint (%p). Dette er signifikant bedre end referenceindekset.

| Årligt afkast (baseret på 66-dages-tal) | |

| Købssignaler mellemlang | 23.6% |

| Referenceindeks | 13.8% |

| Merafkastning | 9.8%p |

Disse forskningsresultater er baseret på 4314 signaler fra nordiske aktier i perioden 1996-2018.

Læs mere

- Forskningsrapport: Avkastning etter signaler fra rektangelformasjoner i aksjekurser - mellomlang sikt, Norden 1996-2018

- Forskningsartikel: Højt merafkast efter købssignaler fra rektangelformationer

Investtech-forskning: Kurs over støtte

Aktier med sådanne købssignaler har i gennemsnit klaret sig bedre end markedet de kommende måneder. Årligt merafkast har været 12.0 procentpoint (%p). Dette er signifikant bedre end referenceindekset.

| Årligt afkast (baseret på 66-dages-tal) | |

| Købssignaler mellemlang | 24.4% |

| Referenceindeks | 12.4% |

| Merafkastning | 12.0%p |

Disse forskningsresultater er baseret på 44463 signaler fra nordiske aktier i perioden 1996-2018.

Læs mere

- Forskningsartikel: Støtte og modstand: Købssignal når aktien ligger over støtte og ikke har modstand

- Forskningsrapport: Avkastning for aksjer som ligger over støtte og mangler motstand og for aksjer som ligger under motstand og mangler støtte i kursdiagrammer, Norden 1996-2018

Investtech-forskning: Insiderkøb

Aktier med sådanne købssignaler har i gennemsnit klaret sig bedre end markedet de kommende måneder. Årligt merafkast har været 7.1 procentpoint (%p). Dette er signifikant bedre end referenceindekset.

| Årligt afkast (baseret på 66-dages-tal) | |

| Købssignaler mellemlang | 16.3% |

| Referenceindeks | 9.3% |

| Merafkastning | 7.1%p |

Disse forskningsresultater er baseret på 11322 signaler fra nordiske aktier i perioden 1999-2018.

Læs mere

- Forskningsartikel: Insiderkøb som indikator for den videre kursudvikling i aktien

- Forskningsrapport: Innsidehandler - signalstatistikk Oslo Børs og Stockhomsbørsen 1999 til 2018

Den næst mest almindelige fejl begået af småsparere; at købe taberaktier

Publiceret d. 13. maj 2020

Når børsnoterede selskaber oplever problemer, og kurserne raser, oplever mange småsparere stor upside og køber, mens erfarne forvaltere og større investorer ofte sælger ud. At købe taberaktier, så som fx Bang & Olufsen, er en af de mest almindelige fejl, småsparere begår. Se statistikken her og bliv klogere på, hvorfor vi også anbefaler at sælge Bioporto, Per Aarsleff og Zealand Pharma.

Forskning, Investtech har foretaget, viser overbevisende tal for, at aktier, der er faldet og har udløst salgssignaler, fortsætter med at gøre det svagt. Vores portefølje af hold dig væk fra-aktier for Oslo Børs, som vi har opdateret siden 2005, har vist et årligt gennemsnitsfald på 23,2 procent, mens Oslo Børs i samme periode i gennemsnit er steget 7,6 procent.

I marts faldt stort set alle aktierne på Stockholmsbørsen. Nogle aktier ligger fortsat i faldende trender, mens andre er brudt op, og flere ligger i stigende trender. Ifølge vores forskning er det helt afgørende, hvilke aktier man køber nu. Vi ser på fire typer aktier, man, ifølge Investtech-forskning, ikke bør købe.

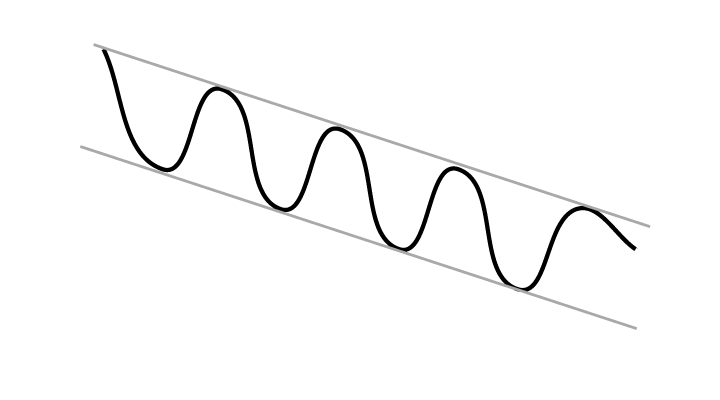

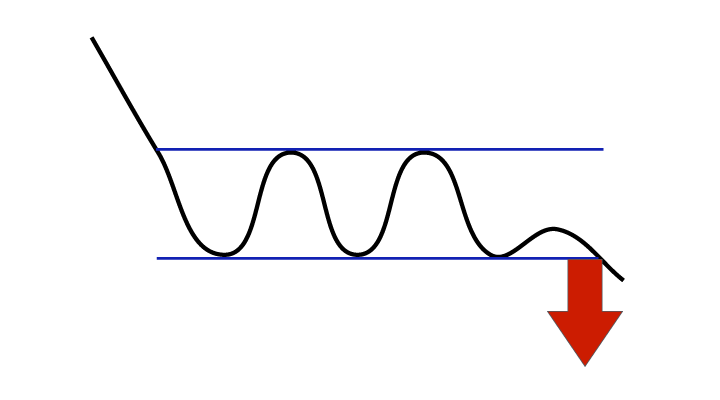

Faldende trend

En faldende trend indikerer, at bedriften er inde i en negativ udvikling, og at købsinteressen blandt investorer er aftagende. Da vil aktiekursen falde videre. Statistik* på 26.943 tilfælde, hvor aktier på de nordiske aktiemarkeder gik ind i faldende trendkanaler på mellemlangt sigt viser, at disse i gennemsnit udviklede sig 5,1 procentpoint svagere end referenceindeksene på årlig basis.

En faldende trend indikerer, at bedriften er inde i en negativ udvikling, og at købsinteressen blandt investorer er aftagende. Da vil aktiekursen falde videre. Statistik* på 26.943 tilfælde, hvor aktier på de nordiske aktiemarkeder gik ind i faldende trendkanaler på mellemlangt sigt viser, at disse i gennemsnit udviklede sig 5,1 procentpoint svagere end referenceindeksene på årlig basis.

Bioporto ligger i en faldende trendkanal på mellemlangt sigt. Et videre fald indikeres.

Bioporto ligger i en faldende trendkanal på mellemlangt sigt. Et videre fald indikeres.

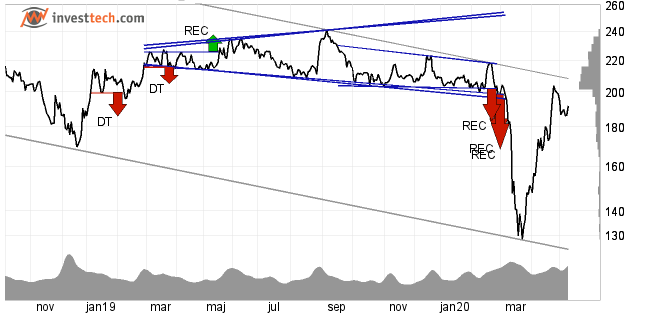

Salgssignal fra rektangelformation

Salgssignal fra rektangelformationer opstår, når investorer presser kursen ned gennem tidligere bundpunkter for at komme ud af aktierne. Investtech-forskning* baseret på 3109 signaler viser, at kursen den efterfølgende periode underpræsterede med 4,9 procentpoint årligt.

Salgssignal fra rektangelformationer opstår, når investorer presser kursen ned gennem tidligere bundpunkter for at komme ud af aktierne. Investtech-forskning* baseret på 3109 signaler viser, at kursen den efterfølgende periode underpræsterede med 4,9 procentpoint årligt.

Per Aarsleff Holding har afgivet salgssignal fra en stor rektangelformation og indikerer derved en videre svag udvikling.

Per Aarsleff Holding har afgivet salgssignal fra en stor rektangelformation og indikerer derved en videre svag udvikling.

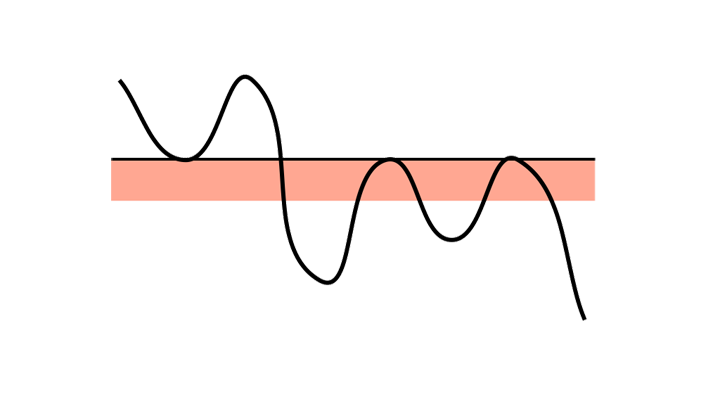

Brud på sidste støtte

Brud under det sidste støtteniveau i et kursdiagram sker, når mange investorer sælger trods det, at aktien aldrig - eller ikke i meget langt tid - er blevet handlet til lavere kurser. Samtidig er der få købere til at tage imod, og kursen bryder ned. Aktier, som udløste et sådant brud og lå langt under det sidste støtteniveau i grafen, klarede sig ifølge Investtech-forskning* 7,6 procentpoint svagere end andre aktier på årlig basis.

Brud under det sidste støtteniveau i et kursdiagram sker, når mange investorer sælger trods det, at aktien aldrig - eller ikke i meget langt tid - er blevet handlet til lavere kurser. Samtidig er der få købere til at tage imod, og kursen bryder ned. Aktier, som udløste et sådant brud og lå langt under det sidste støtteniveau i grafen, klarede sig ifølge Investtech-forskning* 7,6 procentpoint svagere end andre aktier på årlig basis.

Bang & Olufsen har udviklet sig negativt længe og er nu også brudt ned gennem den sidste støtte i kursdiagrammet ved 21 kr. Investtech anbefaler at sælge aktien.

Bang & Olufsen har udviklet sig negativt længe og er nu også brudt ned gennem den sidste støtte i kursdiagrammet ved 21 kr. Investtech anbefaler at sælge aktien.

Insidesalg

Når en person i et selskabs bestyrelse eller ledelse sælger aktier, kan det være et signal om, at vedkommende er bange for, at aktiekursen vil falde. Det kan være, at insideren mener, at aktien er steget for meget i forhold til udvikling og potentiale i selskabet, eller at markedet ikke har taget godt nok imod øget risiko eller negative nyheder. Aktier med salg fra insidere har statistisk set* udviklet sig 3,0 procentpoint svagere end referenceindeksene på årlig basis.

Når en person i et selskabs bestyrelse eller ledelse sælger aktier, kan det være et signal om, at vedkommende er bange for, at aktiekursen vil falde. Det kan være, at insideren mener, at aktien er steget for meget i forhold til udvikling og potentiale i selskabet, eller at markedet ikke har taget godt nok imod øget risiko eller negative nyheder. Aktier med salg fra insidere har statistisk set* udviklet sig 3,0 procentpoint svagere end referenceindeksene på årlig basis.

Zealand Pharma er steget med over 50 procent, siden aktien bundede ud i marts. EVP Adam Steensberg har i løbet af opsvingsperioden solgt ud for cirka 13 millioner kroner á tre omgange, og Zealand er negativ på insiderhandler.

Zealand Pharma er steget med over 50 procent, siden aktien bundede ud i marts. EVP Adam Steensberg har i løbet af opsvingsperioden solgt ud for cirka 13 millioner kroner á tre omgange, og Zealand er negativ på insiderhandler.

*Alle forskningsresultaterne gælder for nordiske aktier indsamlet i Danmark fra 2005, Sverige fra 2003, Norge fra 1996 og Finland fra 2007. For alle landene gælder, at vi så på data frem til 31.12.2018. Årlige afkastningstal er beregnet baseret på kursudvikling de første tre måneder efter signalerne.

Forskningsresultater

Investtech-forskning: Faldende trend

Aktier med sådanne salgssignaler har i gennemsnit klaret sig dårligere end markedet de kommende måneder. Årligt mindre afkast har været 5.1 procentpoint (%p). Dette er signifikant lavere end referenceindekset.

| Årligt afkast (baseret på 66-dages-tal) | |

| Salgssignaler mellemlang | 2.2% |

| Referenceindeks | 7.3% |

| Merafkastning | -5.1%p |

Disse forskningsresultater er baseret på 26943 signaler fra nordiske aktier i perioden 1996-2018.

Læs mere

- Forskningsartikel: Investtech-forskning: Mindre afkast fra aktier i faldende trend

- Forskningsrapport: Investtech-forskning: Stigende og fallende trender

Investtech-forskning: Salgssignal fra rektangelformation

Aktier med sådanne salgssignaler har i gennemsnit klaret sig dårligere end markedet de kommende måneder. Årligt mindre afkast har været 4.9 procentpoint (%p). Dette er signifikant lavere end referenceindekset.

| Årligt afkast (baseret på 66-dages-tal) | |

| Salgssignaler mellemlang | 5.6% |

| Referenceindeks | 10.5% |

| Merafkastning | -4.9%p |

Disse forskningsresultater er baseret på 3109 signaler fra nordiske aktier i perioden 1996-2018.

Læs mere

- Forskningsrapport: Investtech-forskning: Avkastning etter signaler fra rektangelformasjoner i aksjekurser - mellomlang sikt, Norden 1996-2018

- Forskningsartikel: Gode salgssignaler fra rektangelformationer

Investtech-forskning: Kurs under modstand

Aktier med sådanne salgssignaler har i gennemsnit klaret sig dårligere end markedet de kommende måneder. Årligt mindre afkast har været 7.6 procentpoint (%p). Dette er signifikant lavere end referenceindekset.

| Årligt afkast (baseret på 66-dages-tal) | |

| Salgssignaler mellemlang | -4.6% |

| Referenceindeks | 3.1% |

| Merafkastning | -7.6%p |

Disse forskningsresultater er baseret på 19586 signaler fra nordiske aktier i perioden 1996-2018.

Læs mere

- Forskningsartikel:Gode salgssignaler fra aktier, der ligger under modstand og mangler støtte

- Forskningsrapport: Investtech-forskning: Avkastning for aksjer som ligger over støtte og mangler motstand og for aksjer som ligger under motstand og mangler støtte i kursdiagrammer, Norden 1996-2018

Investtech-forskning: Insidersalg

Aktier med sådanne salgssignaler har i gennemsnit klaret sig dårligere end markedet de kommende måneder. Årligt afkast har været 3.0 procentpoint (%p) lavere end referenceindekset.

| Årligt afkast (baseret på 66-dages-tal) | |

| Salgssignaler mellemlang | 8.4% |

| Referenceindeks | 11.4% |

| Merafkastning | -3.0%p |

Disse forskningsresultater er baseret på 6944 signaler fra nordiske aktier i perioden 1999-2018.

Læs mere

- Forskningsartikel: Insidersalg som indikator for den videre kursudvikling i aktien

- Forskningsrapport: Innsidehandler - signalstatistikk Oslo Børs og Stockhomsbørsen 1999 til 2018

The most important buy and sell signals - how well do they perform?

Published 29 September 2023

Based on nearly 200,000 signals in stocks on the Nordic stock exchanges in the period from 2008 to 2020, we have studied to what extent key signals in technical analysis have proven accurate. This article provides an overview of our most significant research results. The main conclusion is that stocks have largely risen after buy signals and fallen after sell signals, as the theory suggests.

Investtech's systems are based on research dating back to 1994. Several of our projects are supported by the Norwegian Research Council. The research is built on principles such as mathematical pattern recognition, statistical optimization, and behavioural finance. We use algorithms to automatically identify buy and sell signals. There are four main signal groups within technical analysis. In addition, we also examine return following insider trading signals.

1. Stocks in a rising trend (buy) and stocks in a falling trend (sell)

Trends are one of the most important indicators in technical analysis. According to technical analysis theory, stocks in rising trends continue to rise, while stocks in falling trends continue to fall. Research conducted by Investtech shows that this holds true.

2. Price far above last resistance (buy) and far below last support (sell)

Support and resistance can be used to find good buy and sell levels. When the price breaks upwards through a resistance level, it triggers a buy signal. When it breaks downwards through a support level, it triggers a sell signal. The price may then move several percentage points in a short time.

3. RSI above 70 (buy signal) versus RSI below 30 (sell signal)

Momentum has proven to be a strong indicator of future price development.

4. Rectangle patterns

A rectangle formation indicates consolidation in the market. The longer the formation develops, the more pressure builds among investors. When the formation is broken, it is often followed by a significant price movement in the same direction.

5. Insider buying (buy signal) and insider selling (sell signal)

Analysis of insider transactions is Investtech's alternative to fundamental analysis. When a person in the company's board or management buys stocks, it is a signal that they believe the stock is cheap. Insider selling is considered a signal that the stock is expensive or that the risk is high.

Below, you will find research results for each of the five signal types, but first, a brief explanation of how to interpret the results.

How to interpret the tables and charts

When the systems detect a new technical signal, we set day number 0 to be the day the signal was triggered. This is on the far left in the charts below. We have then studied how these stocks have developed in the subsequent 66 trading days, equivalent to three months.

The charts show relative figures in relation to benchmark. For example, if a stock on the Oslo Stock Exchange increased by 5.0 per cent in three months, while benchmark increased by 3.5 per cent, the relative return is +1.5 percentage points.

The blue line represents stocks with buy signals. If it rises, it means that the stocks with buy signals increased more than the market in the same period. The red line represents stocks with sell signals. If it falls, it means that the stock with the sell signal performed weaker than the market in the same period.

The shaded areas are an estimate of uncertainty. The narrower they are, the less uncertainty in the chart.

When the blue line rises and the red one falls, along with with narrow shaded areas, we have strong signals. It has then been advantageous to buy the stocks with buy signals and sell those with sell signals.

For a rising trend, the chart shows a relative increase of 1.5 percentage points, as seen in the blue line in the chart below. This is for a period of 66 days, equivalent to a quarter of a year. Repeated four times over a year, and with the compounding effect, it results in an annual excess return of 6.5 percentage points, as shown in the table.

However, this is relative to benchmark, which increased by 9.7 per cent annually, so the annual return for stocks in a rising trend has been an average of 16.3 per cent per year.

You can also experiment a bit and, for example, repeat it over ten years. This results in a return of 352 per cent for stocks in a rising trends, 152 per cent for benchmark, and 40 per cent for stocks in falling trends.

1. Stocks in a rising trend (buy) and stocks in a falling trend (sell)

Nordic markets combined: 35,097 buy signals, 23,289 sell signals in the period 2008-2020:

| Nordic markets, annualised (based on 66-day figures) | Return | Benchmark | Diff v average benchmark | Diff v benchmark in same period |

| Buy signals | 16.3 % | 9.7 % | 6.4 %p | 6.5 %p |

| Sell signals | 3.4 % | 9.2 % | -6.4 %p | -5.8 %p |

%p = percentage point

Figure: Nordic markets combined, medium long term, development relative to benchmark in same period.

- More details are available (in Norwegian) in the research report here (Professional subscription required).

- See also this research article here for results for the period 2020-2022.

2. Price far above last resistance (buy) and far below last support (sell)

Nordic markets combined: 32,531 buy signals, 17,487 sell signals in the period 2008-2020:

| Nordic markets, annualised (based on 66-day figures) | Return | Benchmark | Diff v average benchmark | Diff v benchmark in same period |

| Buy signals | 18.2 % | 8.1 % | 8.4 %p | 10.1 %p |

| Sell signals | 4.5 % | 11.6 % | -5.3 %p | -7.1 %p |

Figure: Nordic markets combined, medium long term, development relative to benchmark in same period.

- More details are available (in Norwegian) in the research report here (Professional subscription required).

3. RSI above 70 (buy signal) versus RSI below 30 (sell signal)

Nordic markets combined: 35,864 buy signals, 24,920 sell signals in the period 2008-2020:

| Nordic markets, annualised (based on 66-day figures) | Return | Benchmark | Diff v average benchmark | Diff v benchmark in same period |

| Buy signals | 17.1 % | 9.7 % | 7.3 %p | 7.4 %p |

| Sell signals | 6.1 % | 11.7 % | -3.8 %p | -5.7 %p |

- More details are available (in Norwegian) in the research report here (Professional subscription required).

4. Rectangle patterns

Nordic markets combined: 3,368 buy signals, 2,677 sell signals in the period 2008-2020:

| Nordic markets, annualised (based on 66-day figures) | Return | Benchmark | Diff v average benchmark | Diff v benchmark in same period |

| Buy signals | 19.8 % | 10.8 % | 10.0 %p | 9.0 %p |

| Sell signals | 4.3 % | 10.9 % | -5.5 %p | -6.6 %p |

Figure: Nordic markets combined, medium long term, development relative to benchmark in same period.

- More details are available (in Norwegian) in the research report here (Professional subscription required).

5. Insider buying (buy signal) and insider selling (sell signal)

Nordic markets combined: 9,837 buy signals, 5,158 sell signals in the period 2008-2020:

| Nordic markets, annualised (based on 66-day figures) | Return | Benchmark | Diff v average benchmark | Diff v benchmark in same period |

| Buy signals | 19.0 % | 10.9 % | 8.7 %p | 8.1 %p |

| Sell signals | 8.0 % | 9.7 % | -2.3 %p | -1.8 %p |

- More details are available (in Norwegian) in the research report here (Professional subscription required).

Investtech Research: Price shocks in Nordic stocks can be used as buy and sell signals

By Head of R&D Mr. Geir Linløkken and research assistant Mr. Fredrik Dahl Bråten, Investtech, published October 6th, 2022.

Abstract: A price shock is when a stock price rises or falls unusually hard. International research into price shocks suggests that such stocks are usually followed by negative return, regardless of the price shock’s direction. We have studied this effect in the Nordic markets. Based on previous Investtech research, we figured that the negative return could not exclusively be explained by price shocks, but rather by the stocks’ high volatility. By excluding the most volatile stocks from the data set, we found that stocks with positive price shocks continued rising and stocks with negative price shocks continued falling. In other words, for normal volatile stocks with positive price shocks, the results are the opposite of that indicated by international research.

Absolute price shocks

International research has largely studied absolute price shocks, i.e. percentage change in closing price from one day to the next. Negative return of 6 and 13 percentage points following large positive and negative price shocks respectively were found in the month following the price shocks.

Our data from the Nordic stock markets in the period 2008 to 2020 showed that both positive and negative absolute price shocks statistically were followed by assumed statistically significant negative excess return vs benchmark. The strongest effects were seen for the largest price shocks, with a price rise of at least 27 per cent or a fall of at least 19 per cent from one day to the next. Shocks this big were identified approximately once every second or third year per stock. Negative excess returns the following month were 6.3 and 1.8 percentage points for positive and negative price shocks respectively.

The largest absolute price shocks tend to come from stocks with high volatility. Thus, such stocks represent a disproportionately large percentage of the buy and sell signals from absolute price shocks. Based on our previous research into excess return from buy and sell signals from highly volatile stocks, it made sense to study whether negative excess return after positive price shocks ties in with higher volatility in the stock, rather than being an effect of the price shock itself.

Volatility-normalized price shocks

Certain high-risk stocks can fluctuate 5-10 per cent on an average day, while low-risk stocks barely fluctuate 1 per cent. Consequently, we think that percentage change alone is not sufficient an identifier of a price shock. We calculated volatility-normalized price shocks as closing price change in per cent, adjusted for the stock’s volatility in the last 22 days. The measurement variable is thus price change divided by volatility. The 1.5 per cent biggest price shocks are considered buy and sell signals. This equals a price change of approximately five volatility-normalized price changes’ standard deviations, so that the signal was triggered when the stock in one day changed more than five times the daily standard deviation.

We chose to remove high volatility stocks from the data set, in order to exclude the negative excess return effect from high volatility stocks as much as possible. This means that stocks with an average monthly volatility of 30 per cent or more are excluded from the data set.

Results for buy signals from volatility-normalized price shocks

Figure 1: Nordic markets combined. Return following buy signals from volatility-normalized price shocks. Thick blue line is signal stocks, thin black line is benchmark. Nordic markets 2008-2020.

| Annualised return (based on 66-day figures) | Norway | Sweden | Denmark | Finland | Weighted average |

| Buy signal | 13,8 % | 17,7 % | 14,8 % | 12,8 % | 15,8 % |

| Benchmark in the same period | 5,8 % | 9,9 % | 11,4 % | 7,9 % | 9,0 % |

| Excess return, buy signal | 8,0 pp | 7,8 pp | 3,4 pp | 4,9 pp | 6,8 pp |

pp = percentage point, i.e. the arithmetic difference of the percentage returns. Annualised figures are calculated by repeating the 66-day figures for one year, assuming an average year has 252 stock exchange days.

On average, stocks with positive volatility-normalized price shocks continued rising. After three months, stocks with buy signals had on average risen 3.9 per cent, an excess return of 1.7 percentage points vs benchmark. Statistical measurement values indicate high statistical significance.

All four Nordic markets showed good price increase and excess return for signal stocks. The combined results are considered consistent even though the specific return figures vary. Buy signals from volatility-normalized price shocks are statistically considered to give good signals that can be a basis for making investment decisions in individual stocks.

Results for sell signals from volatility-normalized price shocks

Figure 2: Nordic markets combined. Return following sell signals from volatility-normalized price shocks. Thick red line is signal stocks, thin black is benchmark. Nordic markets 2008-2020.

| Annualised return (based on 66-day figures) | Norway | Sweden | Denmark | Finland | Weighted average |

| Sell signal | -8,8 % | 8,9 % | -1,0 % | 4,7 % | 3,3 % |

| Benchmark in same period | 5,8 % | 16,1 % | 9,3 % | 9,3 % | 12,0 % |

| Excess return, sell signal | -14,6 pp | -7,3 pp | -10,3 pp | -4,6 pp | -8,6 pp |

On average, stocks with sell signals have risen following the signals for the Nordic markets combined. However, the rise has been a lot lower than benchmark in the same period, and negative excess return has increased over the following three-month period.

After three months, stocks with sell signals had on average risen 0.9 per cent, a negative excess return of 2.3 percentage points vs benchmark. Annualised negative excess return was 8.6 percentage points. Statistical measurement values indicate high statistical significance.

Sell signals from negative volatility-normalized price shocks are considered to be good input into a technical stock trading strategy for identification of stocks to sell and stay away from.

Summary and conclusion

Stocks where the price on a single day changes to an unusual degree are said to trigger price shocks. Following absolute price shocks, we found that stocks with positive and negative price shocks both underperformed compared to benchmark, in line with previous research.

When we normalized the price shocks for the stock’s volatility, and also excluded the most volatile stocks, we found that stocks with positive price shocks were followed by excess return of assumed statistical significance. Stocks with negative price shocks were followed by assumed statistically significant negative excess return.

The results indicate that stocks with volatility-normalized price shocks, larger than five times normal daily fluctuations, statistically will give excess return in the same direction as the price shock.

Robustness measures indicate that it will be statistically beneficial to sell stocks with negative price shocks, and at the same time beneficial to buy stocks with positive price shocks, in addition to always staying away from the most volatile stocks.

Further details and discussion of results can be found in Norwegian in this research report (Professional subscription required).

References

- Fredrik Dahl Bråten, Geir Linløkken. 2022. “Investtech-forskning: Prissjokk - signalstatistikk nordiske markeder 2008-2020.” Investtech. Norwegian only.

- Lalwani, Vaibhav, Udayan Sharma, and Madhumita Chakraborty. 2019. “Investor reaction to extreme price shocks in stock markets: A cross country examination.” IIMB Management Review 31 (3): 258-267.

- Lu, Hai, Kevin Q. Wang, and Xiaolu Wang. “Price Shocks, News Disclosures, and Asymmetric Drifts.” The Accounting Review 89, no. 5 (2014): 1805–34.

- Linløkken, Geir. 2021. “Investtech-forskning: Sterkest signaler i lavlikvide aksjer.” Investtech. Norwegian only.

Investtech Research: Strongest signals in low-liquidity stocks

Published 13 June 2024

Background and Objectives

Previous research by Investtech suggests that technical signals perform better in small companies than in large companies. We have now summarized the extensive data and research work we conducted during the winter and spring of 2021. We examined data from all listed companies in Norway, Sweden, Denmark, and Finland for the years 2008-2020. We studied signal types including Trends, Support and Resistance, Price Formations, Volume Balance, Momentum, and Insider Trading.

For references on research reports on the individual signals, see the literature list.

We chose to focus on the most important and largest subtypes of signals from each of the above categories: Within rising/falling trend channels, Break upwards through resistance/break downwards through support, Rectangles and Head-and-shoulders formations, High/low volume balance, High/low RSI momentum, and Insider buying/selling.

In total, this comprised 254,548 signals, divided into 150,380 buy signals and 104,168 sell signals. We defined small companies and large companies as stocks with an average daily turnover of between 0.5 and 5 million NOK and over 5 million NOK, respectively.

The signals were roughly equally distributed between large and small companies, with a total of 128,089 signals from small companies and 126,459 signals from large companies.

We wanted to see if there were systematic differences between the groups.

Example buy signal: Within a rising trend channel

The charts below show average price development following buy signal from stocks being within a rising trend channel. The signals are triggered on day 0. Only days when the exchange is open are included, so 66 days equal approximately three months. The thick blue line shows the development of buy signal stocks. The shaded areas are the standard deviation of the calculations. The thin blue line shows benchmark development in the same period as the buy signal stocks.

Two charts are shown, for low-liquidity and high-liquidity companies respectively, referred to as Small companies and Large companies. The charts apply to the Nordic markets as a whole. Click the images for bigger version.

| Relative return after 66 days | Norway | Sweden | Denmark | Finland | Weighted average |

| Excess return buy signal Small companies | 2.2 %p | 2.5 %p | 1.5 %p | 2.3 %p | 2.3 %p |

| Excess return buy signal Large companies | 1.0 %p | 0.9 %p | 0.9 %p | 0.6 %p | 0.9 %p |

Example sell signal: Within a falling trend channel

| Relative return after 66 days | Norge | Sverige | Danmark | Finland | Weighted average |

| Excess return sell signal Small companies | -4.0 %p | -1.7 %p | -2.8 %p | -0.5 %p | -2.2 %p |

| Excess return sell signal Large companies | -3.2 %p | 0.4 %p | -0.8 %p | 1.7 %p | -0.4 %p |

Results and recommendations

The examples above show results for rising and falling trends, which together make up about a quarter of the total dataset. We see that both buy and sell signals have performed better for small companies than for large companies, and that the results are quite consistent across the four markets.

The same largely applies to the other signal types. Annualized figures for all the signals we examined show that small companies with buy signals were followed by an annualized excess return of 6.6 percentage points, while large companies with buy signals were followed by an excess return of 2.9 percentage points.

Several factors can explain such an effect:

*First, small companies are less analyzed than large companies and receive less attention in the press. It can therefore take longer for company-specific or industry-specific information to become known to investors, and the information can be disclosed at different times. When some begin to trade on the information, this will often trigger technical signals, and when others later follow, the stocks will continue in the same direction.

*The second factor is that small companies have low liquidity on the stock exchange. In our dataset, we included stocks with an average daily turnover of between half a million and five million NOK. If a large investor or a large stock fund wants to build a position in a small company, it will often take many days to complete the trade. A technical signal can thus be the start of further buy or sell interest in the same direction. For example, if a large investor wants to invest 10 million NOK in a stock that trades for 2 million NOK daily on average, the transaction could easily take several weeks.

*A final explanation may be that news and changing market conditions often have a larger relative effect on small companies than on large companies. This can lead to greater price movements for small companies.

Regardless of the explanation, the differences seem to be statistically significant: The signals have worked better for small companies than for large companies. By consistently focusing on small companies and signals in small companies, the results indicate good opportunities for achieving better returns than the market as a whole, but also better returns than for large companies with corresponding buy signals.

Note that the signals for large companies also predominantly show excess return vs the market, and stocks with sell signals underperform. Systematic use of technical analysis can yield good results and excess return vs the market also for large companies.

In our statistics we used data from 2008-2020 and a liquidity threshold of five million NOK. Liquidity on the stock exchange has increased during this period, and it may be that many stocks that were previously in the small companies group now fall under large companies. We consider this not as a fixed limit but rather as a sliding transition between small and large companies. We set the limit to study if there are differences between large and small companies. Simple tests indicate that there are statistically significant results for medium-sized companies as well, and that it is primarily the largest companies, such as OBX, OMX and C20 companies, that weaken the results for large companies.

Literature

- Geir Linløkken et co. Investtech research: Volume balance - signal statistics Nordics markets 2019 and 2020, (Norwegian only), Investtech 2021.

- Geir Linløkken et co. Investtech research: Insider trades - signal statistics Scandinavia 2008 - 2020, (Norwegian only), Investtech 2021.

- Geir Linløkken. Investtech research: Return following signals from price formations in stock prices, Nordic markets 1996-2018, Investtech 2020.

- Geir Linløkken, Asbjørn Taugbøl, Fredrik Tyvand. Investtech research: Support and resistance - signal statistics Nordic markets 2019 and 2020, (Norwegian only), Investtech 2021.

- Geir Linløkken, Asbjørn Taugbøl, Fredrik Tyvand. Investtech research: Insider trades - signal statistics Norway, Sweden and Denmark 2019 and 2020, (Norwegian only), Investtech 2021.

- Geir Linløkken. Volume balance - signal statistics Nordic markets 1996 - 2018, (Norwegian only), Investtech 2020.

- Geir Linløkken, Asbjørn Taugbøl, Fredrik Tyvand. Investtech research: Return following testing of and breaks through support and resistance in stock prices, the Nordic markets, 1996-2018, Investtech 2019.

- Asbjørn Taugbøl. Stocks in rising trends have given excess return in the Nordic markets, Investtech 2019.

- Asbjørn Taugbøl. Trend signals better than theory suggests, Investtech 2019.

- Geir Linløkken. Insider purchase as indicator of further price development in the stock, (Norwegian only), Investtech 2019.

- Geir Linløkken. RSI is a good momentum indicator, Investtech 2019.

