US Stocks sharply lower

The market dropped considerably Friday, and Nasdaq Combined Composite Index closed at 17323 points after a decline of 2.7 percent. The week as a whole showed a loss of 2.6 percent. This past month the index has lost as much as 9.2 percent. 1352 shares were up and 5687 were down, while 193 remained unchanged, and there was no trading in 141 shares. Total value of the trading volume for shares and primary capital certificates Friday was approximately 642.3 billion. | |

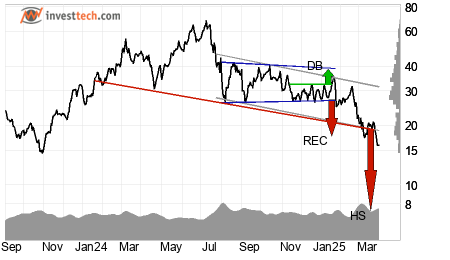

Semiconductor Bull 3X Direxion lost 9.7 percent to 16.03 dollar. The stock has not closed lower since Nov 2023. The stock has now closed down for the fourth day in a row. The stock has by that dropped 16.2 percent since the sell signal from the head and shoulders formation two days ago.

Semiconductor Bull 3X Direxion lost 9.7 percent to 16.03 dollar. The stock has not closed lower since Nov 2023. The stock has now closed down for the fourth day in a row. The stock has by that dropped 16.2 percent since the sell signal from the head and shoulders formation two days ago.

Alphabet C lost 4.9 percent to 156 dollar. The stock has not closed lower since Sep 2024. It does not look good technically either. The stock is assessed as technically slightly negative for the medium long term.

Alphabet C lost 4.9 percent to 156 dollar. The stock has not closed lower since Sep 2024. It does not look good technically either. The stock is assessed as technically slightly negative for the medium long term.

Lululemon Athletica fell sharply to close at 293 dollar, down 14.2 percent. The previous time the stock lost this much was Mar 22. 2024, when it closed down 15.8 percent. The volume was also high. At session end it was bought and sold shares for about 3785 million dollar in the stock, which equals seven times mean daily turnover. The stock is trend wise positive in the medium term.

Lululemon Athletica fell sharply to close at 293 dollar, down 14.2 percent. The previous time the stock lost this much was Mar 22. 2024, when it closed down 15.8 percent. The volume was also high. At session end it was bought and sold shares for about 3785 million dollar in the stock, which equals seven times mean daily turnover. The stock is trend wise positive in the medium term.

Nike was down 3.8 percent to close at 63.29 dollar. The stock has not closed at a lower price since Mar 2020. The stock has thereby closed down 19 out of the past 23 days and this past month the stock has lost as much as 22.0 percent. It does not look good technically either. The stock is trend wise negative in the medium term, has resistance at 70.00 dollar and a further decline is indicated.

Nike was down 3.8 percent to close at 63.29 dollar. The stock has not closed at a lower price since Mar 2020. The stock has thereby closed down 19 out of the past 23 days and this past month the stock has lost as much as 22.0 percent. It does not look good technically either. The stock is trend wise negative in the medium term, has resistance at 70.00 dollar and a further decline is indicated.

Meta Platforms A closed down 4.3 percent to 577 dollar. The stock has not closed at a lower price since Nov 2024. The stock is trend wise positive in the medium term, but has marginally broken down through support at 580 dollar.

Meta Platforms A closed down 4.3 percent to 577 dollar. The stock has not closed at a lower price since Nov 2024. The stock is trend wise positive in the medium term, but has marginally broken down through support at 580 dollar.

|

Winners Friday

| Aclarion | 2221.84% |

| Splash Beverage Group | 2107.14% |

| Portage Biotech | 103.82% |

| Lexicon Pharmaceuticals | 64.13% |

| DBV Technologies ADR | 58.57% |

Losers Friday

| Sharps Technology | -72.30% |

| Milestone Pharmaceuticals | -60.89% |

| Wolfspeed | -51.86% |

| LogicMark | -50.20% |

| XTI Aerospace | -50.00% |

Most traded Friday

| SPDR S&P 500 ETF | 39820.07 |

| Tesla | 32629.96 |

| NVIDIA | 25210.12 |

| Powershares QQQ | 21741.84 |

| Meta Platforms A | 10152.25 |

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices