Volume analysis

Volume analysis is greatly underestimated among technical analysts. Volume analysis often gives strong warnings when a stock otherwise looks technically positive. Volume analysis is used to confirm the strength of a buy or sell signal.

Investtech has two important volume indicators; volume balance and price/volume correlation. In addition, we have short term candlestick charts, which make a good starting point for detailed short term volume analyses.

How to use volume analysis?

Trend analysis is central to the Investtech concept. This includes direct visual trend analysis, support and resistance and formation analysis.

Normally a trend analysis is carried out first, and then volume is used to confirm or disprove what the trend analysis shows. If both are positive, the stock can be bought. When already owning a stock, volume analysis is used as a stock health check, to confirm a positive development or be warned of a potential negative reversal.

Guidelines

- If considering buying a stock: it is a signal of strength if the stock has positive volume.

- If considering buying a stock, but it has negative volume: it is recommended to wait or look for other potential stocks.

- Owning a stock that is positive on volume and trend: it is recommended to keep it.

- Owning a stock that is positive on trend but negative on volume: it is recommended to keep a close eye on it. Be ready to sell if the trend signals turn negative as well.

Please note that volume indicators are fairly short term indicators. They are easily influenced by noise. Therefore, be careful not to emphasize volume too much if investing long term and e.g. trading in stocks that are in long term trends. At the same time, volume indicators can quickly catch mood changes among the investors, making it possible to get in or out of stocks early, before the masses start to move. Volume analysis is therefore a very important element for short term, active investors.

Investtech’s volume indicators

Volume balance

Positive volume balance strengthens buy signals from other indicators, while negative volume balance strengthens sell signals. Likewise, positive volume balance will strengthen or confirm a rising trend, whereas negative volume balance will confirm a falling trend.

Price/volume correlation

Correlation between price development and volume development shows whether volume confirms the overall trend or if it warns of a coming reversal.

Candlesticks

Candlestick analysis is the best tool for doing a detailed short term volume analysis. Candlesticks help identify signals before they appear in the price chart, as well as assist with short term timing and setting limits. Candlesticks also strengthen or weaken more long term trend signals.

Positive volume balance

Positive volume balance is a sign of health. It shows that the stock price is rising on high volume and reacting back on low volume. This indicates that investors are worried about not getting into the stock when something happens, and also hesitant to sell on falling prices.

Positive volume balance is a sign of health. It shows that the stock price is rising on high volume and reacting back on low volume. This indicates that investors are worried about not getting into the stock when something happens, and also hesitant to sell on falling prices.

Volume balance is a very important indicator. It is often used alongside trend analysis and other indicators based on the stock price.

The following applies to positive volume balance:

- Strengthens a buy signal

- Weakens a sell signal

- Indicates that investors are positive and rising prices will continue

- Indicates the end of falling prices and a trend reversal upwards

In general we want the stocks we own or plan to buy to have positive volume balance. Positive volume balance indicates a healthy stock with positive development of the investors’ view of the stock. Such a stock is indicated to rise further.

Investtech Research: Positive volume balance

Stocks with these positive signals have on average outperformed the market in the following months. Annualised return has been 1.8 percentage points (pp) better than benchmark.

| Annualised return (based on 66-day figures) | |

| Positive signals medium term | 11.9% |

| Reference index | 10.1% |

| Excess return | 1.8pp |

The research results are based on 44054 signals from Nordic stocks in the period 2008-2020.

Read more

- Research Report: Volumbalanse - signalstatistikk nordiske markeder 1996 til 2018 (Required access level: PRO)

- Research Article: Investtech-forskning: Volumenbalance er en nyttig indikator ved investeringsbeslutninger

- Research Report: Investtech-forskning: Volumbalanse - signalstatistikk nordiske markeder 2019 og 2020 (Required access level: PRO)

- Research Article: Investtech-forskning: Volumbalanse må kombineres med andre indikatorer

- Research Report: Investtech-forskning: Volumbalanse - signalstatistikk nordiske markeder 2008-2020 (Required access level: PRO)

Negative volume balance

Negative volume balance is a sign of weakness. It shows that the stock falls on high volume and reacts upwards on low volume. This indicates that investors are worried about not being able to sell when something happens, and also hesitant to buy on rising prices.

Negative volume balance is a sign of weakness. It shows that the stock falls on high volume and reacts upwards on low volume. This indicates that investors are worried about not being able to sell when something happens, and also hesitant to buy on rising prices.

Volume balance is a very important indicator. It is often used alongside trend analysis and other indicators based on the stock price.

The following applies to negative volume balance:

- Strengthens a sell signal

- Weakens a buy signal

- Indicates that investors are negative and falling prices will continue

- Indicates the end of rising prices and a trend reversal downward

Negative volume balance warns of uncertainty among investors and high risk in a rising phase. Negative volume balance also confirms falling trends and sell signals in a falling phase.

Investtech Research: Negative volume balance

Stocks with these negative signal have on average underperformed compared to benchmark in the following months. Annualised return has been 3.8 percentage points (pp) weaker than benchmark.

| Annualised return (based on 66-day figures) | |

| Negative signal medium term | 8.3% |

| Reference index | 12.1% |

| Excess return | -3.8pp |

The research results are based on 24530 signals from Nordic stocks in the period 2008-2020.

Read more

- Research Report: Volumbalanse - signalstatistikk nordiske markeder 1996 til 2018 (Required access level: PRO)

- Research Article: Investtech-forskning: Volumenbalance er en nyttig indikator ved investeringsbeslutninger

- Research Report: Investtech-forskning: Volumbalanse - signalstatistikk nordiske markeder 2019 og 2020 (Required access level: PRO)

- Research Article: Investtech-forskning: Volumbalanse må kombineres med andre indikatorer

- Research Report: Investtech-forskning: Volumbalanse - signalstatistikk nordiske markeder 2008-2020 (Required access level: PRO)

Correlation between price development and volume development

Correlation between price development and volume development shows whether volume confirms the overall trend or if it warns of a coming reversal.

Ordinarily volume should increase in the trend direction. In rising trends we want high volume on rises and near tops, and low volume on falling prices and near bottoms. This development signals a healthy stock with ever more optimistic investors, and strengthens an overall positive trend.

Similarly high volume on falling prices and near bottoms in a falling trend will confirm the overall negative trend and indicate it will continue to fall.

Deviations from the above warn of a coming trend reversal.

Normal situations

Volume should increase in the trend direction. The figure shows a rising trend with high volume near tops and low volume near bottoms. Aggressive investors have to pay more to get the stocks that they want. Few investors sell near bottoms, as they are positive to the stock and comfortable keeping it.

Volume should increase in the trend direction. The figure shows a rising trend with high volume near tops and low volume near bottoms. Aggressive investors have to pay more to get the stocks that they want. Few investors sell near bottoms, as they are positive to the stock and comfortable keeping it.

Decreasing volume in the trend direction warns of a possible trend break. In the figure to the left the buyers have little power, as volume near the last top is low. At the same time, sellers are aggressive when the price falls. This indicates nervous sellers and hesitant buyers, and signals a potential break downward.

Decreasing volume in the trend direction warns of a possible trend break. In the figure to the left the buyers have little power, as volume near the last top is low. At the same time, sellers are aggressive when the price falls. This indicates nervous sellers and hesitant buyers, and signals a potential break downward.

Trading opportunities

Volume development can indicate trading opportunities. When the correlation between price development and volume development is clearly positive in falling or sideways trends, this may open up for good short term trading opportunities. Such situations often involve high risk, but the upside can be very good.

Volume development can indicate trading opportunities. When the correlation between price development and volume development is clearly positive in falling or sideways trends, this may open up for good short term trading opportunities. Such situations often involve high risk, but the upside can be very good.

The best trading opportunities are when the price falls on a low volume in rising trends and approaches the trend floor.

Special circumstances

Greatly increasing volume along with a serious price increase can indicate a final rally. Such situations tend to occur when a rising trend has lasted for a long time. Following new positive news or new focus in the media, everyone wants to own the stock. This results in a great and sudden price increase on high volume. If the situation is followed by significant price reduction, it may have been a final rally.

Greatly increasing volume along with a serious price increase can indicate a final rally. Such situations tend to occur when a rising trend has lasted for a long time. Following new positive news or new focus in the media, everyone wants to own the stock. This results in a great and sudden price increase on high volume. If the situation is followed by significant price reduction, it may have been a final rally.

However, please note that rising trends tend to last longer than many investors think, and the stocks often keep rising, even after significant price increases on very high volume.

A significant price fall on very high volume in a falling trend may indicate a sell off. Following a long list of negative news, the last investors give up. If the price then rises and volume increases, it signals that the investors have been as negative as they can possibly get and that optimism is returning.

A significant price fall on very high volume in a falling trend may indicate a sell off. Following a long list of negative news, the last investors give up. If the price then rises and volume increases, it signals that the investors have been as negative as they can possibly get and that optimism is returning.

Please note, however, that falling trends often last for a long time, and disappointment is often followed by more disappointment. Beware of buying into the stock after a fall like this, at least until a clearly positive volume development is seen, preferably in combination with a short term positive overall trend. And even then the risk will still be high.

Positive correlation between price and volume development

Positive correlation between price development and volume development is a sign of strength. It shows high buy interest near tops in the price chart, and low sell interest near price bottoms. This indicates that investors who already own the stock and those who consider buying both believe that the price will rise.

Correlation between price and volume development is considered an important indicator. It is often used alongside trend analysis and other indicators based on the stock price.

The chart shows positive correlation between price development and volume development when the stock is in a rising trend. This volume development confirms the positive mood among investors and indicates that the rising trend will continue.

The chart shows positive correlation between price development and volume development when the stock is in a rising trend. This volume development confirms the positive mood among investors and indicates that the rising trend will continue.

There can also be positive correlation when a stock is in a falling trend. It then signals that the strength of the falling trend is waning and a reversal may happen in the near future.

There can also be positive correlation when a stock is in a falling trend. It then signals that the strength of the falling trend is waning and a reversal may happen in the near future.

The following applies to positive correlation between price and volume development:

- Strengthens a buy signal

- Weakens a sell signal

- Indicates that investors are positive and the rising trend will continue

- Indicates that sellers are passive, a falling trend is ending and a trend reversal is near

Thus we want to see a positive correlation between price and volume development for stocks we own or will buy. Positive correlation indicates a healthy stock with a positive development of the investors’ view of the stock. Such a stock is indicated to continue rising.

Negative correlation between price and volume development

Negative correlation between price development and volume development is a sign of weakness. It shows high sell interest near bottoms in the price chart, and low buy interest near price tops. This indicates that investors who have already sold the stock and those who consider selling both believe that the price will fall.

Correlation between price and volume development is considered an important indicator. It is often used alongside trend analysis and other indicators based on the stock price.

The chart shows negative correlation between price development and volume development when the stock is in a falling trend. This volume development confirms the negative mood among investors and indicates that the falling trend will continue.

The chart shows negative correlation between price development and volume development when the stock is in a falling trend. This volume development confirms the negative mood among investors and indicates that the falling trend will continue.

There can also be negative correlation when a stock is in a rising trend. It then signals that the strength of the rising trend is waning and a reversal may happen in the near future.

There can also be negative correlation when a stock is in a rising trend. It then signals that the strength of the rising trend is waning and a reversal may happen in the near future.

The following applies to negative correlation between price and volume development:

- Strengthens a sell signal

- Weakens a buy signal

- Indicates that investors are negative and the falling trend will continue

- Indicates that buyers are passive, a rising trend is ending and a trend reversal is near

Thus negative correlation between price and volume development is a warning sign of a coming falling trend. Negative correlation indicates weak buyers and aggressive sellers and thereby negative development of the investors’ view of the stock. Such a stock is indicated to continue falling.

Candlestick analysis

Candlestick analysis is the best tool for doing a detailed short term volume analysis. Candlesticks help identify signals before they appear in the price chart, as well as assist with short term timing and setting limits. Candlesticks also strengthen or weaken more long term trend signals.

The Candlestick graphs

You switch the candlestick graphs on and off by clicking the ![]() button. The graphs show short term details in the price chart. Opening price, low and high prices are stated in addition to closing price. You can also study volume details and the connection between volume and price changes.

button. The graphs show short term details in the price chart. Opening price, low and high prices are stated in addition to closing price. You can also study volume details and the connection between volume and price changes.

About Candle formation

The rectangle section of the candle line is called the Real body. Thin lines above and below the real body are called Shadows. These shadows represent the session’s price extremes. The shadow above the real body is called the upper shadow, and the shadow below is called the lower shadow. Accordingly, the peak is the high of the trading session and the bottom is the low.

When the closing price is higher than the opening, we get a white real body.

When the price closes below the open, we get a black real body.

Volume is plotted with one column per day. The column is green if the closing price was higher than the day before. It is red if the closing price fell, and blue if there was no change.

Volume is plotted with one column per day. The column is green if the closing price was higher than the day before. It is red if the closing price fell, and blue if there was no change.

Volume analysis with Investtech’s candlesticks

In short term volume analysis we study what volume is like on days when the price rises and on days when the price falls. Investtech’s candlesticks are very good tools for this analysis, especially due to the colour coded volume columns.

The main rules are:

- Tall green volume columns and low red ones indicate rising prices.

- Tall red volume columns and low green ones indicate falling prices.

Positive

Positive

High volume on rising prices indicates that optimism is increasing and many investors pay more to acquire stocks. Low volume on falling prices indicates that few investors will reduce the price in order to sell, and that they are comfortable keeping the stock. This is positive and indicates further rise.

Negative

Negative

High volume on falling prices indicates that uncertainty is on the increase and that many investors will reduce the price in order to get rid of their stocks. Low volume on rising prices indicates that few investors will pay more to be able to acquire the stock, and that they are not very interested or they assume they will be able to get the stocks more cheaply later. This is negative and indicates further fall.

Please note the tall red volume columns in the chart on the left, combined with the low green columns. This is evident already in the first half of the chart. Volume balance was negative and gave a good warning of the falling prices to come.

Find buy opportunities with candlestick patterns

Traditionally, candlestick analysis is used to identify short-term purchase and sale signals. By identifying candle patterns, one can understand something about the change in optimism or pessimism among investors. Thus, one can also predict whether stock prices are going to go up or down for the next few days. Such signals provide good opportunities to enter in or get out of the market at favorable times.

Read more about Candlestick patterns here.

Read more about Candlestick patterns here.

At what time of day should trading be done?

Sometimes buyers and sellers of a stock are active at different times of day.

Price rises throughout the day

Price rises throughout the day

The figure shows a stock that sees few buyers in the morning, but many sellers. Such stocks open low and rise during the day. The candlestick graph shows this in a glance, as almost all the price columns are white.

- A stock with a large majority of white candlesticks should be bought in the morning and sold in the evening.

Price falls throughout the day

Price falls throughout the day

The figure shows a stock that sees few buyers in the evening, but many sellers. Such stocks fall during the day and close low. The candlestick graph shows this in a glance, as almost all the price columns are black.

- A stock with a large majority of black candlesticks should be bought in the evening and sold in the morning.

Find buy and sell opportunities by Candlesticks

Traditionally, candlestick analysis is used to identify short-term purchase and sale signals. By identifying candle patterns, one can understand something about the change in optimism or pessimism among investors. Thus, one can also predict whether stock prices are going to go up or down for the next few days. Such signals provide good opportunities to enter in or get out of the market at favourable times. At the same time, the patterns are short-term and exposed to noise, and many false signals occur. We recommend that candlestick analysis be combined with more long-term analysis on trends and volume development.

Hammer

Hammer is a one candle pattern which has a small real body (black or white) at the top of the trading range, a very long lower shadow and little or no upper shadow. The lower shadow should be at least twice the height of the real body. It must come after a decline, suggesting that the market is trying to determine a bottom, and is a bullish reversal pattern.

Psychology: Price opens and trades lower as bears are still in control. The bulls then step in to hammer the falling price. However, this does not suggest the end of a downtrend, but simply suggests that bullish investors are strengthening. They try to take the price higher to close near the top of the trading range. Hence a small real body and long shadow.

How to trade: This pattern suggests an upward movement in price. Volume on the hammer day must be higher than previously falling candles. Suggested entry could be after a close above the real body of the hammer. A buy based on this pattern must preferably be supported by a longer term rising trend channel, positive volume balance or other longer term technical indicators. Low of the hammer can be used as a stop-loss on closing basis.

Shooting Star is the reverse pattern of the hammer. It is formed at the top after a prolonged uptrend.

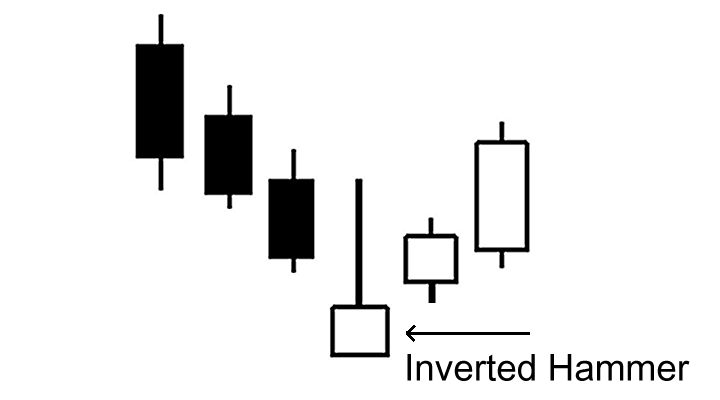

Inverted Hammer

Inverted hammer appears after a decline and is a bottom reversal line. It has a small real body (black or white), a long upper shadow, which must be at least twice the size of the real body, and a very tiny or no lower shadow.

Psychology: The inverted hammer needs bullish confirmation which could be ideal in the form of next day’s close above the real body of the inverted hammer. The reason for the bullish verification is that it has a long upper shadow that gives the inverted hammer a bearish shade. A close above will, in a way, nullify this bearish effect. This could further lead to the beginning of a rally.

How to trade: This pattern suggests an upward movement in price. Volume on the inverted hammer day or the following candle must be higher than previously falling candles. Suggested entry could be a close above the real body of the inverted hammer. A buy can be initiated based on this pattern, preferably supported by a longer term rising trend channel, positive volume balance or other longer term technical indicators. Low of the inverted hammer can be used as a stop-loss on the closing basis.

Bullish Engulfing

Bullish engulfing is a two-candle bullish reversing pattern. The real body of the first candle is entirely engulfed by the real body of the second candle. The second candle’s real body is white and first candle’s is preferably black in color. The first candle must be preceded by falling candles and the pattern is of any significance only after a downtrend. The engulfing candle may or may not have an upper shadow.

Psychology: Bears have been in charge so far and price opens with a gap down from previous close. Before the end of the day bulls charge in and downtrend runs out of steam. The large body shows that the new direction has started with good force.

How to trade: The engulfing candle must be accompanied by higher volume. The pattern must be followed by a higher top and higher close candle to ensure change in trend. A close above the high of the engulfing pattern suggests a potential buy can be initiated. A close below the low of the pattern can be used as a stop-loss. Any signal is suggested to be supported by a longer term rising trend channel, positive volume balance or other longer term technical indicators.

Bearish engulfing is just the opposite of the bullish engulfing pattern mostly appearing at the top of a move.

Bullish Harami

Bullish Harami is a two candle pattern where the second candle’s real body (black or white) is completely inside the first candle’s real body. The color of the first candle should ideally be black. This is seen as a trend reversing pattern and comes after a decline in price. The second candle may or may not have a real body.

Psychology: This pattern means that the market is losing its breath because the small real body is a sign of uncertainty. The small real body’s opening and close within prior candle’s real body is another indication that the bears are losing momentum. Thus a trend reversal is possible.

How to Trade: A buy is suggested if the share price closes above the high of the pattern. A close below the pattern triggers the stop-loss. It is suggested that this signal be used in association with a longer term rising trend channel, positive volume balance or other longer term trend reversing or technical indicators.

Bearish Harami is the reverse of this pattern and appears after an uptrend. It is a bearish reversal signal.

The Morning Star

The Morning Star is composed of three candles. The first candle has a black real body, second candle is a small candle with small or no real body and tiny shadows, and the third candle has a long white real body. The second candle usually appears outside the real body of the first candle and can be either black or white. It appears after a downward move and is a bullish or bottom reversal pattern.

Psychology: The first black candle is a continuation of a falling trend. Second candle represents indecision between bulls and bears and the market is losing its prior directional bias. Hence a small real body. The third candle is a long white candle which defines that the bulls are trying to overpower the bears and ready to take charge of an upcoming uptrend. Ideally the real body of the white candle should close more than halfway into the first candle’s real body.

How to trade: The morning star is used as an early indication that the down move is about to reverse, but this trend reversing pattern is suggested to be seen together with a longer term rising trend channel, positive volume balance or other technical indicators to confirm the change in trend. The low of the pattern, which is the low of the middle candle, can be used as the stop-loss on closing basis to come out of the stock.

Evening Star: Reverse formation of the morning star is called the evening star. It appears after an uptrend and is a top or bearish reversal pattern.

Piercing Line

Piercing line is composed of two candles and is a bullish or bottom reversal pattern if it appears after a downtrend or series of falling candles. The first candle is a black real body and the second candle is a white real body. On the second day price opens with a gap down and travels higher to close more than halfway into the body of the first candle, but does not cross its entire real body.

Psychology: Bears are content with the reinforced downtrend. Next day price opens with the gap down, but eventually starts to inch upwards as bulls start to step in. Price manages to rise half way through the previous candle's real body and closes above its close. This leaves the bears in confusion. Opportunist buyers say new lows could not hold and view this as a chance to get in.

How to trade: This pattern must be confirmed by another candle closing above the close of the piercing candle. Suggested volume on the second candle must be higher. A stop-loss on closing basis below the low of the pattern is suggested. A buy based on this pattern should be supported by a longer term rising trend channel, positive volume balance or other longer term technical indicators.

Dark Cloud Cover: Reverse of the piercing line pattern is the dark cloud cover. It is a bearish reversing pattern and appears after an uptrend. All the properties are similar to the piercing line pattern but in reverse manner. This pattern can be used to get out of the stock to avoid any possible loss in existing holding due to any downward move.

Windows

Windows or Gaps (as it is called in Western methods) are of two types, bullish or bearish. A rising window is a bullish signal. There is a price vacuum between the prior session’s high and current session’s low. The trading session followed by the window is usually accompanied by higher volume.

Psychology: A window appears when there is sudden optimism in the market. It is created either by some market news that had come overnight, or driven by high optimism among buyers that take the price higher.

How to trade: A rising window must be confirmed by successive rising candle or candles in the upward direction. Further, it always acts as a support in an uptrending market. However, any price close below the bottom of a rising window is interpreted as a sign of weakness. A close below this level is where one may stop any loss in the stock and get out of the stock.

It is suggested not to trade windows in isolation, but in combination with long term trend channel, volume balance or other longer term supportive technical indicators.

Three Advancing White Soldiers

Three Advancing White Soldiers is seen as both a bullish reversal (when appears after a downward trend) as well as a continuation candle pattern (appears after a consolidation phase in an uptrend). It comprises of three advancing candles which has higher closes. Each line is a long white candle with prices closing near their highs.

Psychology: This pattern is a sign of strength and change in investor sentiment, and it confirms a shift in momentum if it appears at a low price area or after a period of stable prices.

How to trade:This is a rare pattern. However, when it appears, a short move upward after a breakout from this pattern is common. One can buy based on this formation with a strict stop-loss on closing basis below the low of the very first candle of the three candles. It is recommended to see this candlestick signal along with a longer term rising trend channel, positive volume balance or other longer term suggestive technical indicators.

Three Black Crows is the opposite candlestick pattern of the three white soldiers. It either occurs after an uptrend to mark weakening of the uptrend and a possible reversal, or shows after a consolidation phase in a preceeding downtrend.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices