Trender

Trender er en af de allervigtigste indikatorer i teknisk analyse. I følge teknisk analyseteori vil aktier, som ligger i stigende trender, fortsætte med at stige, og aktier, som ligger i faldende trender, fortsætte med at falde. Forskning, som Investtech har lavet, viser, at dette stemmer.

Det er meget vigtigt, at identificere om en aktie er i en stigende eller en faldende trend. Det er også vigtigt, at identificere når trender drejer for at komme tidligt ud ved en nedgang og tidligt ind ved en opgang.

Trend er en enkel indikator at følge. Investtechs computere identificerer hver dag den kvalitetsmæssigt bedste trend for hver enkelt aktie. Aktier, som ligger i stigende trender, bør købes, og aktier, som ligger i faldende trender, bør sælges.

Køb og hold aktier i stigende trender

Sælg og hold dig væk fra aktier i faldende trender

Aktier i sidelæns trender kan købes nær trendgulvet og sælges nær trendtaget

Hovedprincipper

Grundlaget i trendanalyse er enkel: The trend is your friend.

- Køb og hold aktier i stigende trender.

- Sælg og hold dig væk fra aktier i faldende trender.

- Aktier i sidelæns trender kan købes nær trendgulvet og sælges nær trendtaget.

Varselsignaler

- Kurs nær trendgulvet indikerer en større upside, men samtidig en større risiko for brud ned.

- Kurs nær trendtag indikerer en mindre upside, men samtidig en større mulighed for brud op.

Trendbrud

Som udgangspunkt skulle man tro, at man bør sælge en aktie, når den bryder ned fra en stigende trend. Ofte er dette imidlertid blot et signal om, at aktien holder en lille pause og snart fortsætter op. Følgende gælder ved vurdering af trendbrud:

- Højt volumen forstærker et brud og varsler mulig trendvending.

- Lavt volumen indikerer, at aktien snart vil fortsætte i trendretningen.

- Ved stigende trend: Brud under den foregående bund varsler vending ned.

- Ved faldende trend: Brud over den foregående top varsler vending op.

Hvordan identificerer Investtech en trend?

Investtechs computersystemer identificerer én trend per graf. Dette er den kvalitetsmæssigt ’bedste’ trend i chartet. En god stigende trend opfylder flere af følgende kriterier:

- Trendkanalen er lang.

- Trendkanalen er smal.

- Kanalen har en moderat stigningstakt (ikke for brat).

- Kursen har flere punkter på eller nær støttelinjen i gulvet af kanalen.

- Kursen har flere punkter på eller nær modstandslinjen i loftet af kanalen.

- Kursen har relativt jævne svingninger inden for kanalen.

- Kursen afviger lidt fra en tænkt ret linje trukket gennem punkterne.

- Sidste slutkurs ligger nær, eller inde i, trendkanalen.

I et mellemlangt kursdiagram vil der være cirka 80.000 mulige trender. Alle disse bliver analyseret i henhold til kriterierne herover og der beregnes en pointsum for hver. Trenden med den højeste pointsum tegnes ind i Investtechs graf.

En trend kan veksle mellem at være faldende, stigende og sidelæns fra en dag til den næste. Hældningsgraden på trendkanalen vil typisk justeres over tid, når nye slutkurser kommer til. Dermed vil man ofte opleve, at en aktie bryder ud af en trendkanal i nogle dage for så igen at komme ind nogle dage senere, når trendkanalen bliver justeret.

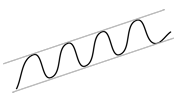

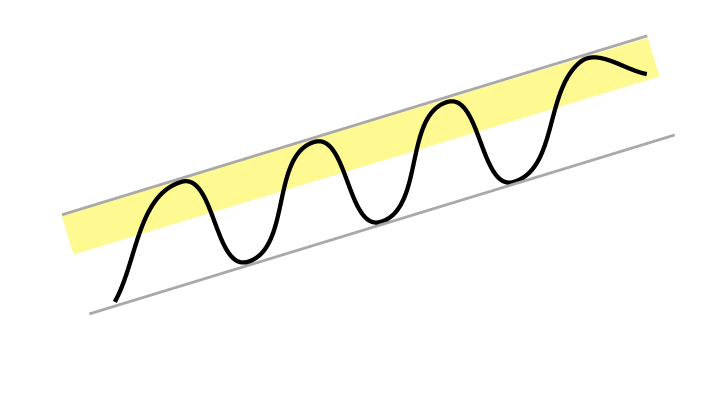

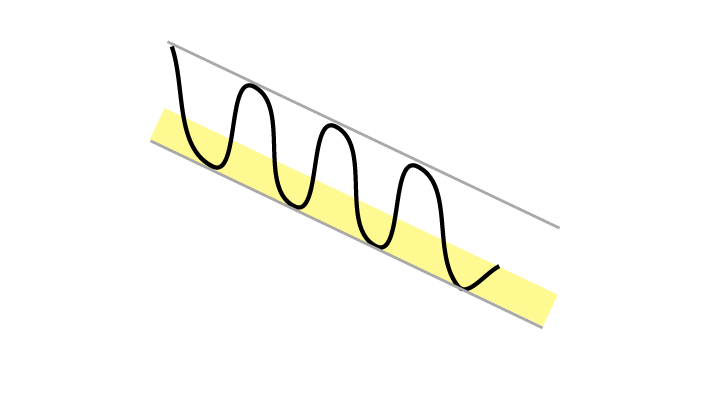

Rising trend

Rising trends indicate that the company experiences positive development and increasing buy interest among investors.

A rising trend signals that the stock will continue to rise. Trends often last longer than investors think, and consequently many sell too soon. If you own a stock in a rising trend, you should normally keep it. And you should consider buying stocks that are in rising trends if you are looking for new stocks to buy.

A rising trend signals that the stock will continue to rise. Trends often last longer than investors think, and consequently many sell too soon. If you own a stock in a rising trend, you should normally keep it. And you should consider buying stocks that are in rising trends if you are looking for new stocks to buy.

- Buy stocks in rising trends.

- Keep stocks you own while they are in rising trends.

A stock in a rising trend has investors who have become increasingly positive to the company. When this sort of movement has started among the investors, it tends to last over time. Ever more people see the positive development, make their own analyses, and thereby nurture further positive development.

The market often overreacts to short term news and underreacts to long term news. A contract today gives direct income in the short term. However, it also influences the company’s long term potential and chances of landing a new contract tomorrow. Stocks in positive trends therefore often continue to rise.

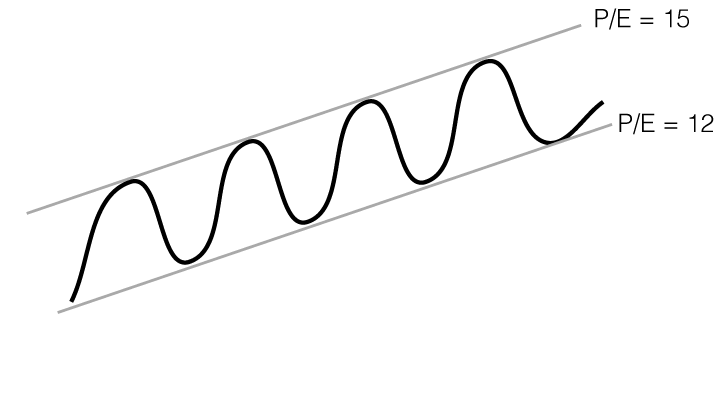

The commercial development in companies often moves in long term cycles. Yet the market will respond in the short term to news and other impulses. A company with steady growth will tend to have low fundamental valuation near the floor of a trend channel, and a high valuation near the ceiling. Thus it can be advantageous to buy near the trend floor and sell near the trend ceiling. This means there is support near the trend floor and resistance near the trend ceiling.

The commercial development in companies often moves in long term cycles. Yet the market will respond in the short term to news and other impulses. A company with steady growth will tend to have low fundamental valuation near the floor of a trend channel, and a high valuation near the ceiling. Thus it can be advantageous to buy near the trend floor and sell near the trend ceiling. This means there is support near the trend floor and resistance near the trend ceiling.

The figure shows a stock in a rising trend where the fundamental key figure P/E (price-to-earnings ratio) fluctuates between 12 at the trend floor and 15 at the trend ceiling.

Warning signals for long term reversal downward

- Decreasing volume on rising prices and near tops.

- Increasing volume on falling prices and near bottoms.

- Price near floor, especially if the stock also sees horizontal resistance and negative volume development.

Warning signals for short term reaction downward

- Price near resistance and overbought RSI, and often negative volume development.

Should warning signals trigger a sale?

Rising trends often last longer than many investors think, and it is easy to sell too soon. However, sometimes selling at early trend reversal warning signals gives very good sales. What to do is a matter of risk assessment.

Investtech Research: Rising trend

Stocks with these ostosignaalit have on average outperformed the market in the following months. Annualised excess return has been 6.5 percentage points (pp). This is significantly better than benchmark.

| Annualised return (based on 66-day figures) | |

| Ostosignaalit keskipitkä tähtäin | 16.3% |

| Reference index | 9.7% |

| Excess return | 6.5pp |

The research results are based on 35097 signals from Nordic stocks in the period 2008-2020.

Lue lisää

- Research Report: Stocks in rising trends have given excess return in the Nordic countries (Vaadittu käyttäjätaso PRO)

- Research Article: Investtech Research: Trend signals better than theory suggests

- Research Report: Investtech Research: Rising and falling trends (Vaadittu käyttäjätaso PRO)

- Research Article: Investtech Research: Trend signals remain reliable

- Research Article: Buy signal from rising trend: Research results 2021-2023

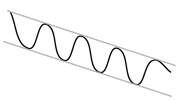

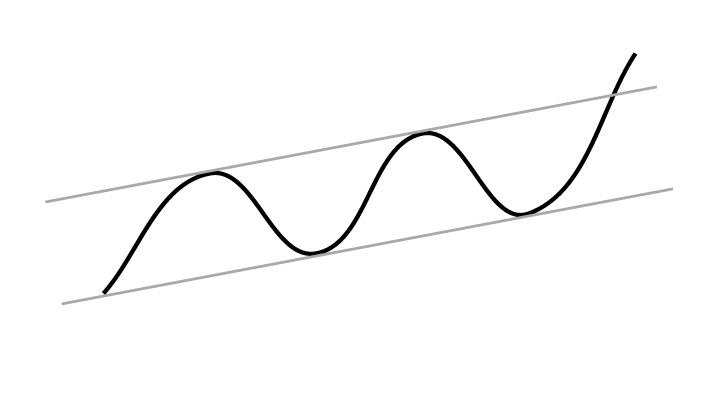

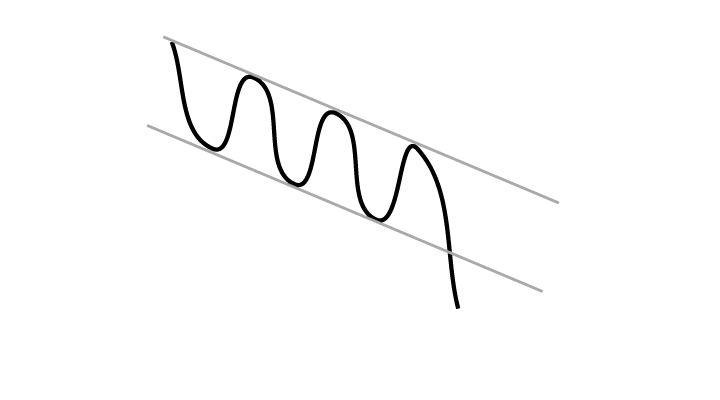

Falling trend

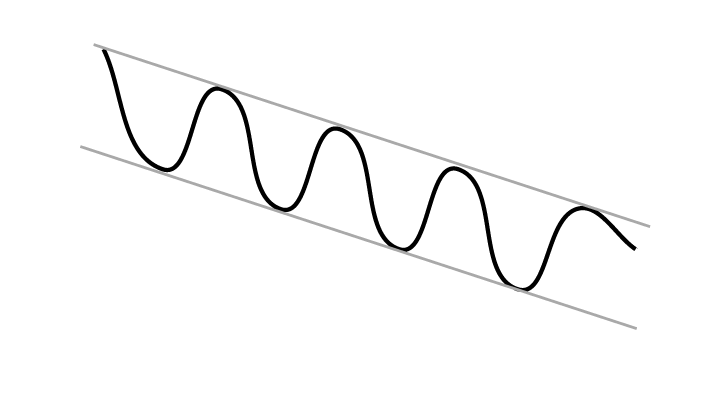

Falling trends indicate that the company experiences negative development and that buy interest among investors is in decline.

Falling trends indicate that the stocks will continue to fall. Trends often last for longer than investors think they will, and thus many buy a stock too soon. If you own a stock in a falling trend, you should normally sell it. If you are looking to buy stocks, you should stay away from stocks that are in falling trends.

- Sell stocks you own that are in falling trends.

- Do not buy stocks that are in falling trends.

When a stock is in a falling trend, investors have become ever more negative to the company. When this sort of movement has started among the investors, it tends to last over time. Negative impulses are picked up by the media, analysts and investors, and tend to reinforce each other. This leads to further negative development.

The market often overreacts to short term news and underreacts to long term news. Problems with a contract or a product line today, gives direct loss of profit in the short term. However, it also influences the company’s long term potential and chance of more problems tomorrow. Stocks in falling trends therefore often continue to fall.

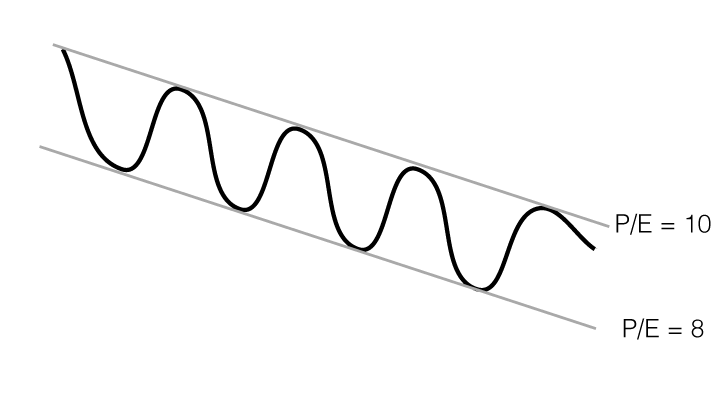

The commercial development in companies often moves in long term cycles. Yet the market will respond in the short term to news and other impulses. A company with shrinking markets or increasing competition and price pressure will tend to have low fundamental valuation near the floor of a trend channel, and a high valuation near the ceiling. For fundamental investors it can be advantageous to buy near the trend floor and sell near the trend ceiling. As such there is support near the trend floor and resistance near the trend ceiling.

The figure shows a stock in a falling trend where the fundamental key figure P/E (price-to-earnings ratio) fluctuates between 8 at the trend floor and 10 at the trend ceiling.

Warning signals for long term reversal upward

- Decreasing volume on falling prices and near bottoms.

- Increasing volume on rising prices and near tops.

- Price near ceiling, especially if the stock also sees horizontal support and positive volume development.

Warning signals for short term reaction upward

- Price near support with oversold RSI and often positive volume development.

Should warning signals trigger a purchase?

Falling trends often last longer than many investors think they will, and it is easy to buy too soon. Nevertheless, sometimes buying at early trend reversal warning signals gives very good purchases. The choice depends on risk assessment. Please note that it is easy to be fooled by very short term fluctuations. Keep investment horizon in mind and place less emphasis on analyses for other time horizons.

Buying stocks in falling trend channels is considered high risk, even if warning signals are triggered for a reversal upward. Investtech’s statistics show that stocks in falling trends keep falling in the short term, and underperform significantly in the long term.

Investtech Research: Falling trend

Stocks with these myyntisignaalit have on average underperformed compared to benchmark in the following months. Annualised negative excess return has been 5.8 percentage points (pp). This is significantly weaker than benchmark.

| Annualised return (based on 66-day figures) | |

| Myyntisignaalit keskipitkä tähtäin | 3.4% |

| Reference index | 9.2% |

| Excess return | -5.8pp |

The research results are based on 23289 signals from Nordic stocks in the period 2008-2020.

Lue lisää

- Research Report: Stocks in rising trends have given excess return in the Nordic countries (Vaadittu käyttäjätaso PRO)

- Research Report: Investtech Research: Rising and falling trends (Vaadittu käyttäjätaso PRO)

- Research Article: Investtech Research: Negative excess return from stocks in falling trends

- Research Article: Sell signal from falling trend: Research results 2021-2023

- Research Report: Investtech-forskning: Trender - signalstatistikk Norden 2019 og 2020 (Vaadittu käyttäjätaso PRO)

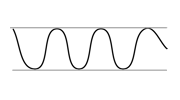

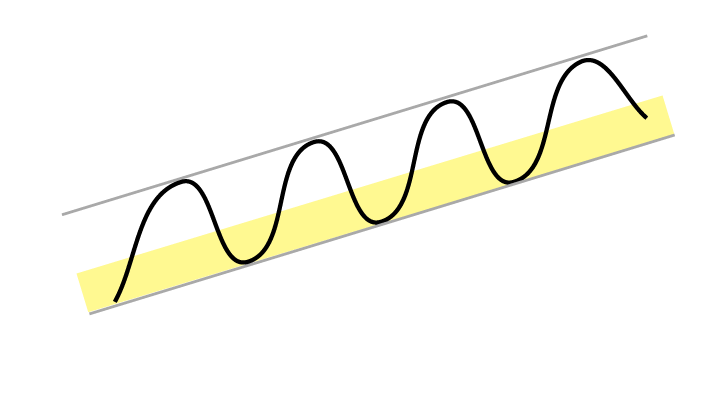

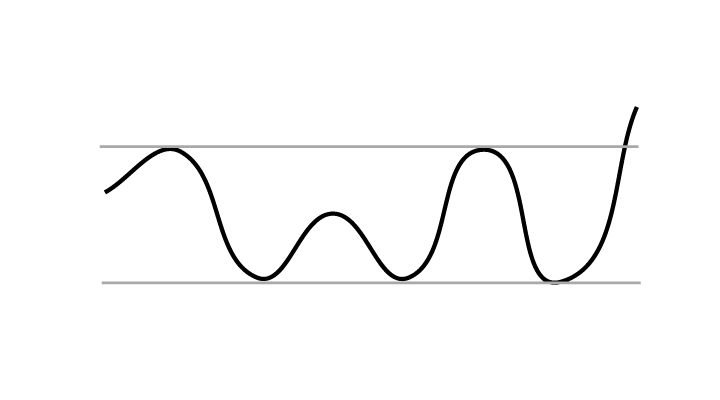

Horizontal trend

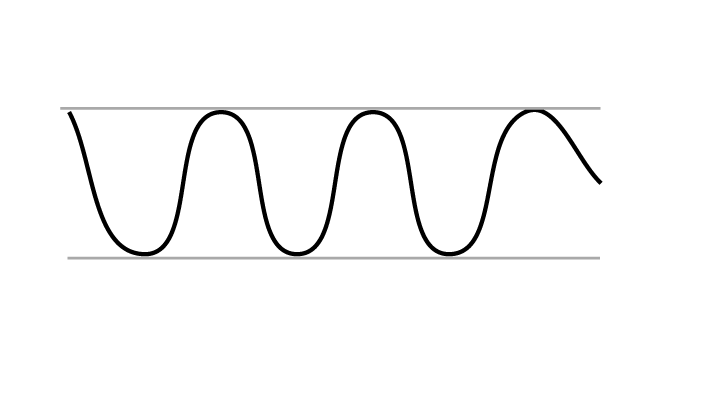

Horizontal trends indicate that the investor base is balanced. News and short term impulses will make the stock fluctuate in the short term, but it will remain near long term equilibrium.

Stocks in horizontal trends signal continued sideways development.

Stocks in horizontal trends signal continued sideways development.

Investors who bought when the stock was near the trend floor saw that the stock was cheap at the time, and may well buy again if the stock falls to the same level. This constitutes support at the floor. Similarly, investors who sold when the stock was near the trend ceiling may well remember this good sale and want to sell again. This constitutes resistance near the trend channel ceiling. Barring large changes for the company or in the market, the stock will carry on its sideways development.

Kurs nær loftet i stigende trend

Stigende trender indikerer, at bedriften er inde i en positiv udvikling, og at købsinteressen blandt investorer er øgende. Aktier, der ligger i stigende trender, signalerer at stige videre inden for trendkanalen.

Når kursen ligger nær modstanden ved loftet i trendkanalen, er downsiden til gulvet i kanalen stor. Aktien kan da få en nedgang på kort sigt.

Når kursen ligger nær modstanden ved loftet i trendkanalen, er downsiden til gulvet i kanalen stor. Aktien kan da få en nedgang på kort sigt.

Et salg nær loftet kan imidlertid være en dårlig strategi. Dette gælder især på lang sigt. En af de typiske fejl, investorer gør, er at sælge aktier med gevinst for tidligt. En aktie i trendopgang stiger ofte meget længere end mange tror. Langsigtede investorer gør derfor ofte klogest i at sidde i aktien, selvom den er nær loftet.

Salg nær trendloftet i en stigende trend kan imidlertid også på kort sigt være en dårlig strategi. Når kursen er nær loftet, er muligheden for et brud op stor, i forhold til når kursen er i nedre halvdel af trendkanalen. Et brud op vil være et nyt køssignal og indikere en endda kraftigere stigningstakt fremover. Derfor vil det også for kortsigtede investorer ofte være rigtigt at sidde med en aktie nær et trendloft.

Hvad man vælger afhænger i høj grad af en risikoanalyse. En kurs nær trendloftet giver stor mulighed for et brud op, men også stor mulighed for en snarlig reaktion ned.

I Investtechs analyser tæller aktier i stigende trender lige positivt, uanset om kursen ligger nær gulvet, nær loftet, eller midt i trendkanalen. En aktie klassificeres som ”nær trendloftet”, hvis den ligger i den øvre femtedel af trendkanalen.

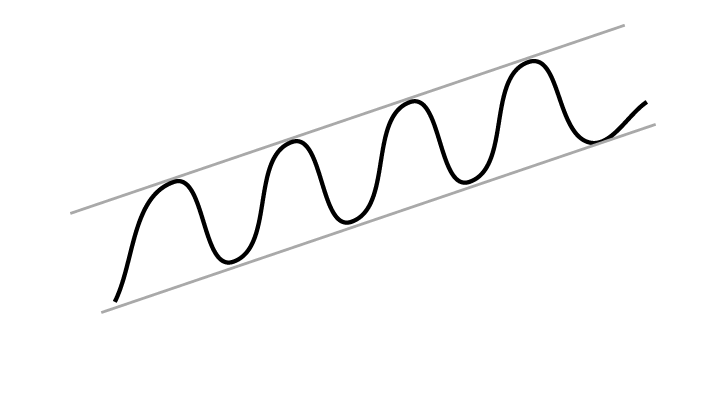

Rising trend breaking upwards

Rising trends indicate that the company experiences positive development and increasing buy interest among investors.

A rising trend signals that the stock will continue to rise. Trends often last longer than investors think, and consequently many sell too soon. If you own a stock in a rising trend, you should normally keep it. Are you looking for new stocks to buy, you should consider buying stocks that are in rising trends.

A rising trend breaking upwards signals strongly increasing buy interest among investors. This can be initiated by fundamental aspects of the stock or via media or stock brokers focusing on the company, making more investors aware of it.

A rising trend breaking upwards signals strongly increasing buy interest among investors. This can be initiated by fundamental aspects of the stock or via media or stock brokers focusing on the company, making more investors aware of it.

A break upward is often the start of a further rise, with an even steeper rate of increase than before.

Special circumstances

In some rare cases, especially if the trend has lasted for a long time and the volume is unusually high, a break upward can signal an end rally: everything looks positive and every investor wants in. This pushes the price up while the last investors buy into the stock. A price reduction after this, on high volume, is a clear warning of a negative reversal in the stock.

The main rule remains that a break upward through a rising trend is a positive signal.

In Investtech’s analyses, a stock in a rising trend and a stock that has broken upwards through a rising trend will both be equally positive, given they are otherwise identical.

Investtech Research: Rising trend breaking upwards

Stocks with these ostosignaalit have on average outperformed the market in the following months. Annualised excess return has been 9.8 percentage points (pp). This is significantly better than benchmark.

| Annualised return (based on 66-day figures) | |

| Ostosignaalit keskipitkä tähtäin | 17.3% |

| Reference index | 7.5% |

| Excess return | 9.8pp |

The research results are based on 6053 signals from Nordic stocks in the period 2008-2020.

Lue lisää

- Research Article: Investtech Research: Excess return after break upwards from rising trend

- Research Article: Investtech Research: Trend signals remain reliable

- Research Report: Investtech-forskning: Trender - signalstatistikk Norden 2019 og 2020 (Vaadittu käyttäjätaso PRO)

- Research Report: Investtech-forskning: Trender - signalstatistikk Norden 2008 - 2020 (Vaadittu käyttäjätaso PRO)

- Research Article: Investtech-forskning: Meravkastning etter kjøpssignal fra trend

Kurs nær gulvet i stigende trend

Stigende trender indikerer, at bedriften er inde i en positiv udvikling, og at købsinteressen blandt investorer er øgende. Aktier, der ligger i stigende trender, signalerer at stige videre inden for trendkanalen.

Når kursen ligger nær støtten ved gulvet i trendkanalen, er upsiden til taget i kanalen stor. Man har da mulighed for at gøre gode køb, givet at trendudviklingen fortsætter.

Når kursen ligger nær støtten ved gulvet i trendkanalen, er upsiden til taget i kanalen stor. Man har da mulighed for at gøre gode køb, givet at trendudviklingen fortsætter.

Samtidig er risikoen for et brud ned større, end når aktien ligger i den øvre halvdel af trendkanalen. Et brud ned er ikke noget salgssignal – se hjælp om brud ned på stigende trend – men aktien vil i så fald vurderes mindre positivt, end når kursen ligger inde i trenden.

Altså er det ikke altid mere gunstigt at købe en aktie nær gulvet i en trend, end når den er i midten eller i toppen.

I Investtechs analyser tæller aktier i stigende trender lige positivt, uanset om kursen ligger nær gulvet, nær taget, eller midt i trendkanalen. En aktie klassificeres som ”nær trendgulvet”, hvis den ligger i den nedre femtedel af trendkanalen.

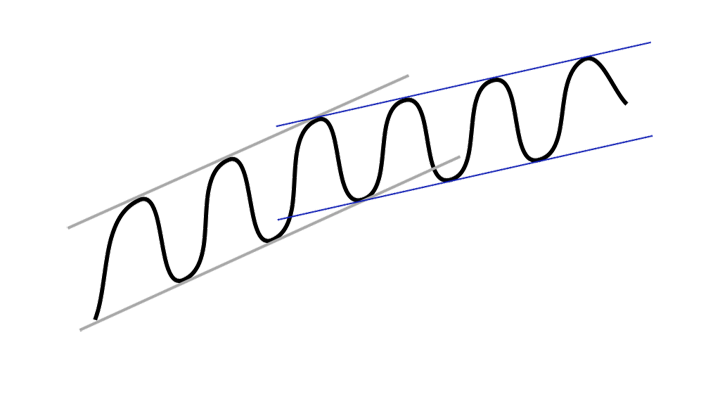

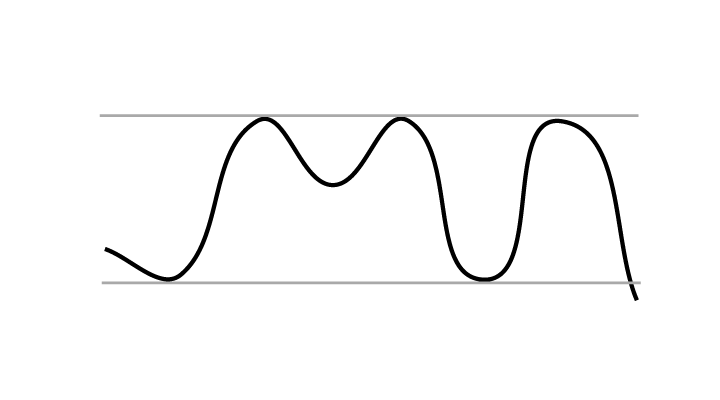

Rising trend breaking downwards

Rising trends indicate that the company experiences positive development and increasing buy interest among investors. Rising trends indicate that the stock will continue to rise. Trends often last longer than investors think, and consequently many sell too soon.

When a rising trend breaks downwards it signals a change in the rate of increase. Rising trends often begin with a steep rate of increase, which slows down over time. The company can still be in a long term positive development with optimism reaching ever new investment groups and analysts.

When a rising trend breaks downwards it signals a change in the rate of increase. Rising trends often begin with a steep rate of increase, which slows down over time. The company can still be in a long term positive development with optimism reaching ever new investment groups and analysts.

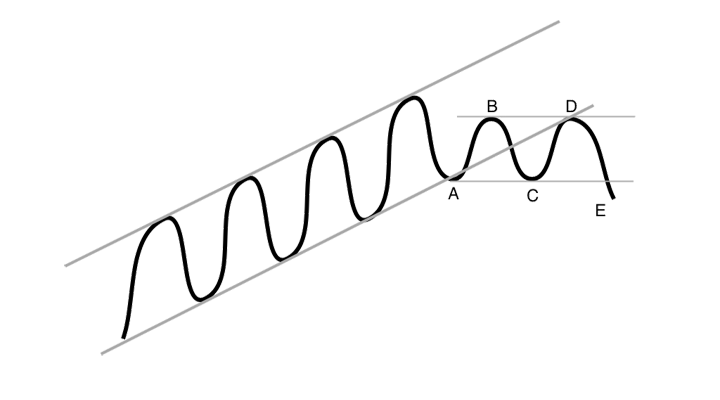

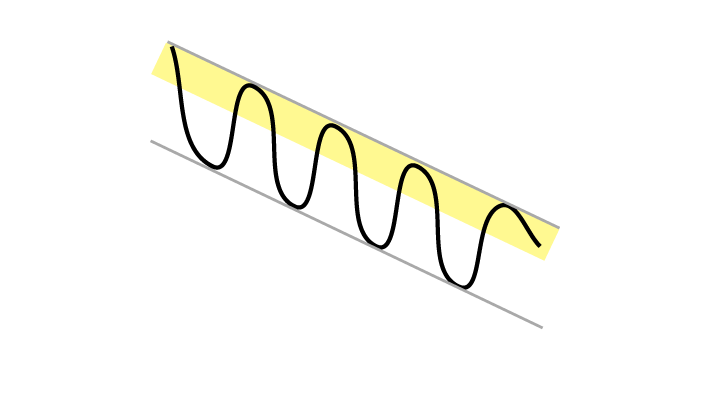

The figure shows what is normally the case when a rising trend breaks downwards. The original trend in black and the new trend in blue.

The figure shows the phases of how a trend reversal arises. Warning signals are triggered at the break downward through the trend floor, moving from B to C, while a sell signal is only triggered at point E, when the price is below that of the previous bottom.

The figure shows the phases of how a trend reversal arises. Warning signals are triggered at the break downward through the trend floor, moving from B to C, while a sell signal is only triggered at point E, when the price is below that of the previous bottom.

Volume development matters

If a break downward occurs on neutral or decreasing volume, it is often simply a sign of passive investors. This is natural following a stream of positive news, and long term investors can use it to slowly increase their holding in the stock.

On the other hand, if the break downward occurs on increasing volume, it indicates that active sellers are pushing the price down in order to get rid of stocks. This signals a potential negative change in investor psychology and can be seen as an early sell signal. The sell signal is only confirmed when the stock price breaks downwards below the previous bottom in the price chart.

Investtech’s analyses will assign a stock in a rising trend breaking downwards only half the technical score of a stock in a rising trend.

Investtech Research: Rising trend breaking downwards

Stocks with these ostosignaalit have on average outperformed the market in the following months. Annualised return has been 2.3 percentage points (pp) better than benchmark.

| Annualised return (based on 66-day figures) | |

| Ostosignaalit keskipitkä tähtäin | 14.3% |

| Reference index | 12.0% |

| Excess return | 2.3pp |

The research results are based on 21567 signals from Nordic stocks in the period 2008-2020.

Lue lisää

- Research Article: Investtech Research: Trend signals remain reliable

- Research Report: Investtech-forskning: Brudd ned fra stigende trender og brudd opp fra fallende trender (Vaadittu käyttäjätaso PRO)

- Research Article: Investtech-forskning: Aksjer med brudd ned fra stigende trend fortsetter å stige

- Research Report: Investtech-forskning: Trender - signalstatistikk Norden 2019 og 2020 (Vaadittu käyttäjätaso PRO)

- Research Report: Investtech-forskning: Trender - signalstatistikk Norden 2008 - 2020 (Vaadittu käyttäjätaso PRO)

Kurs nær taget i faldende trend

Faldende trender indikerer, at bedriften er inde i en negativ udvikling, og at købsinteressen blandt investorer er aftagende. Aktier, der ligger i faldende trender, signalerer at falde videre inden for trendkanalen.

Når kursen ligger nær modstanden ved taget i trendkanalen, er downsiden til gulvet i kanalen stor. Man har da mulighed for at gøre gode salg, givet at trendudviklingen fortsætter.

Når kursen ligger nær modstanden ved taget i trendkanalen, er downsiden til gulvet i kanalen stor. Man har da mulighed for at gøre gode salg, givet at trendudviklingen fortsætter.

Samtidig er risikoen for et brud op større, end når aktien ligger i den nedre halvdel af trendkanalen. Et brud op er ikke noget købssignal – se hjælp om brud op på faldende trend – men aktien vil da vurderes mindre negativt, end når kursen ligger inde i trenden.

Altså er det ikke oplagt, at det er mere gunstigt at sælge en aktie nær taget i en trend, end når den er i midten eller nær gulvet.

I Investtechs analyser tæller aktier i faldende trender lige negativt, uanset om kursen ligger nær gulvet, nær taget, eller midt i trendkanalen. En aktie klassificeres som ”nær trendtaget”, hvis den ligger i den øvre femtedel af trendkanalen.

Falling trend breaking upwards

Falling trends indicate that the company experiences negative development and decreasing buy interest among investors. Falling trends indicate that the stocks will continue to fall. Trends often last for longer than investors think they will, and thus many buy a stock too soon.

When a falling trend breaks upwards, it signals a change in the rate of decline. Falling trends often begin with a steep rate of decline, but it slows over time. Yet the company can be in a long term negative development and pessimism can reach ever new investor groups and analysts.

When a falling trend breaks upwards, it signals a change in the rate of decline. Falling trends often begin with a steep rate of decline, but it slows over time. Yet the company can be in a long term negative development and pessimism can reach ever new investor groups and analysts.

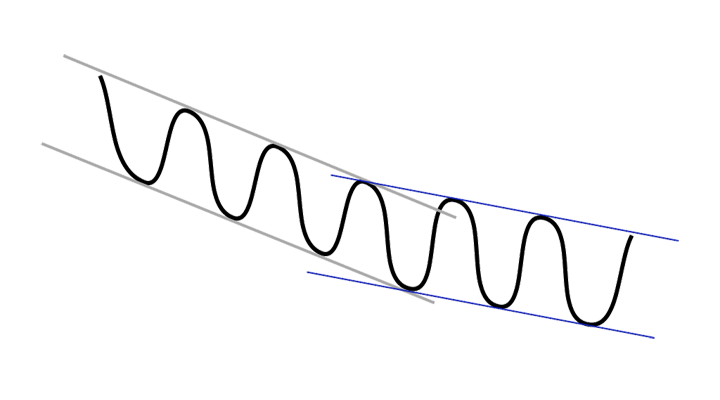

The figure shows the normal state of affairs when a falling trend breaks upwards. The original trend in black, the new one in blue.

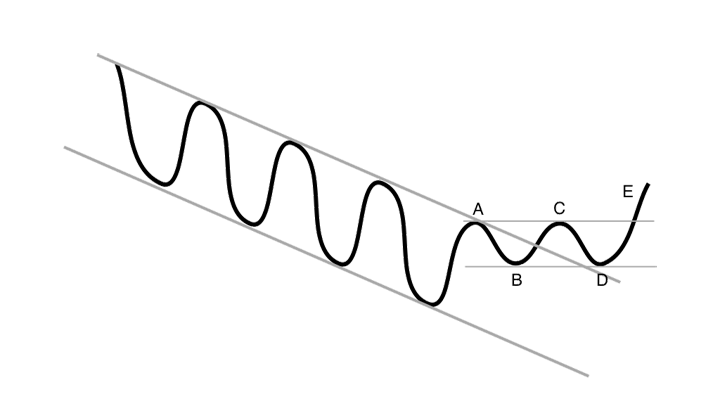

The figure shows the phases of a trend reversal. Warning signals are triggered at the break of the trend ceiling, moving upwards from B to C, while a buy signal is only triggered at point E, when the price ends above that of the previous top.

The figure shows the phases of a trend reversal. Warning signals are triggered at the break of the trend ceiling, moving upwards from B to C, while a buy signal is only triggered at point E, when the price ends above that of the previous top.

Volume development matters

If a break upward happens on neutral or declining volume, it is often simply a sign of passive investors. This is natural following a negative news stream, and can be used to sell for those who still own the stock.

If the break upward happens on increasing volume, it indicates that buyers actively have to push the price up to get hold of stocks. This is a sign of a potential change of investor psychology, and can be seen as an early buy signal. A confirmation of the buy signal is only given when the stock price breaks above the previous price chart top.

In Investtech’s analyses, a stock which has broken upwards through a falling trend will be assigned a technical trend score which is half of what a stock in a falling trend will be assigned. It counts as half as negative when a falling trend breaks upwards, as when the stock is in a falling trend or the falling trend breaks downwards.

Investtech Research: Falling trend breaking upwards

Stocks with these myyntisignaalit have on average underperformed compared to benchmark in the following months. Annualised return has been 1.7 percentage points (pp) weaker than benchmark.

| Annualised return (based on 66-day figures) | |

| Myyntisignaalit keskipitkä tähtäin | 8.3% |

| Reference index | 10.0% |

| Excess return | -1.7pp |

The research results are based on 16075 signals from Nordic stocks in the period 2008-2020.

Lue lisää

- Research Report: Investtech-forskning: Brudd ned fra stigende trender og brudd opp fra fallende trender (Vaadittu käyttäjätaso PRO)

- Research Article: Investtech-forskning: Brudd opp fra fallende trend har gitt meravkastning på lang sikt

- Research Report: Investtech-forskning: Trender - signalstatistikk Norden 2019 og 2020 (Vaadittu käyttäjätaso PRO)

- Research Report: Investtech-forskning: Trender - signalstatistikk Norden 2008 - 2020 (Vaadittu käyttäjätaso PRO)

- Research Article: Investtech-forskning: Svak utvikling etter salgssignal fra trend

Kurs nær gulvet i faldende trend

Faldende trender indikerer, at bedriften er inde i en negativ udvikling, og at købsinteressen blandt investorer er aftagende. Aktier, der ligger i faldende trender, signalerer at falde videre inden for trendkanalen.

Når kursen ligger nær støtten ved gulvet i trendkanalen, er upsiden til taget i kanalen stor. Aktien kan da få en opgang på kort sigt.

Når kursen ligger nær støtten ved gulvet i trendkanalen, er upsiden til taget i kanalen stor. Aktien kan da få en opgang på kort sigt.

Et køb nær gulvet kan imidlertid være en dårlig strategi. Dette gælder specielt på lang sigt. To af de typiske fejl, investorer laver, er for det første at sidde for længe på aktier med tab og for det andet at blive fristet til at gå ind i aktier, som er ”billige” efter en nedgang. En aktie i trendnedgang falder ofte meget længere, end mange tror. Langsigtede investorer gør derfor ofte klogest i at holde sig væk fra aktier i faldende trender, selv om de er nær gulvet.

Også kortsigtede køb nær trendgulv kan være en dårlig strategi. Når kursen er nær gulvet, er muligheden for et brud ned stor, i forhold til når kursen er i øvre halvdel af trendkanalen. Et brud ned vil være et nyt salgssignal og indikere en endda kraftigere faldtakt fremover. Derfor vil det også for kortsigtede investorer ofte være forkert at sidde med en aktie nær trendgulvet i en faldende kanal. Dette gælder især for aktier i små og mellemstore bedrifter, hvor risikoen for store kursudslag generelt er stor.

I Investtechs analyser tæller aktier i faldende trender lige negativt, uanset om kursen ligger nær gulvet, nær taget, eller midt i trendkanalen. En aktie klassificeres som ”nær trendgulvet”, hvis den ligger i den nedre femtedel af trendkanalen.

Særlige situationer

Upsiden kan være rigtig god, når kursen ligger nær et trendgulv. Derfor er det ofte fristende at købe aktier i sådanne situationer. Købet kan begrundes, hvis volumenudviklingen indikerer, at stemningen i aktien er i færd med at vende, eller insiderne er positive, samtidig med at man måske har positive fundamentale indikatorer.

Vær imidlertid opmærksom på meget høj risiko. En kurs nær trendgulvet i en faldende trend giver stor mulighed for et brud ned, men også stor mulighed for en god reaktion op. Det anses som mindre risikofyldt at købe nær trendgulv i en faldende trend, som er næsten horisontal end i en trend som falder kraftigt.

Falling trend breaking downwards

Falling trends indicate that the company experiences negative development and that buy interest among investors is declining.

Falling trends indicate that the stocks will continue to fall. Trends often last for longer than investors think they will, and thus many buy a stock too soon. If you own a stock in a falling trend, you should normally sell it. If you are looking to buy stocks, you should stay away from stocks that are in falling trends.

A falling trend breaking downwards signals increasing sales interest among investors. This can be triggered by fundamental aspects in the stock or by media or stock brokers focusing on the company, making more investors aware of the dangers and challenges the company faces.

A falling trend breaking downwards signals increasing sales interest among investors. This can be triggered by fundamental aspects in the stock or by media or stock brokers focusing on the company, making more investors aware of the dangers and challenges the company faces.

A break downward is often the beginning of a continued fall, at an even steeper rate.

Special circumstances

In some rare cases, especially if the trend has lasted for a long time and the volume is unusually high, a break downward can signal a sell-off: everything looks negative and every investor wants out. This makes the price fall straight down, while the last investors sell. If the price rises again on high volume, it signals a clear mood change among investors. It is a warning sign of a potential reversal upward.

Nevertheless, the main rule is that a break downward from a falling trend is a negative signal.

In Investtech’s analyses, a stock in a falling trend and a stock that has broken downwards though a falling trend will both be equally negative, given they are otherwise identical.

Investtech Research: Falling trend breaking downwards

Stocks with these myyntisignaalit have on average underperformed compared to benchmark in the following months. Annualised negative excess return has been 9.2 percentage points (pp). This is significantly weaker than benchmark.

| Annualised return (based on 66-day figures) | |

| Myyntisignaalit keskipitkä tähtäin | -0.7% |

| Reference index | 8.5% |

| Excess return | -9.2pp |

The research results are based on 5108 signals from Nordic stocks in the period 2008-2020.

Lue lisää

- Research Article: Investtech Research: Negative excess return after break downwards from falling trend

- Research Report: Investtech-forskning: Trender - signalstatistikk Norden 2019 og 2020 (Vaadittu käyttäjätaso PRO)

- Research Report: Investtech-forskning: Trender - signalstatistikk Norden 2008 - 2020 (Vaadittu käyttäjätaso PRO)

- Research Article: Investtech-forskning: Svak utvikling etter salgssignal fra trend

- Research Report: v2: Investtech-forskning: Trender - signalstatistikk Norden 2008 - 2020 (Vaadittu käyttäjätaso PRO)

Horizontal trend breaking upwards

A break upward through a horizontal trend signals a positive change in investor psychology and is a buy signal.

Horizontal trends indicate that the investor base is balanced over time. When the price breaks upwards, it signals increased buy interest – there is now a majority of buyers in the stock. This is often a result of fundamental news. Especially if the break upward happens on increasing volume, it signals the start of a rising trend and thereby continued rise in the long term.

Horizontal trends indicate that the investor base is balanced over time. When the price breaks upwards, it signals increased buy interest – there is now a majority of buyers in the stock. This is often a result of fundamental news. Especially if the break upward happens on increasing volume, it signals the start of a rising trend and thereby continued rise in the long term.

A break upward through a horizontal trend is a stronger signal if the price also breaks over the tops that define the trend ceiling. If this is not the case, there will still be resistance at these tops, and the price can more easily fall back again.

Investtech Research: Horizontal trend breaking upwards

Stocks with these ostosignaalit have on average outperformed the market in the following months. Annualised excess return has been 19.1 percentage points (pp). This is significantly better than benchmark.

| Annualised return (based on 66-day figures) | |

| Ostosignaalit keskipitkä tähtäin | 29.4% |

| Reference index | 10.3% |

| Excess return | 19.1pp |

The research results are based on 2540 signals from Nordic stocks in the period 2008-2020.

Lue lisää

- Research Article: Investtech Research: Trend signals remain reliable

- Research Article: Investtech-forskning: Sterk meravkastning etter brudd opp fra horisontal trend

- Research Report: Investtech-forskning: Trender - signalstatistikk Norden 2019 og 2020 (Vaadittu käyttäjätaso PRO)

- Research Report: Investtech-forskning: Trender - signalstatistikk Norden 2008 - 2020 (Vaadittu käyttäjätaso PRO)

Horizontal trend breaking downwards

A break downward through a horizontal trend signals a negative change in investor psychology and is a sell signal.

Horizontal trends indicate that the investor base is balanced over time. When the price breaks downwards, it signals increased sell interest – there is a majority of sellers in the stock. This may well be a result of fundamental news. Especially if a break downward happens on increasing volume, it signals the start of a falling trend and thus continued fall in the long term.

Horizontal trends indicate that the investor base is balanced over time. When the price breaks downwards, it signals increased sell interest – there is a majority of sellers in the stock. This may well be a result of fundamental news. Especially if a break downward happens on increasing volume, it signals the start of a falling trend and thus continued fall in the long term.

A break downward through a horizontal trend is a stronger signal if the price also breaks below the bottom points that define the trend floor. Otherwise there will still be support at these points, which means the price can more easily rise back up again.

Investtech Research: Horizontal trend breaking downwards

Stocks with these myyntisignaalit have on average underperformed compared to benchmark in the following months. Annualised negative excess return has been 7.3 percentage points (pp). This is significantly weaker than benchmark.

| Annualised return (based on 66-day figures) | |

| Myyntisignaalit keskipitkä tähtäin | 14.4% |

| Reference index | 21.7% |

| Excess return | -7.3pp |

The research results are based on 2222 signals from Nordic stocks in the period 2008-2020.

Lue lisää

- Research Article: Investtech-forskning: Brudd ned fra horisontal trend er et salgssignal

- Research Report: Investtech-forskning: Trender - signalstatistikk Norden 2019 og 2020 (Vaadittu käyttäjätaso PRO)

- Research Report: Investtech-forskning: Trender - signalstatistikk Norden 2008 - 2020 (Vaadittu käyttäjätaso PRO)

- Research Article: Investtech-forskning: Svak utvikling etter salgssignal fra trend

Investtech ei takaa analyysien tarkkuutta tai kattavuutta. Kaikkien analyysien tuottamien neuvojen ja signaalien käyttäminen on täysin käyttäjän vastuulla. Investtech ei vastaa mistään tappioista, jotka saattavat syntyä Investtechin analyysien käytön seurauksena. Mahdollisten eturistiriitojen yksityiskohdat mainitaan aina sijoitusneuvon yhteydessä. Lisätietoja Investtechin analyyseistä löytyy täältä disclaimer.

Investtech ei takaa analyysien tarkkuutta tai kattavuutta. Kaikkien analyysien tuottamien neuvojen ja signaalien käyttäminen on täysin käyttäjän vastuulla. Investtech ei vastaa mistään tappioista, jotka saattavat syntyä Investtechin analyysien käytön seurauksena. Mahdollisten eturistiriitojen yksityiskohdat mainitaan aina sijoitusneuvon yhteydessä. Lisätietoja Investtechin analyyseistä löytyy täältä disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices