ABB (ABB.ST)

Algorithmic Overall Analysis

Positive (Score: 94)

Nov 21, 2024. Updated daily.

Analyst's Recommendation

No recent analyses written.Analyses

Short

Medium

Long

Overall

Insider

Investor Psychology - Behavioural Finance - Quantitative Analysis - Scientific Methods

Technical Analysis - Insider Trades - Seasonal Variations - Intraday Trading

Stock data

| Price date | Nov 21, 2024 |

| Currency | SEK |

| ISIN | CH0012221716 |

| Rise from year low | 54.96% |

| Fall from year high | -1.15% |

Automatic technical analysis. Short term

Short term

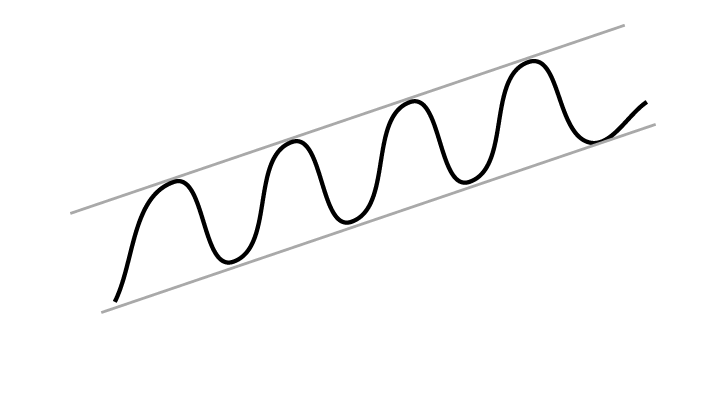

Investors have paid higher prices over time to buy ABB and the stock is in a rising trend channel in the short term. This signals increasing optimism among investors and indicates continued rise. The stock is between support at kronor 612 and resistance at kronor 626. A definitive break through of one of these levels predicts the new direction. The stock is assessed as technically slightly positive for the short term.Recommendation one to six weeks: Weak Positive (Score: 37)

Automatic technical analysis. Medium term

Medium term

ABB shows strong development within a rising trend channel in the medium long term. Rising trends indicate that the company experiences positive development and that buy interest among investors is increasing. The stock has marginally broken up through resistance at kronor 613. An established break predicts a further rise. The stock is assessed as technically positive for the medium long term.Recommendation one to six months: Positive (Score: 84)

Automatic technical analysis. Long term

Long term

ABB shows strong development within a rising trend channel in the long term. Rising trends indicate that the company experiences positive development and that buy interest among investors is increasing. The stock has marginally broken up through resistance at kronor 600. An established break predicts a further rise. The stock is assessed as technically positive for the long term.Recommendation one to six quarters: Positive (Score: 86)

Full history

Candlesticks 95 days

Candlesticks 22 days

Insider Trades

Insider trades reported last 18 months. The stock is positive on Insider Trades.

| List date | Trade date | Count | Price | Value | Text | Importance |

|---|---|---|---|---|---|---|

| Nov 18, 2024 | Nov 15, 2024 | 330 | 30.49 | 10 | Karin Charlotte Lepasoon (annan medlem i bolagets administrations-, lednings- eller kontrollorgan) köper 330 | 0 |

| Nov 18, 2024 | Nov 15, 2024 | 330 | 30.49 | 10 | Peter Terwiesch (annan medlem i bolagets administrations-, lednings- eller kontrollorgan) köper 330 | 0 |

| Nov 18, 2024 | Nov 15, 2024 | 330 | 30.49 | 10 | Morten Wierod (verkställande direktör (vd)) köper 330 | 0 |

| Nov 8, 2024 | Nov 5, 2024 | 12022 | 47.71 | 573 | Peter Voser (styrelseordförande) köper 12022 | 100 |

| Nov 8, 2024 | Nov 5, 2024 | 1323 | 47.71 | 63 | Mats Rahmström (styrelseledamot) köper 1323 | 33 |

| Nov 8, 2024 | Nov 5, 2024 | 1604 | 47.71 | 76 | David Meline (styrelseledamot) köper 1604 | 41 |

| Nov 8, 2024 | Nov 5, 2024 | 1634 | 47.71 | 77 | Geraldine Matchett (styrelseledamot) köper 1634 | 41 |

| Nov 8, 2024 | Nov 5, 2024 | 2666 | 47.71 | 127 | Jennifer Li (styrelseledamot) köper 2666 | 61 |

| Nov 8, 2024 | Nov 5, 2024 | 2702 | 47.71 | 128 | Denise Johnson (styrelseledamot) köper 2702 | 61 |

| Nov 8, 2024 | Nov 5, 2024 | 1283 | 47.71 | 61 | Johan Forssell (styrelseledamot) köper 1283 | 32 |

| Nov 8, 2024 | Nov 5, 2024 | 3183 | 47.71 | 151 | Lars Forberg (styrelseledamot) köper 3183 | 68 |

| Nov 8, 2024 | Nov 5, 2024 | 2666 | 47.71 | 127 | Frederico Curado (styrelseledamot) köper 2666 | 61 |

| Nov 8, 2024 | Nov 5, 2024 | 1283 | 47.71 | 61 | David Constable (styrelseledamot) köper 1283 | 32 |

| Oct 23, 2024 | Oct 21, 2024 | 20474 | 49.37 | 1010 | Timo Ihamuotila (ekonomichef/finanschef/finansdirektör) säljer 20474 | -100 |

| Aug 29, 2024 | Aug 28, 2024 | 35000 | 48.09 | 1683 | Peter Voser (styrelseordförande) säljer 35000 | -100 |

| Aug 6, 2024 | Aug 2, 2024 | 25000 | 45.97 | 1149 | Peter Terwiesch (annan medlem i bolagets administrations-, lednings- eller kontrollorgan) säljer 25000 | -100 |

| Jul 29, 2024 | Jul 25, 2024 | 47542 | 47.03 | 2236 | Tarak Mehta (annan medlem i bolagets administrations-, lednings- eller kontrollorgan) säljer 47542 | -100 |

| Jul 29, 2024 | Jul 29, 2024 | 33000 | 48.36 | 1595 | Morten Wierod (annan medlem i bolagets administrations-, lednings- eller kontrollorgan) säljer 33000 | -100 |

| May 6, 2024 | May 2, 2024 | 13754 | 41.69 | 573 | Peter Voser (styrelseordförande) köper 13754 | 100 |

| May 6, 2024 | May 2, 2024 | 1835 | 41.69 | 76 | David Meline (styrelseledamot) köper 1835 | 41 |

| May 6, 2024 | May 2, 2024 | 1490 | 41.69 | 62 | Jennifer Li (styrelseledamot) köper 1490 | 33 |

| May 6, 2024 | May 2, 2024 | 1873 | 41.69 | 78 | Geraldine Matchett (styrelseledamot) köper 1873 | 41 |

| May 6, 2024 | May 2, 2024 | 3092 | 41.69 | 128 | Denise Johnson (styrelseledamot) köper 3092 | 61 |

| May 6, 2024 | May 2, 2024 | 3649 | 41.69 | 152 | Lars Forberg (styrelseledamot) köper 3649 | 68 |

| May 6, 2024 | May 2, 2024 | 3058 | 41.69 | 127 | Frederico Curado (styrelseledamot) köper 3058 | 61 |

| May 6, 2024 | May 2, 2024 | 1468 | 41.69 | 61 | David Constable (styrelseledamot) köper 1468 | 32 |

| Apr 30, 2024 | Apr 26, 2024 | 37402 | 44.78 | 1674 | Peter Terwiesch (annan medlem i bolagets administrations-, lednings- eller kontrollorgan) säljer 37402 | -100 |

| Apr 30, 2024 | Apr 30, 2024 | 25000 | 44.93 | 1123 | Tarak Mehta (annan medlem i bolagets administrations-, lednings- eller kontrollorgan) säljer 25000 | -100 |

| Apr 23, 2024 | Apr 19, 2024 | 62402 | 43.70 | 2726 | Sami Atiya (annan medlem i bolagets administrations-, lednings- eller kontrollorgan) säljer 62402 | -100 |

| Feb 6, 2024 | Feb 5, 2024 | 27000 | 37.37 | 1008 | Timo Ihamuotila (ekonomichef/finanschef/finansdirektör) säljer 27000 | -100 |

| Dec 19, 2023 | Dec 14, 2023 | 2000 | 37.29 | 74 | Daniela Voser v/Peter Voser (styrelseordförande) säljer 2000 | -40 |

| Dec 18, 2023 | Dec 14, 2023 | 50000 | 37.23 | 1861 | Peter Voser (styrelseordförande) säljer 50000 | -100 |

| Dec 13, 2023 | Dec 11, 2023 | 30360 | 36.71 | 1114 | Peter Terwiesch (annan medlem i bolagets administrations-, lednings- eller kontrollorgan) säljer 30360 | -100 |

| Nov 24, 2023 | Nov 1, 2023 | 3929 | 32.81 | 128 | Denise Johnson (styrelseledamot) köper 3929 | 61 |

| Nov 20, 2023 | Nov 15, 2023 | 360 | 27.99 | 10 | Tarak Mehta (annan medlem i bolagets administrations-, lednings- eller kontrollorgan) köper 360 | 0 |

| Nov 20, 2023 | Nov 15, 2023 | 360 | 27.99 | 10 | Peter Terwiesch (annan medlem i bolagets administrations-, lednings- eller kontrollorgan) köper 360 | 0 |

| Nov 20, 2023 | Nov 15, 2023 | 360 | 27.99 | 10 | Björn Rosengren (verkställande direktör (vd)) köper 360 | 0 |

| Nov 20, 2023 | Nov 15, 2023 | 360 | 27.99 | 10 | Morten Wierod (annan medlem i bolagets administrations-, lednings- eller kontrollorgan) köper 360 | 0 |

| Nov 20, 2023 | Nov 15, 2023 | 360 | 27.99 | 10 | Karin Charlotte Lepasoon (annan medlem i bolagets administrations-, lednings- eller kontrollorgan) köper 360 | 0 |

| Nov 7, 2023 | Nov 1, 2023 | 2332 | 32.81 | 76 | David Meline (styrelseledamot) köper 2332 | 41 |

| Nov 7, 2023 | Nov 1, 2023 | 2376 | 32.81 | 77 | Geraldine Matchett (styrelseledamot) köper 2376 | 41 |

| Nov 7, 2023 | Nov 1, 2023 | 1890 | 32.81 | 62 | Jennifer Li (styrelseledamot) köper 1890 | 33 |

| Nov 7, 2023 | Nov 1, 2023 | 4628 | 32.81 | 151 | Lars Forberg (styrelseledamot) köper 4628 | 68 |

| Nov 7, 2023 | Nov 1, 2023 | 3876 | 32.81 | 127 | Frederico Curado (styrelseledamot) köper 3876 | 61 |

| Nov 7, 2023 | Nov 1, 2023 | 1866 | 32.81 | 61 | David Constable (styrelseledamot) köper 1866 | 32 |

| Nov 7, 2023 | Nov 1, 2023 | 1924 | 32.81 | 63 | Lars Gunnar Bertelson Brock (styrelseledamot) köper 1924 | 33 |

| Nov 7, 2023 | Nov 1, 2023 | 2624 | 32.81 | 86 | Jacob Wallenberg (styrelseledamot) köper 2624 | 45 |

| Nov 7, 2023 | Nov 1, 2023 | 17462 | 32.81 | 572 | Peter Voser (styrelseordförande) köper 17462 | 100 |

| May 17, 2023 | May 15, 2023 | 44644 | 33.08 | 1476 | Timo Ihamuotila (ekonomichef/finanschef/finansdirektör) säljer 44644 | -100 |

| May 17, 2023 | May 15, 2023 | 41205 | 32.95 | 1357 | Peter Terwiesch (annan medlem i bolagets administrations-, lednings- eller kontrollorgan) säljer 41205 | -100 |

| May 12, 2023 | May 8, 2023 | 2485 | 30.74 | 76 | David Meline (styrelseledamot) köper 2485 | 41 |

| May 12, 2023 | May 8, 2023 | 2683 | 30.74 | 82 | Geraldine Matchett (styrelseledamot) köper 2683 | 44 |

| May 12, 2023 | May 8, 2023 | 2018 | 30.74 | 62 | Jennifer Li (styrelseledamot) köper 2018 | 33 |

| May 12, 2023 | May 8, 2023 | 4945 | 30.74 | 152 | Lars Forberg (styrelseledamot) köper 4945 | 68 |

| May 12, 2023 | May 8, 2023 | 4130 | 30.74 | 126 | Frederico Curado (styrelseledamot) köper 4130 | 61 |

| May 12, 2023 | May 8, 2023 | 1988 | 30.74 | 61 | David Constable (styrelseledamot) köper 1988 | 32 |

| May 12, 2023 | May 8, 2023 | 2048 | 30.74 | 62 | Lars Gunnar Bertelson Brock (styrelseledamot) köper 2048 | 33 |

| May 12, 2023 | May 8, 2023 | 2796 | 30.74 | 85 | Jacob Wallenberg (styrelseledamot) köper 2796 | 45 |

| May 12, 2023 | May 8, 2023 | 18607 | 30.74 | 571 | Peter Voser (styrelseordförande) köper 18607 | 100 |

| May 3, 2023 | May 2, 2023 | 50000 | 32.17 | 1608 | Tarak Mehta (annan medlem i bolagets administrations-, lednings- eller kontrollorgan) säljer 50000 | -100 |

Commentaries

Automatic technical analysis of the stock, based on last closing price. The chart may have changed since the analyst's recommendation was written.

Analyst's Recommendation

Jul 19, 2024 (126 days ago)Lars-Göran Westerberg

lars.goran.westerberg@investtech.com

Lars-Göran Westerberg, Jul 19, 2024 (price 578.00)

Svensk-Schweiziska ABB som levererar elektrisk utrustning och automationsprodukter, offentliggjorde resultatet för Q2-24 under torsdagen. Marknadens mottagande blev svalt och aktien handlades ned 5,2 procent. I och med detta har den långa stigande trendkanalen brutits på nedsidan. Detta är isolerat sett ingen säljsignal utan indikerar i första hand en svagare stigningstakt framöver, alternativt början på en mer horisontell utveckling. Aktien har dock - om än nätt och jämnt, brutit stödnivån vid 582 kronor. Nedöver finns även stöd runt 558 kronor. Etablerat brott genom dessa nivåer utlöser säljsignal med möjlig stor nedsida. Detta då nästa stöd återfinns först vid 492 kronor.ABB är neutral på insiderhandel i Investtechs insideranalys och samlat sett tekniskt svagt negativ på medellång sikt. Närheten till 582 kronor som numer är motstånd, gör att den tekniska bilden - och med det rekommendationen för aktien, kan svänga fort vid vändning upp.

Published: Morning Report (Jul 19, 2024 00:11) [LGW]

Previous recommendations

Espen Grønstad, Apr 25, 2024 (price 532.00)

ABB is in a rising trend channel in the medium long term. This shows that investors over time have bought the stock at higher prices and indicates good development for the company. There is no resistance in the price chart and further rise is indicated. In case of a negative reaction, the stock has support at approximately 493 kronor. Positive volume balance indicates that buyers are aggressive while sellers are passive, and strengthens the stock. The stock is overall assessed as technically positive for the medium long term.

Recommendation one to six months: PositivePublished: Nordic Top 10 (Apr 25, 2024 08:39) [EG]

Lars-Göran Westerberg, Apr 19, 2024 (price 532.00)

Ny köpsignal efter rapport

ABB presenterade resultatet för Q1-24 den 18 april. Marknaden reagerade positivt på denna och handlade upp aktien sex procent. Detta gjorde att den tidigare toppnoteringen runt 504 kronor bröts vilket utlöste ny köpsignal. Den underliggande tekniska bilden är positiv med en homogen, stigande trend på medellång sikt vilken bekräftas av en stark volymbalans. Ett nytt alltime-high gör att motstånd ovanför dagens kurs saknas. Detta stärker utsikterna för vidare press uppåt enligt Investtechs forskning. 494 kronor är stöd vid reaktion ned.

ABB är svagt negativ på insiderhandel och samlat sett tekniskt positiv på medellång sikt.

Published: Morning Report (Apr 19, 2024 08:23), Today´s Case (Apr 19, 2024 08:23) [LGW]

Analysts' recommendations last 18 months

| Evaluation | Time horizon | Price | Published | Analyst |

|---|---|---|---|---|

Weak Negative Weak Negative | Medium term | 578.00 | Jul 19, 2024 00:11, Morning Report | LGW |

Positive Positive | Medium term | 532.00 | Apr 25, 2024 08:39, Nordic Top 10 | EG |

Positive Positive | Medium term | 532.00 | Apr 19, 2024 08:23, Morning Report, Today´s Case | LGW |

Positive Positive | Medium term | 490.10 | Mar 13, 2024 22:43, Morning Report, Today´s Case | LGW |

Positive Positive | Medium term | 441.40 | Dec 14, 2023 08:41, Nordic Top 10 | EG |

Positive Positive | Medium term | 421.60 | Dec 7, 2023 22:52, Morning Report, Today´s Case | LGW |

Positive Positive | Medium term | 418.20 | Aug 15, 2023 07:32, Morning Report | DO |

DO: David Östblad (Analyst)

EG: Espen Grønstad (Senior Advisor)

LGW: Lars-Göran Westerberg (Analyst)

Seasonal variations

Seasonal prediction from today's date

Monthly and annual statistics

Average development per month, last 10 years

Average development throughout the year, last 10 years

Annual development from 2015 to 2024

Early warning

Alerts

| Date | Price | Trading opportunity/Description | Time span/Value | Target/Importance |

|---|---|---|---|---|

| Nov 21, 2024 | 618.60 | Inside trades pos, close to sup | Medium term | 670.00 - 690.00 |

| Nov 18, 2024 | 30.49 | Karin Charlotte Lepasoon (annan medlem i bolagets administratio | 10 062 | 0 |

| Nov 18, 2024 | 30.49 | Peter Terwiesch (annan medlem i bolagets administrations-, ledn | 10 062 | 0 |

| Nov 18, 2024 | 30.49 | Morten Wierod (verkställande direktör (vd)) köper 330 | 10 062 | 0 |

Key ratios

Dividend yield: 1.7%

P/E: 29.2

P/S: 3.5

P/B: 8.0

Dividend per share: 10.24

Earnings per share: 21.19

Revenue per share: 176.52

Book value per share: 77.04

Market cap million SEK: 1 141 697.

Financial data

| MSEK | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | Q3-24 |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 248 417 | 252 578 | 230 222 | 200 404 | 210 925 | 174 128 | 214 991 | 307 290 | 325 219 | 325 785 |

| Profit for the year | 16 290 | 19 050 | 19 354 | 19 471 | 14 290 | 2 832 | 42 826 | 27 070 | 38 580 | 39 100 |

| Profit margin | 6.6 % | 7.5 % | 8.4 % | 9.7 % | 6.8 % | 1.6 % | 19.9 % | 8.8 % | 11.9 % | 12.0 % |

| Book value | 122 039 | 122 212 | 121 269 | 125 013 | 126 495 | 128 745 | 141 055 | 133 337 | 135 293 | 142 188 |

| Equity ratio | 36.2 % | 35.3 % | 35.5 % | 32.7 % | 30.3 % | 38.9 % | 39.6 % | 33.7 % | 34.3 % | 36.1 % |

| Revenue per share | 111.60 | 117.42 | 107.68 | 94.00 | 98.93 | 82.49 | 104.71 | 164.77 | 175.32 | 176.77 |

| Book value per share | 54.82 | 56.82 | 56.72 | 58.64 | 59.33 | 60.99 | 68.70 | 71.49 | 72.93 | 77.15 |

| Earnings per share | 8.83 | 10.32 | 10.49 | 10.55 | 7.74 | 1.53 | 23.20 | 14.67 | 20.90 | 21.19 |

| Dividend per share | 7.37 | 8.04 | 7.87 | 8.28 | 8.90 | 8.36 | 9.00 | 9.70 | 10.24 | 10.24 |

| Dividend payout | 101 % | 91 % | 87 % | 91 % | 133 % | 623 % | 43 % | 67 % | 49 % | 48 % |

Dividend yield

Dividend yield for ABB is 1.7%.

P/E - price/earnings

P/E for ABB is 29.2.

P/S - price/sales

P/S for ABB is 3.5.

P/B - price/book

P/B for ABB is 8.0.

Help and information - Research shows the importance of Trend, Momentum and Volume

Investtech’s analyses focus on a stock’s trend status, short term momentum and volume development. These are central topics of technical analysis theory that describe changes in investor optimism or fluctuations in a company’s financial development. However, Investtech’s strong focus on these elements is due to research results that clearly indicate causation between these factors and future return on the stock market.

Trend

Theory: Stocks in rising trends will continue to rise.

Psychology/economy: Rising trends indicate that the company experiences positive development and increasing buy interest among investors. Read more

Research: Stocks in rising trend channels in Investtech’s medium long term charts have been followed by an annualized excess return of 7.8 percentage points compared to average benchmark development. This is shown by Investtech’s research into 34,880 cases of stocks in rising trends on the Nordic Stock Exchanges in the period 1996 to 2015.

Read more about the research results here

Momentum

Theory: Stocks with rising short term momentum will continue to rise. Stocks with very strong momentum (overbought) will react backwards.

Psychology/economy: RSI above 70 shows strong positive momentum. The stock has risen in the short term without any significant reactions downwards. Investors have kept paying more to buy stocks. This indicates that more investors want to buy the stock and that the price will continue to rise. Read more

Research: Stocks with strong momentum have on average continued to rise, and more so than the average stock listed on the Exchange. This is shown by Investtech’s research into 24,208 cases of stocks on the Nordic Stock Exchanges in the period 1996 to 2015 where RSI went above 70 points, indicating strong and increasing short term momentum. On average, annualized, the stocks rose the equivalent of 11.4 percentage points more than the average stock.

Read the research report here

Volume

Theory: Rising prices on high volume and falling prices on low volume indicate strength in a stock. Volume can confirm a rising trend or signal that a falling trend is ending.

Psychology/economy: When investors very much want to buy a stock, they have to increase the price to find new sellers. Rising price on high volume shows that some investors are so aggressive that they push the price up to be able to buy the stock. Investtech’s Volume Balance tool measures the relation between price rise and volume and measures investor aggression at rising and falling prices. Read more

Research: Stocks with volume balance above 40 have been followed by an average annual return of 4.7 percentage points on the Nordic Stock Exchanges, shown by research conducted by Investtech into 24,580 cases.

Read the research report here

Investtech's analyses

Investtech has combined theory, psychology and research into powerful investment tools.

About Investtech

Investtech are behavioural finance and quantitative stock analysis specialists. The company sells analysis products to private, professional and institutional investors. Investtech manage the AIFM company Investtech Invest, which invests customers’ funds in the stock market.

Investtech’s computers analyze more than 28,000 stocks from 12 different countries every day. The analyses are presented in eight languages and sold to customers worldwide. In addition to the automatic analyses, the company’s analysts present subjective assessments and recommendations for some markets. The analyses are available to customers in the form of daily morning reports and cases, and weekly market updates and model portfolios.

Investtech’s algorithms for analysis, ranking and stock recommendations are based on research dating back to 1993. Part of the research was conducted in cooperation with Oslo University and the Norwegian Research Council. Research still has high priority for Investtech. Many of the company’s research results are available for customers on the company’s web site.

The company’s basic product starts at approx. 30 euro per month. Investtech also provides bespoke products for integration on partners’ web sites and for use in newsletters, for example to stock brokers and the media. Contact us by e-mail to info@investtech.com or by phone +47 21 555 888 for more information. A free trial subscription is available to order on our web site www.investtech.com.

Head Office

Investtech ASStrandveien 17

1366 Lysaker

+47 21 555 888

Postal address

Investtech ASStrandveien 17

1366 Lysaker

info@investtech.com

VAT no. 978 655 424 MVA

Research Department

Instituttveien 102007 Kjeller

www.investtech.com

Investor Psychology - Behavioural Finance - Quantitative Analysis - Scientific Methods

Technical Analysis - Insider Trades - Seasonal Variations - Intraday Trading

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Investtech guarantees neither the entirety nor accuracy of the analyses. Any consequent exposure related to the advice / signals which emerge in the analyses is completely and entirely at the investors own expense and risk. Investtech is not responsible for any loss, either directly or indirectly, which arises as a result of the use of Investtechs analyses. Details of any arising conflicts of interest will always appear in the investment recommendations. Further information about Investtechs analyses can be found here disclaimer.

The content provided by Investtech.com is NOT SEC or FSA regulated and is therefore not intended for US or UK consumers.

Oslo Børs

Oslo Børs Stockholmsbörsen

Stockholmsbörsen Københavns Fondsbørs

Københavns Fondsbørs Helsingin pörssi

Helsingin pörssi World Indices

World Indices US Stocks

US Stocks Toronto Stock Exchange

Toronto Stock Exchange London Stock Exchange

London Stock Exchange Euronext Amsterdam

Euronext Amsterdam Euronext Brussel

Euronext Brussel DAX

DAX CAC 40

CAC 40 Mumbai S.E.

Mumbai S.E. Commodities

Commodities Currency

Currency Cryptocurrency

Cryptocurrency Exchange Traded Funds

Exchange Traded Funds Investtech Indices

Investtech Indices