- Geir Linløkken. Return following signals from rectangle formations in stock prices - medium term, Nordic markets, 1996-2018, Investtech 2019.

- Geir Linløkken and Steffen Frölich. Technical Stock Analysis - for lower risk and increased return. Investtech.com, 2001.

- John J. Murphy. Technical Analysis of the Financial Markets. New York Institute of Finance, 1999.

Keywords: Buy signal,Helsingfors,Kjøpssignal,København,Momentum,Oslo,Salgssignal,Sell signal,statistics,statistikk,Stockholm.

Investtech Research: Investtech Indices - results 2023-2024

Published April 11th 2024

By: Analyst Fredrik Dahl Bråten and Head of Research Geir Linløkken, Investtech.

Abstract:

Investtech launched the Investtech Indices in April 2022. We are now following up on last year's Investtech Indices research article with figures for the period 2023-2024. We examine how factors such as trend status, insider trading, and liquidity have contributed to returns over the past year. The main conclusion is that rising trends, positive technical scores, and insider buying have been associated with excess return in the subsequent period. High-volatility stocks have, as before, significantly underperformed compared to less volatile stocks. Low-liquidity stocks showed a significant negative excess return compared to more liquid stocks in this past year, as they also did last year.

Investtech Indices

Investtech has updated a range of equally weighted indices for stocks with different technical and quantitative characteristics since April 2022. The idea is that these indices effectively demonstrate the returns one would have obtained by mechanically following quantitative strategies in stock trading. The indices can also indicate the short-term market drivers and what has recently yielded a good "payoff."

The members of each index are fully updated automatically at specified intervals, and returns are calculated automatically on each trading day.

Unlike many market indices, the Investtech Indices are equally weighted. This means that all stocks initially have the same weight, whether they belong to very large or relatively small companies. These indices can serve as good benchmark indices for investors who follow Investtech's analyses and allocate their funds in fairly equal proportions across their portfolios.

Read more about the Investtech Indices here!

On May 25th 2023, we published results for all Nordic Investtech Indices for the period 2022-202 and 2013-2023. Below we follow up with results for 2023-2024 and the decade 2014-2024. The charts and tables are as of April 5th, 2024.

Investtech Indices for the Nordic markets

Figure 1a: Equally weighted indices for the Nordic markets. Past year until 5 April 2024.

Figure 1b: As above, but past ten years until 5 April 2024.

| Index name | Return past year | Annualised past ten years |

| Norway Equally weighted | 8.5 % | 5.3 % |

| Sweden Equally weighted | -1.1 % | 8.8 % |

| Denmark Equally weighted | 11.6 % | 12.3 % |

| Finland Equally weighted | -2.6 % | 8.5 % |

| Nordic Equally weighted | 5.1 % | 8.5 % |

|---|

Note that the chart for the past year is the past calendar year, whereas the values in the table for the past year are for the past 252 days, which is not quite one calendar year. This may cause a slight difference between the chart and the table.

The equally weighted combined Nordic index will be the benchmark index for all the others. As of April 5 2024, it consists of the 835 Nordic stocks with an average daily turnover above 500,000 NOK. The members of the index are updated quarterly. Each stocks weighs the same to begin with and return is calculated daily.

In the past year, just like last year, Denmark did best, rising 11.5 per cent. Close behind was Norway, rising 8.5 per cent. Sweden and Finland saw a decrease of 1.1 and 2.6 per cent respectively. The Nordic countries combined were up 1.5 per cent, which is significantly better than last year's decrease of 4.6 per cent.

Investtech Trend Indices

Figure 2a: Investtech Indices for Nordic stocks in rising, falling and horizontal trends. Price development past year until 5 April 2024.

Figure 2b: As above, but past ten years until 5 April 2024.

| Index name | Return past year | Annualised past ten years |

| Nordic Rising trend | 12.8 % | 18.4 % |

| Nordic Horizontal trend | 20.6 % | 10.8 % |

| Nordic Falling trend | -1.5 % | -2.6 % |

Members of the trend indices are updated monthly. Index development one month is determined by the development of the stocks that had the various trend statuses at the end of the previous month.

In the past year, stocks in rising trends have risen 12.8 per cent. This is 7.7 percentage points better than benchmark (Nordic Equally weighted). Stocks in falling trends underperformed, falling 1.5 per cent, equal to 3.6 percentage points weaker than benchmark.

Shares in horizontal trends have been a positive surprise this year and shown an excess return of around 10 per cent above the ten-year average.

The difference in the past year between stocks in rising trends and in falling trends is a solid 14.3 percentage points, a little less than last year's difference of 18.7 percentage points. This is a little lower the average for the past ten years, which is 21.0 percentage points.

The figures show that trend signals worked well in the past year.

Investtech Technical Score Indices

Figure 3a: Investtech Indices for Nordic stocks with high, medium and low technical score, equal to algorithmic medium term positive/weak positive, watch and negative/weak negative recommendation. Price development past year until 5 April 2024.

Figure 3b: As above, but past ten years until 5 April 2024.

| Index name | Return past year | Annualised past ten years |

| Nordic High tech score (buy and weak buy) | 13.8 % | 17.8 % |

| Nordic Medium tech score (neutral) | 5.2 % | 3.0 % |

| Nordic Low tech score (sell and weak sell) | 2.0 % | 0.4 % |

In the past year, stocks with high technical score have clearly outperformed stocks with neutral or low technical score. In other words, stocks with positive or weak positive algorithmic recommendations have done better than stocks with neutral or negative recommendations. The difference down to indices for neutral and negative indices is 9-12 percentage points. This is a big gap, but slightly smaller than for the past decade, when the difference was 15-17 percentage points

The figures show that Investtech's technical score recommendations have worked well in the past year, but not quite as well as for the past ten years.

Investtech Insider Indices

Figure 4a: Investtech Indices for Nordic stocks with high, medium and low insider score, equal to algorithmic medium term positive/weak positive, watch and negative/weak negative recommendation based on insider trades. Price development past year until 5 April 2024.

Figure 4b: As above, but past ten years until 5 April 2024.

| Index name | Return past year | Annualised past ten years |

| Nordic High insider score (buy and weak buy) | 14.4 % | 13.7 % |

| Nordic Medium insider score (neutral) | 5.3 % | 6.6 % |

| Nordic Low insider score (sell and weak sell) | 2.2 % | 8.9 % |

There are many more insider purchases than sales in the market, and the insider purchase index has 261 members on April 5, while the insider sales index has 94 members.

In the past year, the index for stocks with high insider score has risen 14.4 per cent, high above last year's rise of 2.4 per cent and close to the average of the past decade of 13.7 per cent. The insider sales index has risen significanty less and was up a mere 2.2 per cent. The difference of 12.2 percentage points is greater than the 4.8 percentage points it has been the past ten years.

The chart shows that insider purchases have been a good indicator in the past year.

Investtech Volatility Indices

Figure 5a: Investtech indices for Nordic stocks with different volatility, split into five approximately same-sized groups. For instance, the index "Most volatile" is the 20 per cent of stocks that fluctuate the most. Price development is past year until 5 April 2024.

Figure 5b: As above, but past ten years until 5 April 2024.

| Index name | Return past year | Annualised past ten years |

| Nordic Least volatile 20 percentile | 15.7 % | 14.7 % |

| Nordic Second least volatile 20 percentile | 18.0 % | 14.5 % |

| Nordic Middle volatile 20 percentile | 20.7 % | 13.9 % |

| Nordic Second most volatile 20 percentile | 4.7 % | 7.6 % |

| Nordic Most volatile 20 percentile | -13.6 % | -2.3 % |

Stock volatility is a fairly consistent characteristic over time. If a stock fluctuated a lot during a period, it's likely to fluctuate for the next period as well.

There are no surprises here. As before, the group of the most volatile stocks has significantly underperformed. This fifth of the stocks is down 14 per cent. This is much weaker than the less volatile indices. Compared to the results of the past 10 years, the less volatile stocks have risen more than usual and the volatile stocks have fallen more than usual. The companies with moderate volatility have been a positive surprise in the past year with an excess return around 7 percentage points above the ten-year average.

The ten-year chart shows these effects very clearly: the most volatile stocks have performed much weaker than the other groups. However, the second most volatile stocks have also underperformed.

The chart shows that the most volatile stocks have underperformed in the past year. It can be tempting to buy such stocks, which have often fallen a lot and have high upside, but the indices suggest this is a dangerous strategy. Based on the long term chart, it is considered a wise strategy for long term investors to stay entirely away from the most volatile stocks.

Investtech Liquidity Indices

Figure 6a: Investtech indices for Nordic stocks with different liquidity, split into five approximately same-sized groups. For instance, for Norway median liquidity for stocks in the five different indices are 0.9, 2.5, 6.0, 23 and 77 MNOK respectively. Price development past year until 5 April 2024.

Figure 6b: As above, but past ten years until 5 April 2024.

| Index name | Return past year | Annualised past ten years |

| Nordic Least liquid 20 percentile | 2.7 % | 8.5 % |

| Nordic Second least liquid 20 percentile | 2.6 % | 8.9 % |

| Nordic Middle liquid 20 percentile | 10.9 % | 10.6 % |

| Nordic Second most liquid 20 percentile | 15.8 % | 10.9 % |

| Nordic Most liquid 20 percentile | 12.4 % | 10.0 % |

In the past year, the equally weighted Investtech index for the largest companies in the Nordic region is up around 12 per cent (black curve in the chart). The index for the second largest companies (dark blue curve) is up around 16 per cent, while the two groups of small companies (light blue curves), those traded for between approximately half a million and three million Norwegian kroner per day, are up a mere 3 per cent.

Small-cap companies have performed much weaker than large-cap companies in the past 12 months. In the long term, the past ten years, the indices have followed each other closely, and there are only small differences between the groups.

Although small companies have underperformed compared to large companies recently, we should be cautious in believing that this is a persistent change in the market. Rather, we believe that the long term statistics still hold true, and that small companies will again develop in line with the market. The groups of small companies performed much better this year than last year, when the indices fell 12 and 18 per cent. This may be a sign that small-cap will do better in the future and eventually catch up to the big companies, based on the ten-year figures.

Summary

Trends have continued to be a good indicator of whether stocks will rise or fall. Just as theory and previous statistics have shown, it has been a good choice to buy stocks in rising trends and sell stocks in falling trends.

Stocks with a high technical score, meaning algorithmic positive recommendations, have performed significantly better in the past year than those with a neutral or negative recommendation.

Insider trading has also been a good indicator, with positive returns in the past year for stocks with insider purchases, while stocks with insider sales or no insider trading have performed less well.

Very high volatility, which has previously been strongly associated with lower returns, continues to indicate weak performance. The most volatile fifth of the Nordic stocks has underperformed by around 30-35 percentage points compared to the other four groups in the past year.

Small-cap companies have performed much weaker than large-cap companies in the past year. However, in the long term, there is nothing to suggest that such stocks will continue to underperform.

Conclusion

We conclude that the Indices have largely followed development patterns from previous years, and that Investtech's analyses can provide valuable insights into which stocks to buy, sell, and avoid.

The Investtech Indices and the statistical relationships revealed through them support our strategy underlying Investtech's analyses: Buy stocks that are technically positive, in upward trends, and/or show positive insider trading. Sell correspondingly negative stocks. Completely avoid investing in the most volatile stocks.

Small-cap stocks have underperformed in the recent period, while in the long term, they have performed in line with larger companies. From the signal statistics in our extensive research project from 2021, we saw that small-cap stocks provided stronger technical signals than large-cap stocks, making it potentially easier to achieve excess return in smaller companies. We still consider it favourable to have more small-caps in a portfolio, even though this may result in significant deviation from benchmark in some periods.

Historical results are no guarantee of similar future results. Market conditions may change in the future, and other factors may come into play. However, the statistics and the summary of the Investtech Indices over the past year are considered to confirm previous results and support the notion that these are persistent effects in the markets. Research findings and statistics will continue to play a central role in Investtech's subjective recommendations in morning reports, model portfolios, and other analysis publications.

Investtech Research: Investtech Indices - results 2022-2023

Published May 25th, 2023.

By: Head of Research Geir Linløkken, Investtech.

Abstract:

Investtech launched the Investtech Indices in April last year. This is the first research article based on the indices. We examine how factors such as trend status, insider trading, and liquidity have contributed to returns over the past year. The main conclusion is that rising trends, positive technical scores, and insider buying have been associated with excess return in the subsequent period. High-volatility stocks have, as before, significantly underperformed compared to less volatile stocks. Unlike in the past, low-liquidity stocks have shown a significant negative excess return compared to more liquid stocks.

Investtech Indices

Investtech has been updating a range of equally weighted indices for stocks with different technical and quantitative characteristics since April 2022. The idea is that these indices effectively demonstrate the returns one would have obtained by mechanically following quantitative strategies in stock trading. The indices can also indicate the short-term market drivers and what has recently yielded a good "payoff."

The members of each index are fully updated automatically at specified intervals, and returns are calculated automatically on each trading day.

Unlike many market indices, the Investtech Indices are equally weighted. This means that all stocks initially have the same weight, whether they belong to very large or relatively small companies. These indices can serve as good benchmark indices for investors who follow Investtech's analyses and allocate their funds in fairly equal proportions across their portfolios.

Read more about the Investtech Indices here!

Below are the results for all Investtech Indices at the Nordic level. The graphs and tables are as of May 15, 2023.

Investtech Indices for the Nordic markets

Figure 1a: Equally weighted indices for the Nordic markets. Past year until May 15, 2023.

Figure 1b: As above, but past ten years until May 15, 2023.

| Index name | Return past year | Annualised past ten years |

| Norway Equally weighted | -3.7 % | 7.4 % |

| Sweden Equally weighted | -10.8 % | 11.6 % |

| Denmark Equally weighted | 15.5 % | 14.5 % |

| Finland Equally weighted | -1.4 % | 10.6 % |

| Nordic Equally weighted | -4.6 % | 10.9 % |

|---|

Note that the chart for the past year is the past calendar year, whereas the values in the table for the past year are for the past 252 days, which is not quite one calendar year. This may cause a slight difference between the chart and the table.

The equally weighted combined Nordic index will be the benchmark index for all the others. As of May 15 2023, it consists of the 807 Nordic stocks with an average daily turnover above 500,000 NOK. The members of the index are updated quarterly. Each stocks weighs the same to begin with and return is calculated daily.

For the past year, Denmark did best, rising 15.5 per cent. Sweden was weakest, down by 10.8 per cent, while Norway and Finland, as well as the Nordic markets combined, saw a slight decrease.

Investtech Trend Indices

Figure 2a: Investtech Indices for Nordic stocks in rising, falling and horizontal trends. Price development past year until May 15, 2023.

Figure 2b: As above, but past ten years until May 15, 2023.

| Index name | Return past year | Annualised past ten years |

| Nordic Rising trend | 8.1 % | 20.4 % |

| Nordic Horizontal trend | -0.3 % | 11.2 % |

| Nordic Falling trend | -10.6 % | -1.0 % |

Members of the trend indices are updated monthly. Index development one month is determined by the development of the stocks that had the various trend statuses at the end of the previous month.

In the past year, stocks in rising trends have risen 8.1 per cent. This is 12.7 percentage points better than benchmark (Nordic Equally weighted). Stocks in falling trends underperformed, falling 10.6 per cent, equal to 6.0 percentage points weaker than benchmark.

The difference in the past year between stocks in rising trends and in falling trends is a solid 18.7 percentage points. This is in line with the average for the past ten years, which is 21.4 percentage points.

The figures show that trend signals have worked well in the past year.

Investtech Technical Score Indices

Figure 3a: Investtech Indices for Nordic stocks with high, medium and low technical score, equal to algorithmic medium term positive/weak positive, watch and negative/weak negative recommendation. Price development past year until May 15, 2023.

Figure 3b: As above, but past ten years until May 15, 2023.

| Index name | Return past year | Annualised past ten years |

| Nordic High tech score (buy and weak buy) | -0.4 % | 19.7 % |

| Nordic Medium tech score (neutral) | -9.6 % | 5.0 % |

| Nordic Low tech score (sell and weak sell) | -8.3 % | 2.5 % |

In the past year, stocks with high technical score have clearly outperformed stocks with neutral or low technical score. In other words, stocks with positive or weak positive algorithmic recommendations have done better than stocks with neutral or negative recommendations. The difference down to indices for neutral and negative indices is 8-9 percentage points. This is a big gap, but slightly smaller than for the past decade, when the difference was 14-16 percentage points.

The figures show that Investtech's technical score recommendations have worked well in the past year, but not quite as well as for the past ten years.

Investtech Insider Indices

Figure 4a: Investtech Indices for Nordic stocks with high, medium and low insider score, equal to algorithmic medium term positive/weak positive, watch and negative/weak negative recommendation based on insider trades. Price development past year until May 15, 202

Figure 4b: As above, but past ten years until May 15, 2023.

| Index name | Return past year | Annualised past ten years |

| Nordic High insider score (buy and weak buy) | 2,4 % | 16,1 % |

| Nordic Medium insider score (neutral) | -9.2 % | 8.7 % |

| Nordic Low insider score (sell and weak sell) | -4.1 % | 11.4 % |

There are many more insider purchases than sales in the market, and the insider purchase index has 257 members on May 15, while the insider sales index has 69 members.

In the past year, the index for stocks with high insider score has risen 2.4 per cent, while the one for insider sales has fallen 4.1 per cent. The difference of 6.5 percentage points is slightly larger than it has been the past ten years.

The chart shows that insider purchases have been a good indicator in the past year.

Investtech Volatility Indices

Figure 5a: Investtech indices for Nordic stocks with different volatility, split into five approximately same-sized groups. For instance, the index "Most volatile" is the 20 per cent of stocks that fluctuate the most. Price development is past year until May 15, 2023.

Figure 5b: As above, but past ten years until May 15, 2023.

| Index name | Return past year | Annualised past ten years |

| Nordic Least volatile 20 percentile | 0,2 % | 15,6 % |

| Nordic Second least volatile 20 percentile | 6.1 % | 15.8 % |

| Nordic Middle volatile 20 percentile | -0.2 % | 14.7 % |

| Nordic Second most volatile 20 percentile | -1.1 % | 10.3 % |

| Nordic Most volatile 20 percentile | -20.3 % | 1.8 % |

Stock volatility is a fairly consistent characteristic over time. If a stock fluctuated a lot during a period, it's likely to fluctuate for the next period as well.

There are no surprises here. As before, the group of the most volatile stocks has significantly underperformed. This fifth of the stocks is down 22 per cent. The other groups are all plus/minus zero.

The ten-year-chart shows the effects just as well: the most volatile stocks have performed much weaker than the other groups. However, here the second most volatile stocks have also underperformed.

The chart shows that the most volatile stocks have underperformed in the past year. It can be tempting to buy such stocks, which have often fallen a lot and have high upside, but the indices suggest this is a dangerous strategy. Based on the long term chart, it is considered a wise strategy for long term investors to stay entirely away from the most volatile stocks.

Investtech Liquidity Indices

Figure 6a: Investtech indices for Nordic stocks with different liquidity, split into five approximately same-sized groups. For instance, for Norway median liquidity for stocks in the five different indices are 0.9, 2.5, 6.0, 23 and 77 MNOK respectively. Price development past year until May 15, 2023.

Figure 6b: As above, but past ten years until May 15, 2023.

| Index name | Return past year | Annualised past ten years |

| Nordic Least liquid 20 percentile | -18.1 % | 11.0 % |

| Nordic Second least liquid 20 percentile | -12.0 % | 11.4 % |

| Nordic Middle liquid 20 percentile | -2.8 % | 12.7 % |

| Nordic Second most liquid 20 percentile | 10.7 % | 12.7 % |

| Nordic Most liquid 20 percentile | 9.1 % | 11.5 % |

In the past year, the equally weighted Investtech index for the largest companies in the Nordic region is up around 5 per cent (black curve in the graph). The index for the second largest companies (dark blue curve) is up around 7 per cent, while the two groups of small companies (light blue curves), those traded for between approximately half a million and three million Norwegian kroner per day, are down between 12 and 18 per cent.

Small-cap companies have performed much weaker than large-cap companies in the past 12 months. In the long term, the past ten years, the indices have followed each other closely, and there are only small differences between the groups.

Although small companies have underperformed compared to large companies recently, we should be cautious in believing that this is a persistent change in the market. Rather, we believe that the long term statistics still hold true, and that small companies will again develop in line with the market.

Summary

Trends have continued to be a good indicator of whether stocks will rise or fall. Just as theory and previous statistics have shown, it has been correct to buy stocks in rising trends and sell stocks in falling trends.

Stocks with a high technical score, meaning algorithmic positive recommendations, have performed significantly better in the past year than those with a neutral or negative recommendation.