Insider trade analysis of stocks

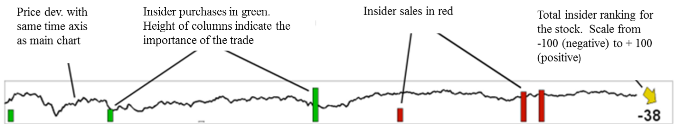

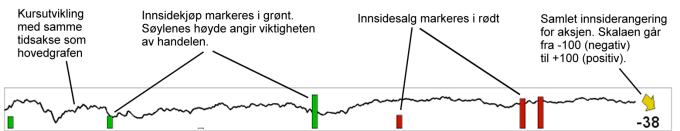

Analysis of insider trades is Investtech’s alternative to fundamental analysis. When persons on a company’s Board or in management buy stocks, it signals that they think the stock is cheap. Insider sales are considered a signal that the stock is expensive or high risk.

Investtech’s insider trade analyses give an overview of insider purchases and insider sales in a company over time.

Each trade is assigned an importance on a scale from 0 to 100. Big trades count more than small ones, and trades where the insiders owned few stocks to start with, are given more weight than where they owned many. An insider purchase gives a positive number and sales give a negative number.

In Norway all registered insiders are obliged to report their own trades as soon as possible, and no later than when the exchange opens the next day. Investtech evaluates all stock exchange messages and registers data on insider trades. The insider trade analysis for Swedish stocks is based on the insider transactions reported

to the Swedish Financial Supervisory Authority’s Insider Register.

Based on all reported insider trades in a company, Investtech’s systems assign the stock an insider ranking on the scale -100 to +100. Stocks with an insider ranking of 50 or higher are considered buy candidates based on insider trades. Insider rankings from 25 to 50 are considered weak buy candidates. Similarly, negative insider rankings are

considered sell candidates.

Explanation of table with insider trades

The trades in this table are the ones in the chart above.

| Field | Description |

| Date | Date the trade was reported |

| Type | Type of transaction |

| Count | Number of stocks |

| Price | The buying/selling price for the stocks |

| Value | Value of the trade in NOK/SEK 1000 |

| Percent | Value of the trade in percentage of the insider's total holding in the stock |

| Controlled | Number of stocks the insider owns after the transaction |

| Text | Short text describing the transaction. Purchases in green, sales in red. |

| Importance | The importance of the trade, calculated based on the amount of money traded for and the insider's change of stock ownership in percent. The scale goes from 0 (= unimportant) to 100 (=important). |

Innsidekjøp som indikator for videre kursutvikling i aksjen

Publisert 26.04.2019

Aksjer med innsidekjøp har i gjennomsnitt gjort det bedre enn referanseindeksen i perioden etter innsidekjøpet, og aksjer med innsidesalg har i gjennomsnitt gjort det dårligere enn referanseindeksen i perioden etter innsidesalget. Det viser en forskningsrapport fra Investtech basert på 20 år med data fra Oslo Børs og 16 år med data fra Stockholmsbørsen.

Analyse av innsidehandler er Investtechs alternativ til fundamental analyse. Når en person i selskapets styre eller ledelse kjøper aksjer, er det et signal om at vedkommende mener aksjen er billig. Innsidesalg blir regnet som signal om at aksjen er dyr eller at risikoen er høy.

Investtechs innsidehandelanalyser gir oversikt over innsidekjøp og innsidesalg i et selskap over tid.

Du kan lese mer om analyse av innsidehandler på våre hjelpesider her.

Resultater innsidekjøp

Figur 1: Kursutvikling første 66 dager etter innsidekjøp.

Grafene i figur 1 viser gjennomsnittlig kursutvikling i etterkant av innsidekjøp i Norge og Sverige. Handlene meldes før børsens stengetid på dag 0. Kun dager da børsen er åpen inngår, slik at 66 dager tilsvarer cirka tre måneder. Den tykke blå linjen viser hvordan aksjer med innsidekjøp i gjennomsnitt har utviklet seg. Det skraverte området angir standardavviket til beregningene. Den tynne blå linjen er gjennomsnittlig utvikling til referanseindeksen i samme periode.

| 66-dagers-tall | Norge | Sverige | Vektet snitt |

| Kjøpssignal | 3.5 % | 4.3 % | 4.0 % |

| Referanseindeks i samme periode | 2.2 % | 2.4 % | 2.3 % |

| Meravkastning kjøpssignal | 1.4 %p | 1.8 %p | 1.7 %p |

| Annualisert | |||

| Kjøpssignal | 14.1 % | 17.3 % | 16.3 % |

| Referanseindeks i samme periode | 8.5 % | 9.6 % | 9.2 % |

| Meravkastning kjøpssignal | 5.7 %p | 7.7 %p | 7.2 %p |

Tabellen viser annualisert avkastning og annualisert meravkastning i prosentpoeng, benevnt %p. Innsidekjøp både i Norge og Sverige har vært fulgt av en positiv avkastning de kommende månedene. I Norge var oppgangen 3,5 prosent og i Sverige 4,3 prosent, som gir et vektet snitt på 4,0 prosent. Annualisert blir avkastningen 16,3 prosent, tilsvarende en meravkastning på 7,2 prosentpoeng mot referanseindeksen i samme periode.

Vi så også at aksjer med innsidekjøp i gjennomsnitt hadde falt i perioden før kjøpet. Motsatt hadde aksjer med innsidesalg steget i perioden før salget. Disse observasjonene er en indikasjon på at innsidere kjøper når de mener aksjene er fundamentalt billige, og har falt mer enn fortjent, samtidig som innsiderne selger når de mener aksjen har steget for mye og har blitt fundamentalt dyr. Investtechs innsidehandelanalyse kan dermed ses på som en enkel fundamental analyse av aksjen.

Du finner flere resultater og detaljer i forskningsrapporten som du kan lese her.

Insider Purchase

When primary insiders in a company buy stocks, it may be a signal that the stock is fundamentally cheap.

When primary insiders in a company buy stocks, it may be a signal that the stock is fundamentally cheap.

When someone on a company’s Board or a member of Management buys stocks, it signals that they think the stock price will rise. The primary insider may feel that the market has punished the stock too hard following negative news or that the market fails to sufficiently value positive news. It may also be the case that the company’s outlook is good and/or that the insider believes the purchase risk is low.

In general, we want to side with the primary insiders. It is considered safer to buy a stock that the company’s directors or management have purchased recently than a similar stock without insider trades.

Investtech Research: Insider Purchase

Stocks with these ostosignaalit have on average outperformed the market in the following months. Annualised excess return has been 8.1 percentage points (pp). This is significantly better than benchmark.

| Annualised return (based on 66-day figures) | |

| Ostosignaalit keskipitkä tähtäin | 19.0% |

| Reference index | 10.9% |

| Excess return | 8.1pp |

The research results are based on 9837 signals from Nordic stocks in the period 2008-2020.

Lue lisää

- Research Article: Innsidekjøp som indikator for videre kursutvikling i aksjen

- Research Report: Innsidehandler - signalstatistikk Norge, Sverige og Danmark 2019 og 2020 (Vaadittu käyttäjätaso PRO)

- Research Article: Investtech-forskning: Innsidehandler under koronapandemien

- Research Report: Investtech-forskning: Innsidehandel - signalstatistikk Skandinavia 2008 til 2020 (Vaadittu käyttäjätaso PRO)

- Research Article: Investtech-forskning: Kursoppgang etter innsidekjøp

Insider Sale

Sales by primary insiders in a company may be a signal that the stock is fundamentally expensive.

Sales by primary insiders in a company may be a signal that the stock is fundamentally expensive.

When someone on a company’s Board or a member of Management sells stocks, it may be a signal that they are afraid the stock price will fall. The primary insider may think the stock has risen too much compared to the development and potential of the company, or that the market has failed to sufficiently take into account increased risk or negative news. It may also be the case that the company’s or sector’s outlook has been weakened or that the insider believes risk is high.

If the insider only sells a smaller share of their stocks, they may want to reduce risk in their own portfolio. Sales may also occur because an insider needs cash for something else or has found a better investment opportunity. In general, it is considered a negative signal when primary insiders sell stocks in their company. It is considered safer to buy a stock where directors or management have purchased stocks recently than similar stocks where insiders have recently sold.

Investtech Research: Insider Sale

Stocks with these myyntisignaalit have on average underperformed compared to benchmark in the following months. Annualised return has been 1.8 percentage points (pp) weaker than benchmark.

| Annualised return (based on 66-day figures) | |

| Myyntisignaalit keskipitkä tähtäin | 8.0% |

| Reference index | 9.7% |

| Excess return | -1.8pp |

The research results are based on 5158 signals from Nordic stocks in the period 2008-2020.

Lue lisää

- Research Article: Innsidesalg som indikator for videre kursutvikling i aksjen

- Research Report: Innsidehandler - signalstatistikk Norge, Sverige og Danmark 2019 og 2020 (Vaadittu käyttäjätaso PRO)

- Research Article: Investtech-forskning: Innsidehandler under koronapandemien

- Research Report: Investtech-forskning: Innsidehandel - signalstatistikk Skandinavia 2008 til 2020 (Vaadittu käyttäjätaso PRO)

- Research Article: Investtech-forskning: Kursoppgang etter innsidekjøp

Kategorisering av innsidehandler

Følgende gjelder for meldepliktige handler som omtales på Investtechs sider:

- Investtech går gjennom alle mottatte OBI-meldinger manuelt. Innsidehandler som ikke er meldt gjennom OBIs meldingssystem blir ikke registrert.

- Som innsidehandler regnes handler der sentrale personer i et selskap har kjøpt eller solgt aksjer i selskapet og rapportert dette til børsen. Selskapers handel med egne aksjer blir ikke ansett som innsidehandler.

- Transaksjoner som ikke anses som mulig kursdrivende blir fjernet. Dette gir en bedre oversikt over de viktige handlene.

- Følgende typer transaksjoner blir ikke rapportert:

- Overføring mellom innsider og selskap som innsider kontrollerer.

- Overføring mellom innsider og innsiders familie (nærstående).

- Kjøp fra selskapet eller en ansattes-organisasjon til pris mer enn 10 % lavere enn børskurs.

- Kjøp eller tegning i forbindelse med emisjoner til pris mer enn 10 % under markedspris.

- Selskapets gjenkjøp av egne aksjer.

- Selskapets ansattes-organisasjons eller fonds kjøp av egne aksjer.

- Kjøp eller salg som følge av tidligere inngåtte forward-kontrakter.

- Kjøp som følge av tidligere inngått kjøpsopsjon.

- Salg som følge av tidligere inngått salgsopsjon.

- Handel med aksjer og opsjoner som følge av bonusordninger eller andre incentiver.

- Transaksjoner mellom innsidere.

- Forlengelse av opsjonsavtaler eller forwards.

- Flaggemeldinger fra ikke-innsidere.

- Følgende blir rapportert:

- Inngåelse av forward-kontrakter.

- Handel med opsjoner.

- Salg av aksjer kjøpt etter innløsning av kjøpsopsjon.

- Handler foretatt av nærstående til innsider blir rapportert/behandlet som om innsideren selv skulle ha gjort handelen.

- Handler foretatt av selskap der innsider har en kontrollerende eierandel eller viktig funksjon (adm.dir, styreleder etc) blir rapportert/behandlet som om innsideren selv skulle ha gjort handelen.

- Det blir forsøkt å angi innsiderens posisjon i selskapet, for eksempel adm.dir, styremedl, etc i tillegg til å bruke innsiderens navn.

- Ved handel i selskaper med A og B-aksjer blir summen av A og B-aksjer lagt til grunn for innsiders handel og innehav.

Investtech ei takaa analyysien tarkkuutta tai kattavuutta. Kaikkien analyysien tuottamien neuvojen ja signaalien käyttäminen on täysin käyttäjän vastuulla. Investtech ei vastaa mistään tappioista, jotka saattavat syntyä Investtechin analyysien käytön seurauksena. Mahdollisten eturistiriitojen yksityiskohdat mainitaan aina sijoitusneuvon yhteydessä. Lisätietoja Investtechin analyyseistä löytyy täältä disclaimer.

Investtech ei takaa analyysien tarkkuutta tai kattavuutta. Kaikkien analyysien tuottamien neuvojen ja signaalien käyttäminen on täysin käyttäjän vastuulla. Investtech ei vastaa mistään tappioista, jotka saattavat syntyä Investtechin analyysien käytön seurauksena. Mahdollisten eturistiriitojen yksityiskohdat mainitaan aina sijoitusneuvon yhteydessä. Lisätietoja Investtechin analyyseistä löytyy täältä disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices