Qt Group (QTCOM.HEX)

Algorithmic Overall Analysis

Myy (Pistesumma: -72)

22. marras 2024. Updated daily.

Analyysit

Lyhyt

Keskipitkä

Pitkä

Kokonaisanalyysi

Investor Psychology - Behavioural Finance - Quantitative Analysis - Scientific Methods

Technical Analysis - Insider Trades - Seasonal Variations - Intraday Trading

Stock data

| Price date | 22. marras 2024 |

| Valuutta | EUR |

| ISIN | FI4000198031 |

| Rise from year low | 13.99% |

| Fall from year high | -30.63% |

Automatic technical analysis. Lyhyt

Lyhyt aikaväli

Osake on laskutrendissä. Tämä indikoi heikon kehityksen jatkuvan trendin mukaisesti. Osake on rikkoutunut alaspäin tukitason läpi n. 67.50 euron kohdalla. Näin ollen on signalisoitu edelleen tapahtuvaa laskua ja jos reaktioita takaisinpäin tapahtuu, on vastustaso nyt 67.50 euro. Negatiivinen volyymibalanssi heikentää osaketta lyhyellä aikavälillä. Osaketta pidetään kokonaisuutena teknisesti negatiivisena lyhyellä aikavälillä.Recommendation one to six weeks: Myy (Pistesumma: -89)

Automatic technical analysis. Keskipitkä tähtäin

Keskipitkä tähtäin

Qt Group on rikkonut nousevan trendin ja reagoinut voimakkaasti alaspäin. On toistaiseksi vaikea sanoa mitään sen tulevasta trendisuunnasta. Osake testaa vastuksen n. 67.00 euron kohdalla, mikä voi antaa reaktion alaspäin. Volyymibalanssi on negatiivinen, mikä heikentää osaketta lyhyellä aikavälillä. RSI on ylimyyty. Osakkeen kurssi saattaa pudota lisää, ja odotamme RSI:n nousevan ennen kuin tämä voidaan tulkita ostosignaaliksi. Osaketta pidetään kokonaisuutena teknisesti heikosti negatiivisena keskipitkällä aikavälillä.Recommendation one to six months: Heikko myyntisuositus (Pistesumma: -25)

Automatic technical analysis. Pitkä

Pitkä aikaväli

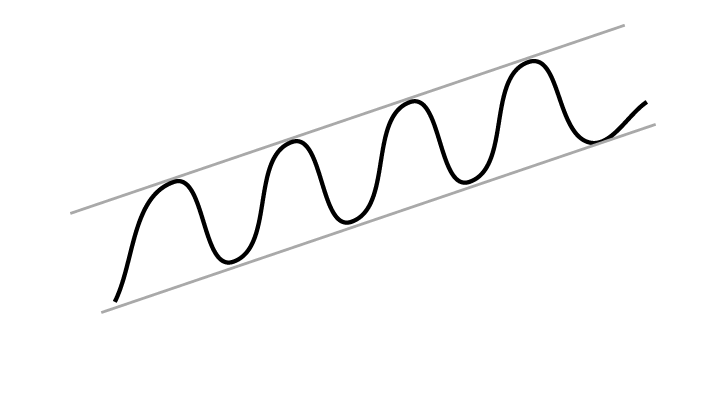

Osakkeen kurssi on läpäissyt nousutrendin tukilinjan. Tämä indikoi hidastuvaa kasvunopeutta tulevaisuudessa. Liikkuu suorakulmiossa tukitason ollessa 55.64 ja vastustustason ollessa 98.07. Näiden tasojen murtuminen indikoi kurssikehityksen tulevaa suuntaa Osakkeella on tukitaso noin 46.00 euro ja vastustaso noin 87.00 euro. Volyymihuiput vastaavat kurssipohjia ja volyymipohjat vastaavat kurssihuippuja. Volyymibalanssi on myös negatiivinen, mikä heikentää osaketta. RSI-käyrä näyttää laskevaa trendiä, mikä voi olla aikainen signaali laskevan trendin alkamisesta. Osaketta pidetään kokonaisuutena teknisesti heikosti negatiivisena pitkällä aikavälillä.Recommendation one to six quarters: Heikko myyntisuositus (Pistesumma: -42)

Max

Candlesticks 95 days

Candlesticks 22 days

Seasonal variations

Seasonal prediction from today's date

Monthly and annual statistics

Average development per month, last 8 years

Average development throughout the year, last 8 years

Annual development from 2017 to 2024

Varoituspalvelu

Hälytykset

Ei hälytyksiäKey ratios

Dividend yield: 0.0%

P/E: 36.7

P/S: 8.5

P/B: 11.3

Dividend per share: 0.00

Earnings per share: 1.82

Revenue per share: 7.85

Book value per share: 5.91

Market cap million EUR: 1 701.

Financial data

| MEUR | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | Q3-24 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 27 | 32 | 36 | 46 | 58 | 79 | 121 | 155 | 181 | 200 |

| Profit for the year | 1 | -2 | -3 | -2 | 0 | 13 | 22 | 34 | 35 | 46 |

| Profit margin | 3.6 % | -5.4 % | -8.9 % | -5.2 % | -0.6 % | 16.1 % | 18.5 % | 22.1 % | 19.6 % | 23.2 % |

| Book value | 9 | 8 | 20 | 18 | 17 | 30 | 52 | 87 | 122 | 150 |

| Equity ratio | 37.4 % | 28.1 % | 54.2 % | 47.3 % | 33.9 % | 48.6 % | 44.0 % | 48.7 % | 59.2 % | 70.4 % |

| Revenue per share | 1.29 | 1.56 | 1.52 | 1.92 | 2.45 | 3.34 | 4.81 | 6.12 | 7.12 | 7.85 |

| Book value per share | 0.43 | 0.40 | 0.85 | 0.77 | 0.71 | 1.26 | 2.05 | 3.41 | 4.82 | 5.91 |

| Earnings per share | 0.04 | -0.07 | -0.13 | -0.09 | -0.01 | 0.50 | 0.88 | 1.35 | 1.39 | 1.82 |

| Dividend per share | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Dividend payout | 0 % | 0 % | 0 % | 0 % | 0 % | 0 % | 0 % | 0 % | 0 % | 0 % |

Dividend yield

Dividend yield for QTCOM is 0.0%.

P/E - price/earnings

P/E for QTCOM is 36.7.

P/S - price/sales

P/S for QTCOM is 8.5.

P/B - price/book

P/B for QTCOM is 11.3.

Ohjeita ja tietoja - Research shows the importance of Trend, Momentum and Volume

Investtech’s analyses focus on a stock’s trend status, short term momentum and volume development. These are central topics of technical analysis theory that describe changes in investor optimism or fluctuations in a company’s financial development. However, Investtech’s strong focus on these elements is due to research results that clearly indicate causation between these factors and future return on the stock market.

Trend

Theory: Stocks in rising trends will continue to rise.

Psychology/economy: Rising trends indicate that the company experiences positive development and increasing buy interest among investors. Read more

Research: Stocks in rising trend channels in Investtech’s medium long term charts have been followed by an annualized excess return of 7.8 percentage points compared to average benchmark development. This is shown by Investtech’s research into 34,880 cases of stocks in rising trends on the Nordic Stock Exchanges in the period 1996 to 2015.

Read more about the research results here

Momentum

Theory: Stocks with rising short term momentum will continue to rise. Stocks with very strong momentum (overbought) will react backwards.

Psychology/economy: RSI above 70 shows strong positive momentum. The stock has risen in the short term without any significant reactions downwards. Investors have kept paying more to buy stocks. This indicates that more investors want to buy the stock and that the price will continue to rise. Read more

Research: Stocks with strong momentum have on average continued to rise, and more so than the average stock listed on the Exchange. This is shown by Investtech’s research into 24,208 cases of stocks on the Nordic Stock Exchanges in the period 1996 to 2015 where RSI went above 70 points, indicating strong and increasing short term momentum. On average, annualized, the stocks rose the equivalent of 11.4 percentage points more than the average stock.

Read the research report here

Volume

Theory: Rising prices on high volume and falling prices on low volume indicate strength in a stock. Volume can confirm a rising trend or signal that a falling trend is ending.

Psychology/economy: When investors very much want to buy a stock, they have to increase the price to find new sellers. Rising price on high volume shows that some investors are so aggressive that they push the price up to be able to buy the stock. Investtech’s Volume Balance tool measures the relation between price rise and volume and measures investor aggression at rising and falling prices. Read more

Research: Stocks with volume balance above 40 have been followed by an average annual return of 4.7 percentage points on the Nordic Stock Exchanges, shown by research conducted by Investtech into 24,580 cases.

Read the research report here

Investtech's analyses

Investtech has combined theory, psychology and research into powerful investment tools.

About Investtech

Investtech are behavioural finance and quantitative stock analysis specialists. The company sells analysis products to private, professional and institutional investors. Investtech manage the AIFM company Investtech Invest, which invests customers’ funds in the stock market.

Investtech’s computers analyze more than 28,000 stocks from 12 different countries every day. The analyses are presented in eight languages and sold to customers worldwide. In addition to the automatic analyses, the company’s analysts present subjective assessments and recommendations for some markets. The analyses are available to customers in the form of daily morning reports and cases, and weekly market updates and model portfolios.

Investtech’s algorithms for analysis, ranking and stock recommendations are based on research dating back to 1993. Part of the research was conducted in cooperation with Oslo University and the Norwegian Research Council. Research still has high priority for Investtech. Many of the company’s research results are available for customers on the company’s web site.

The company’s basic product starts at approx. 30 euro per month. Investtech also provides bespoke products for integration on partners’ web sites and for use in newsletters, for example to stock brokers and the media. Contact us by e-mail to info@investtech.com or by phone +47 21 555 888 for more information. A free trial subscription is available to order on our web site www.investtech.com.

Head Office

Investtech ASStrandveien 17

1366 Lysaker

adr.officeAddress04

+47 21 555 888

Postal address

Investtech ASStrandveien 17

1366 Lysaker

adr.postAddress04

info@investtech.com

VAT no. 978 655 424 MVA

Research Department

Instituttveien 102007 Kjeller

adr.researchAddress03

adr.researchAddress04

www.investtech.com

Investor Psychology - Behavioural Finance - Quantitative Analysis - Scientific Methods

Technical Analysis - Insider Trades - Seasonal Variations - Intraday Trading

Investtech ei takaa analyysien tarkkuutta tai kattavuutta. Kaikkien analyysien tuottamien neuvojen ja signaalien käyttäminen on täysin käyttäjän vastuulla. Investtech ei vastaa mistään tappioista, jotka saattavat syntyä Investtechin analyysien käytön seurauksena. Mahdollisten eturistiriitojen yksityiskohdat mainitaan aina sijoitusneuvon yhteydessä. Lisätietoja Investtechin analyyseistä löytyy täältä disclaimer.

Investtech ei takaa analyysien tarkkuutta tai kattavuutta. Kaikkien analyysien tuottamien neuvojen ja signaalien käyttäminen on täysin käyttäjän vastuulla. Investtech ei vastaa mistään tappioista, jotka saattavat syntyä Investtechin analyysien käytön seurauksena. Mahdollisten eturistiriitojen yksityiskohdat mainitaan aina sijoitusneuvon yhteydessä. Lisätietoja Investtechin analyyseistä löytyy täältä disclaimer.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices